Redfin representatives in locations impacted by harsh weather forecast sluggish homebuying activity, however representatives in warmer areas state purchasers and sellers are active as home loan rates remain in the high-6% variety, below 8% a couple of months earlier.

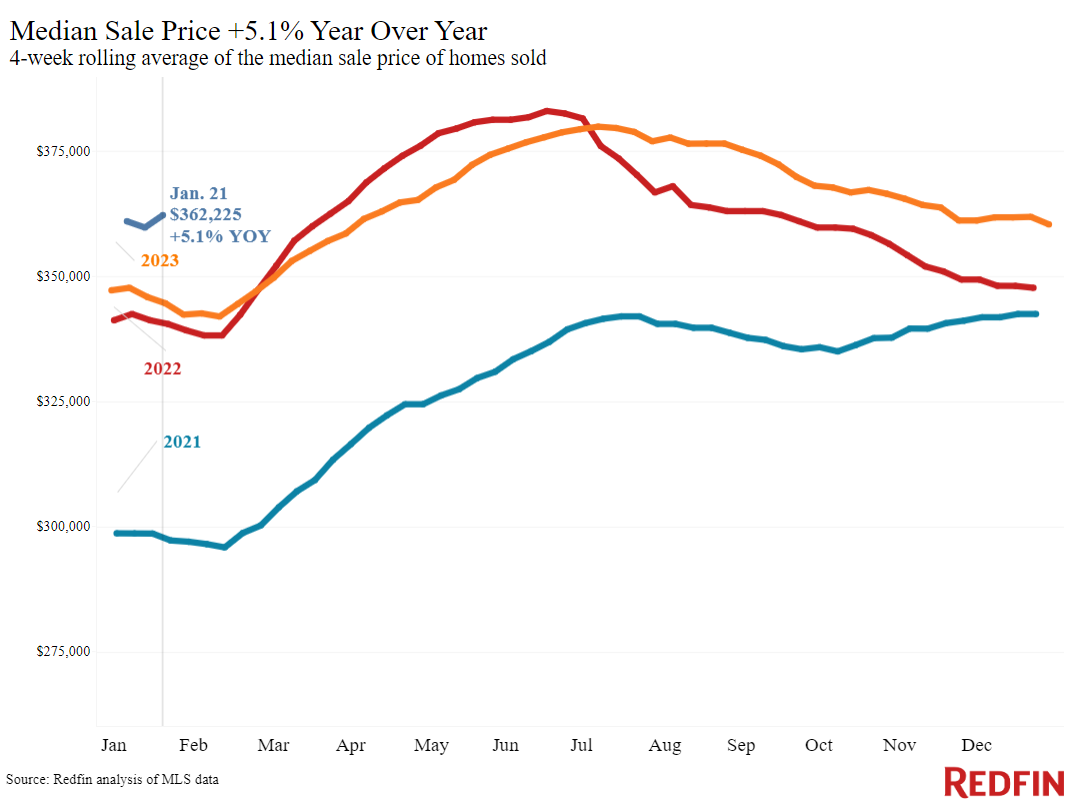

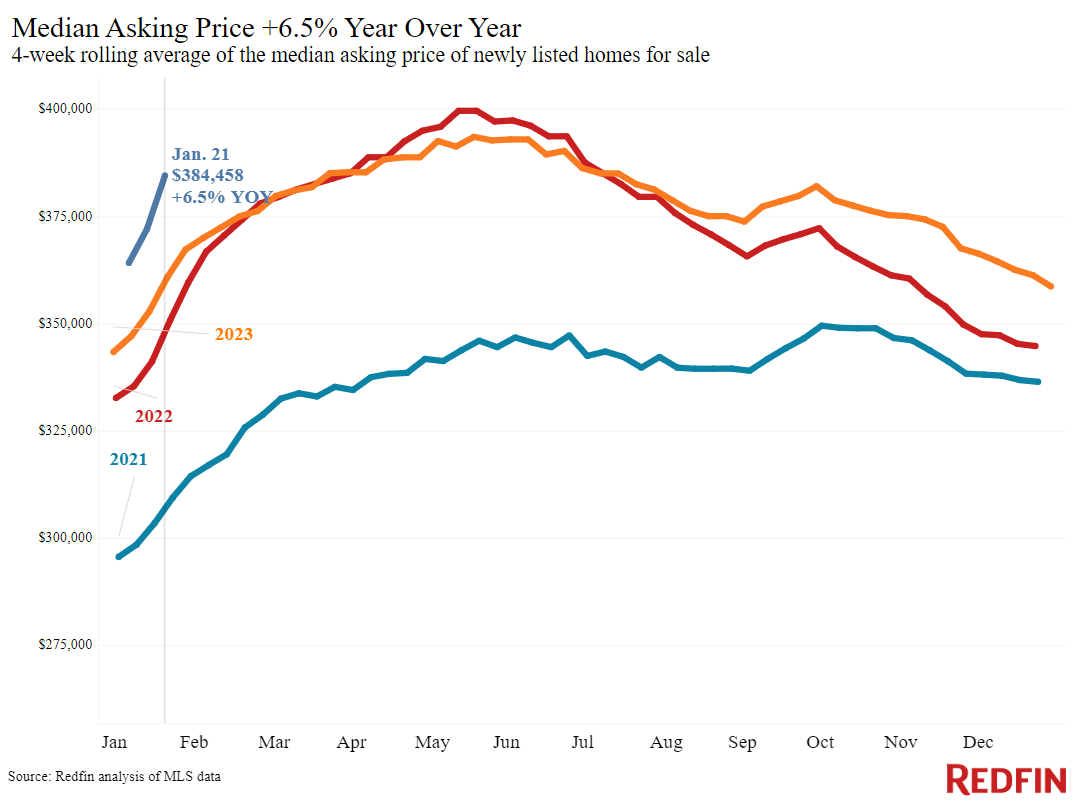

The average U.S. home-sale cost increased 5.1% throughout the 4 weeks ending January 21, the most significant boost because October 2022. Asking costs increased 6.5%, likewise the most significant boost in more than a year.

