Preliminary leakages from the OPEC+ conference recommended that the voluntary nature of extra output cuts is most likely adding to the unfavorable market belief

” Drowning in information” is how another trader MSG ‘d as manufacturers are going to need to develop some tough numbers to encourage the marketplace that the cuts are genuine, and not simply a repackaging of formerly concurred steps.

However as the communique listed below programs, there seems none.

The complete OPEC+ communique has actually simply been launched:

The 36th OPEC and non-OPEC Ministerial Fulfilling (ONOMM), was held by means of videoconference, on Thursday November 30, 2023.

The Fulfilling invited HE Alexandre Silveira de Oliveira, Minister of Mines and Energy of the Federative Republic of Brazil, which will sign up with the OPEC+ Charter of Cooperation beginning January 2024.

The conference declared the continued dedication of the Taking part Nations in the Statement of Cooperation (DoC) to guarantee a steady and well balanced oil market.

In view of existing oil market principles, the Fulfilling:

Declared the Structure of the Statement of Cooperation, signed on 10 December 2016 and additional backed in subsequent conferences consisting of the 35th OPEC and Non-OPEC Ministerial Fulfilling on 4 June 2023; along with the Charter of Cooperation, signed on 2 July 2019.

Kept in mind that, in accordance with the choice of the 35th OPEC and non-OPEC Ministerial Fulfilling, the conclusion of the evaluation by the 3 independent sources (IHS, Wood Mackenzie and Rystad Energy) for production level that can be accomplished in 2024 by Angola, Congo and Nigeria as follows: Angola at 1,110 t/bd, Congo at 277 t/bd and Nigeria at 1,500 t/bd.

The 37th OPEC and non-OPEC Ministerial Fulfilling will be hung on 1 June 2024 in Vienna.

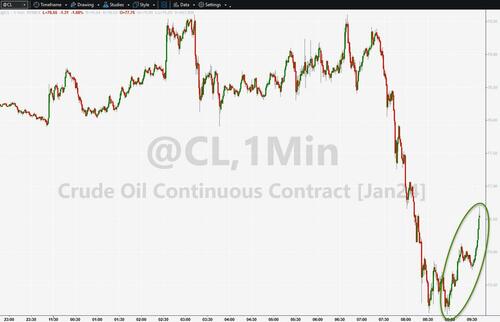

The response is clear – oil rates are falling quickly as the marketplace had been led to anticipate 1 million barrels a day of additional cuts, however there’s no reference of them at all in the communique …

Costs are coming off the lows a little …

… as the numerous countries have started to reveal their voluntary cuts:

-

Saudi Extends Voluntary Oil Cut of 1m B/D to End 1Q24: HEALTH CLUB

-

Russia Oil-Export Cuts increased by 200k B/D in 1Q 2024 to Reach 500k B/D

-

Kuwait Said to Make Extra 135k B/D OPEC+ Oil Output Cut

-

Algeria to Make Extra 51k B/D OPEC+ Output Cut

-

Oman to Make Extra 42k B/D Oil Output Cut in 1Q

-

Kazakhstan to cut oil output by extra 82k B/D in 1Q

-

UAE to Make Extra 160k B/D OPEC+ Output Cut

-

Angola has declined its quota

Here’s what Wall Street considers OPEC+’s actions (or absence of them) …

Alex Longley, Bloomberg

So why are we decrease? Drowning in information is how one trader put it to me. The extra cuts will be revealed by OPEC+ members themselves. Others argue this is a repackaging of formerly concurred steps, with some unpredictable additionals. Include a good rally over the last couple of days (and not to point out month end and expiration day for Brent agreements!), which’s why we are where we are. Our newest oil futures take is here:

Julian Lee, Bloomberg:

What seems the voluntary nature of extra output cuts is most likely adding to the unfavorable market belief. There’s a genuine concern that this may be little bit more than the repackaging of cuts that were currently encompassed completion of 2024 back in June. The manufacturers are going to need to develop some tough numbers to encourage the marketplace that the cuts are genuine. I concur with Arne Lohmann, the interaction has actually been bad. Maybe that’s a reflection of the trouble of getting everybody to concur, however that in itself raises issues about just how much of any additional cut will be genuine.

It’s looking significantly like the extra 1 million barrels a day of cuts will not be formalized in brand-new main output targets. Rather members will separately reveal their contributions, simply as they performed in April for the voluntary decreases that entered into result in May. Those likewise totaled up to a shade over 1 million barrels a day.

Giovanni Staunovo, UBS

” It appears the OPEC+ production cuts are “voluntary” cuts, not part of an OPEC+ arrangement. Thus the issue is that a big portion of it might be a promise on paper and successfully less barrels being gotten rid of from the marketplace.”

Arne Lohmann Rasmussen, A/S Global Threat Management

” They did the ideal thing and responded to the looming 2024 surplus. However the performance/execution has actually been truly bad. Quotas being revealed separately was bad interaction. Nevertheless, the threat likelihood of oil going considerably lower need to now be little.”

Dominic Ellis, UBS

Prospective Reasons Oil Is Fading Post Statement Of OPEC+ Cut. Attempting to comprehend the fade in oil considering that the news earlier of the ~ 2mb/d OPEC+ cut for Q1. Prospective causes for issue: 1.3 mb/d of the overall is an extension of the existing Saudi and Russian cuts which, are either currently in many presumptions for 1Q24 (when it comes to the Saudi 1mb/d) or can’t totally be relied on (when it comes to the Russian 300kb/d). Then there’s the incremental 200kb/d cut from Russia, which would be brand-new versus existing expectations, however is most likely greatly marked down by markets offered historical weak Russian compliance. Lastly, on the staying 500kb/d, it isn’t clear just how much of this will really lead to barrels coming out of the marketplace, instead of “paper” cuts versus greater quotas, or cuts versus quotas that are currently not being struck I still discover the drop in oil confusing, especially offered news that Brazil will be signing up with the OPEC+ group from January 2024, however this is a fine example of OPEC’s opacity being disadvantageous.

There will be no interview after today’s virtual conference.

Maybe most significantly, significant manufacturer Brazil will sign up with OPEC+ from next year, the oil cartel revealed on Thursday. Brazil is amongst the world’s leading 10 manufacturers and has actually been the biggest oil manufacturer in Latin America considering that 2016.

” Thinking About that Brazil is a big oil manufacturer and is driving oil production development it is essential to have them on board, however it appears that they are not cutting production like Mexico, so would conclude with: great for OPEC+, less pertinent for oil market balances,” UBS expert Giovanni Staunovo stated.

By Zerohedge.com

.