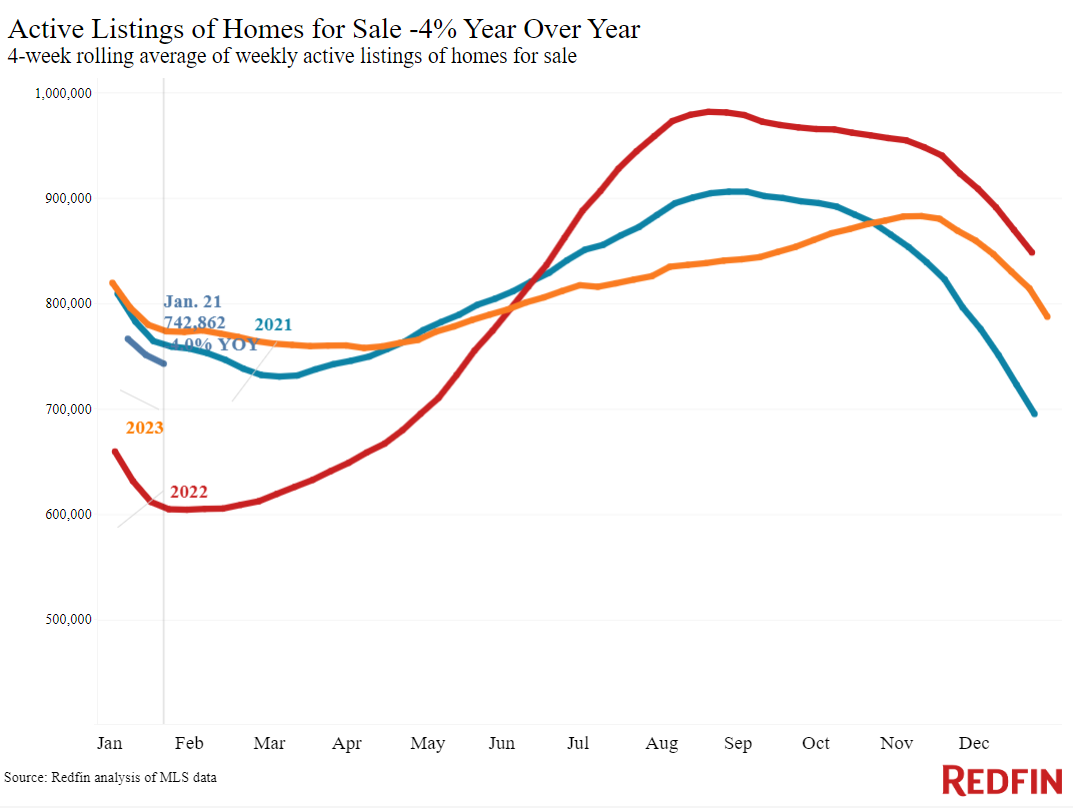

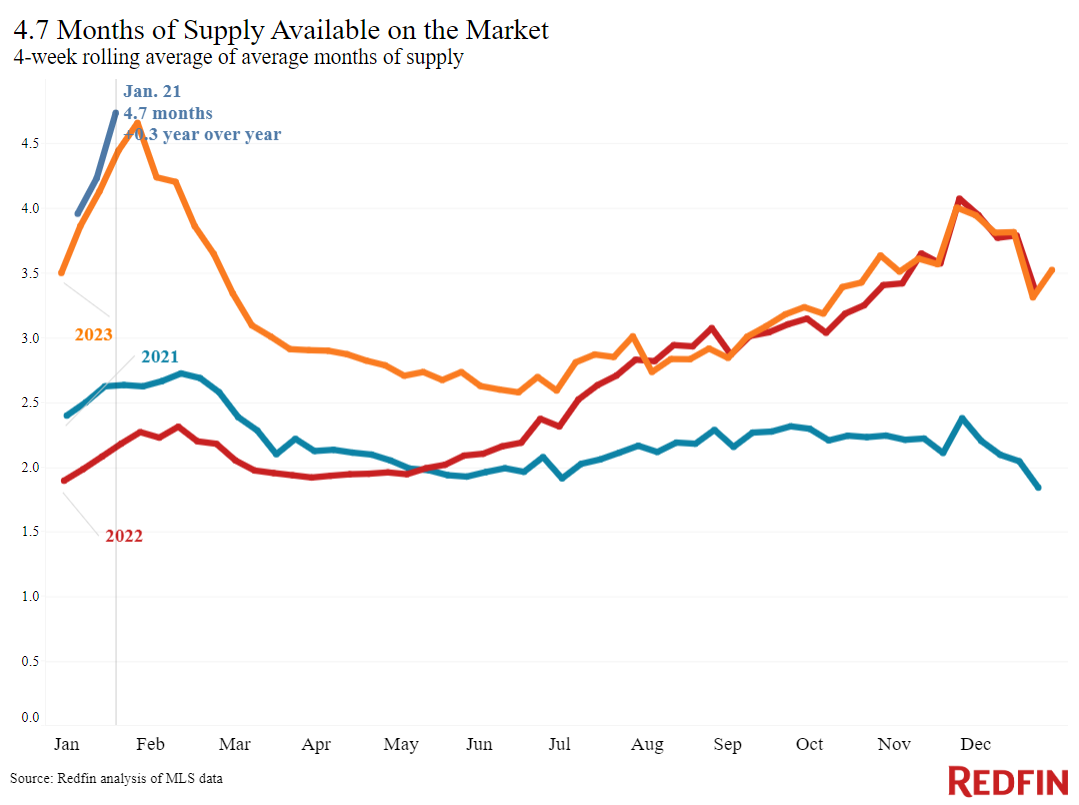

Rates are increasing for a couple of factors. One, stock is still rather low. The overall variety of homes for sale is down 4% year over year. And while brand-new listings are up 2%, that’s the tiniest yearly boost in about 3 months. Furthermore, sellers can command greater costs due to the fact that purchasers have more buying power; home loan rates are holding stable in the mid-to-high 6% variety, below 8% in October.

Today’s sales information reveals slow activity as serious winter season weather condition kept purchasers and sellers on the sidelines in much of the nation: Pending home sales are down 8% year over year, the most significant decrease in 4 months. The huge yearly drop in pending sales can likewise be discussed in part by the reality that they were enhancing at this time in 2015 as home loan rates fell.

While Redfin representatives in locations that are dealing with severe weather forecast that prospective purchasers are staying at home (in the meantime), mortgage-purchase applications are increasing, and representatives in warmer locations state need is getting:

- ” Realty is typically sluggish in the Midwest in the winter season, however this year it’s even slower than normal due to the fact that the weather condition has actually been so severe,” stated Grand Rapids, MI Redfin Premier representative Christine Kooiker “Casual home hunters are staying at home to prevent the roadways– however stock is low enough that severe purchasers are discovering a method to see preferable homes. I likewise think we’ll get busier as we approach spring. Individuals are utilized to greater home loan rates, and they understand costs are most likely to increase more if they wait.”

- ” At the end of 2023, a great deal of my customers stated, ‘I’ll call you in January.’ And they did. This month has actually been continuously,” stated Shay Stein, a Redfin Premier representative in Las Vegas. “I would not state purchasers enjoy about 6.5% rates, however they’ll accept it due to the fact that they’ll feel vindicated if rates increase back to 8%, and they can constantly re-finance and prevent future bidding wars if rates drop even more. And sellers are coming out of the woodwork, discovering the interest from purchasers.”

Leading indications

| Indicators of homebuying need and activity | ||||

| Worth (if relevant) | Current modification | Year-over-year modification | Source | |

| Day-to-day typical 30-year set home loan rate | 6.95% (Jan. 24) | Up a little from a week previously | Up from 6.18% | Home Mortgage News Daily |

| Weekly typical 30-year set home loan rate | 6.6% (week ending Jan. 18) | Most affordable level because Might | Up from 6.15% | Freddie Mac |

| Mortgage-purchase applications (seasonally changed) | Up 8% from a week previously; up 17% from a month previously (since week ending Jan. 19) | Down 18% | Home Mortgage Bankers Association | |

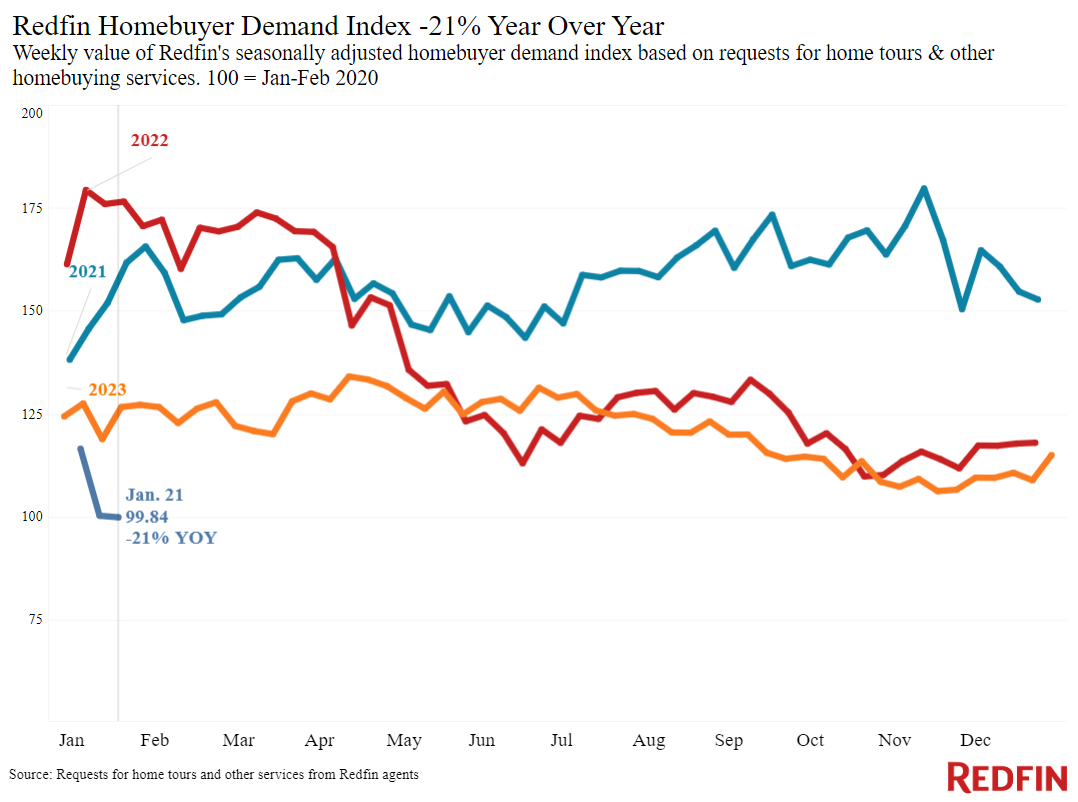

| Redfin Property Buyer Need Index (seasonally changed) | Down 8% from a month previously (since week ending Jan. 21) | Down 21% | Redfin Property Buyer Need Index, a step of ask for trips and other homebuying services from Redfin representatives | |

| Google look for “home for sale” | Up 18% from a month previously (since Jan. 20) | Down 15% | Google Trends | |

Secret housing-market information

| U.S. highlights: 4 weeks ending January 21, 2023

Redfin’s nationwide metrics consist of information from 400+ U.S. city locations, and is based upon homes noted and/or offered throughout the duration. Weekly housing-market information returns through 2015. Topic to modification. |

|||

| 4 weeks ending January 21, 2023 | Year-over-year modification | Notes | |

| Mean price | $ 362,225 | 5.1% | Most significant boost because Oct. 2022 |

| Mean asking cost | $ 384,458 | 6.5% | Most significant boost because Oct. 2022 |

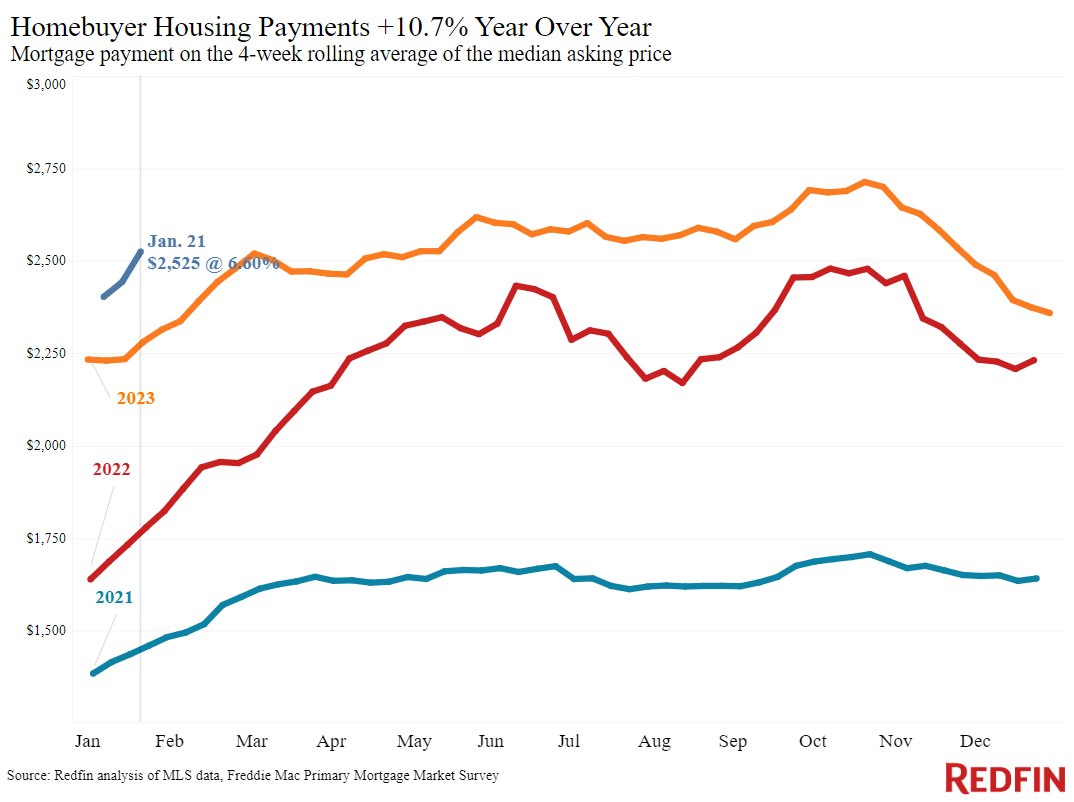

| Mean month-to-month home loan payment | $ 2,525 at a 6.6% home loan rate | 10.7% | Down approximately $200 from all-time high set throughout the 4 weeks ending Oct. 22, however up approximately $200 from the 4 weeks ending Dec. 31 |

| Pending sales | 54,331 | -8.2% | Most significant decrease in 4 months |

| New listings | 54,796 | 2.2% | |

| Active listings | 742,862 | -4% | |

| Months of supply | 4.7 months | +0.3 pts. | 4 to 5 months of supply is thought about well balanced, with a lower number suggesting seller’s market conditions. |

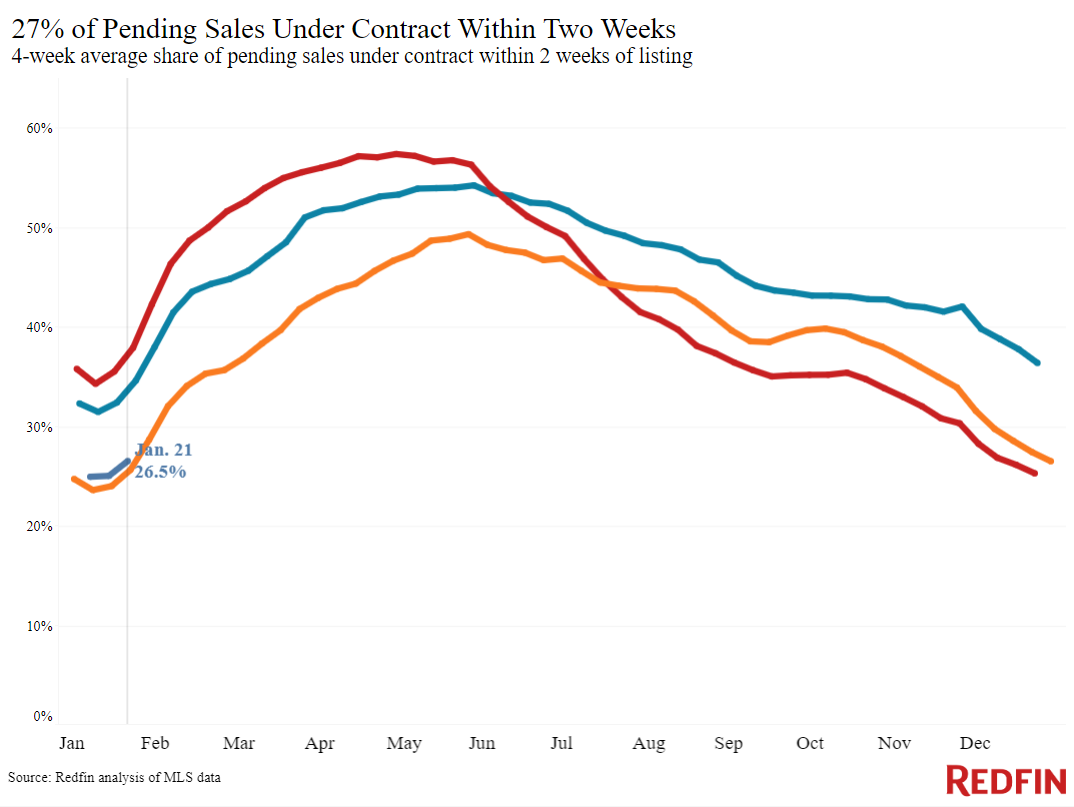

| Share of homes off market in 2 weeks | 26.5% | Basically the same | |

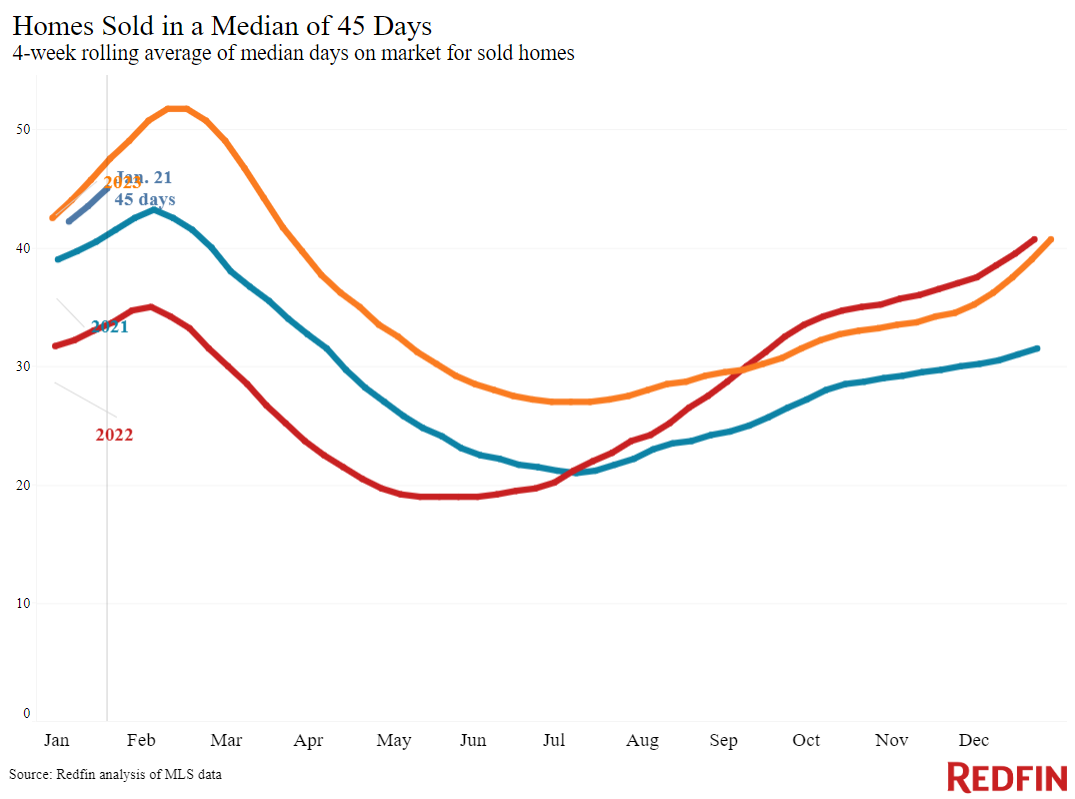

| Mean days on market | 45 | -3 days | |

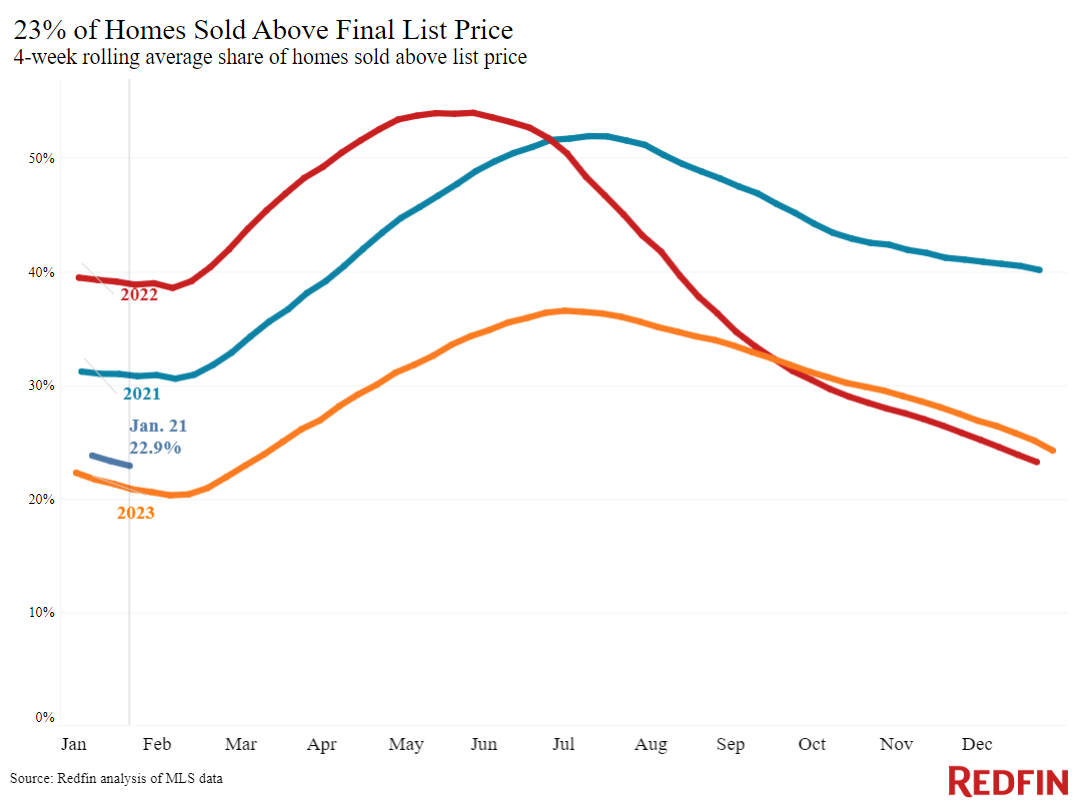

| Share of homes offered above market price | 22.9% | Up from 21% | |

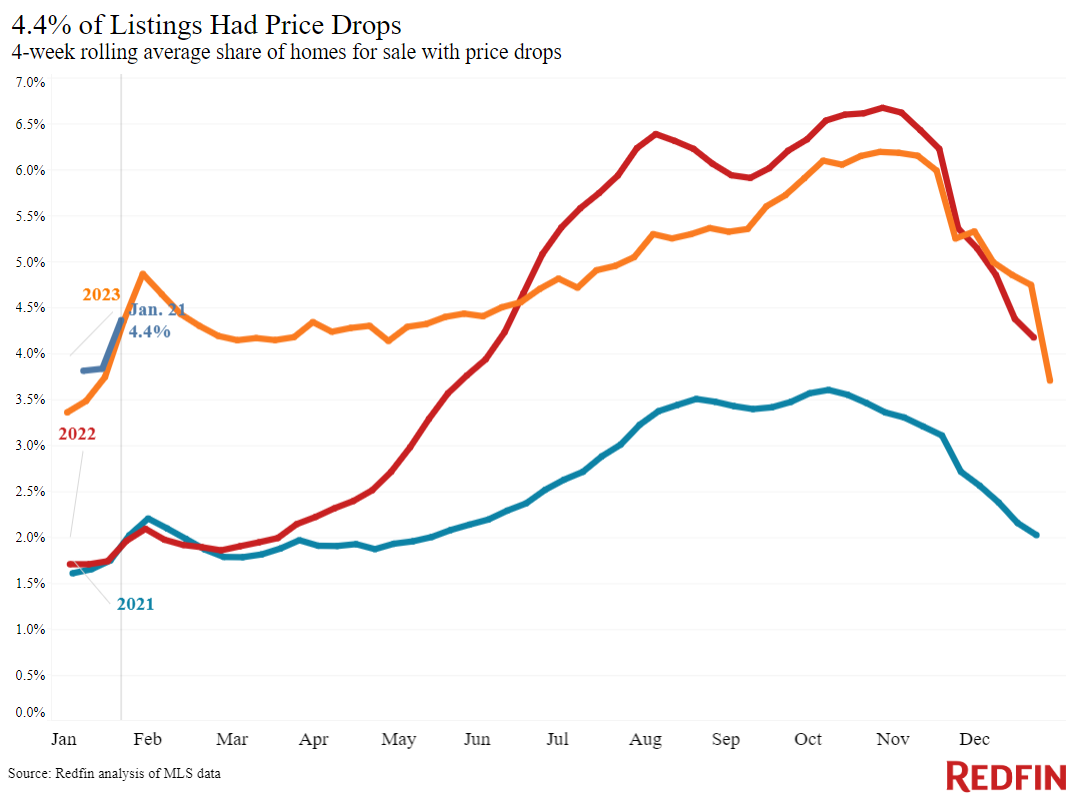

| Share of homes with a rate drop | 4.4% | Basically the same | |

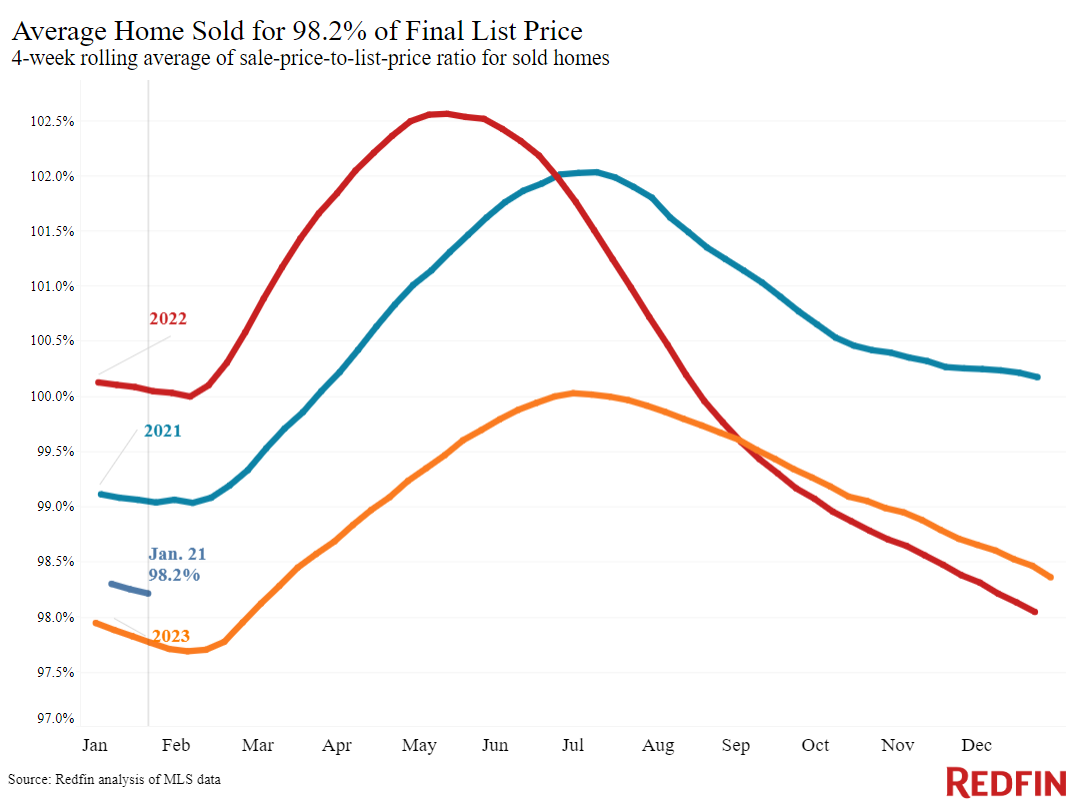

| Typical sale-to-list cost ratio | 98.2% | +0.4 pts. | |

|

Metro-level highlights: 4 weeks ending January 21, 2023 Redfin’s metro-level information consists of the 50 most populated U.S. cities. Select cities might be left out from time to time to make sure information precision. |

|||

|---|---|---|---|

| Metros with most significant year-over-year boosts | Metros with most significant year-over-year reductions | Notes | |

| Mean price | Anaheim, CA (13.6%)

New Brunswick, NJ (13.5%) Miami (13.3%) Newark, NJ (12.6%) Providence, RI (11.8%) |

Austin, TX (-3.7%) San Antonio, TX (-2.2%) Oakland, CA (-1.8%) Jacksonville, FL (-1%) |

Decreased in 4 cities |

| Pending sales | San Jose, CA (8.8%)

Detroit (6.1%) Anaheim, CA (4.5%) Milwaukee, WI (2.6%) San Francisco (2.3%) |

Portland, OR (-24.7%)

New Brunswick, NJ (-21.9%) Newark, NJ (-18.9%) Houston (-18.3%) Atlanta (-17.3%) |

Increased in 9 cities |

| New listings | San Diego, CA (22.3%)

Phoenix (21.6%) Minneapolis, MN (20.4%) Miami (18.8%) Fort Lauderdale, FL (18.7%) |

Chicago (-20.4%)

Atlanta (-17.9%) Portland, OR (-16%) Fort Worth, TX (-11.2%) Nashville, TN (-8.6%) |

Decreased in 14 cities |

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.