By Sean Kevelighan, Triple-I CEO

Legislation proposed by U.S. Rep. Adam Schiff (D-Calif.) to develop a federal “disaster reinsurance program” raises numerous issues that warrant examination and conversation– beginning with the concern: Does what’s being proposed even certify as insurance coverage?

If enacted into law, the expense would develop a “disastrous home loss reinsurance program … to supply reinsurance for certifying main insurer.” To certify, insurance providers would need to provide:

- An all-perils home insurance plan for property and business home, and

- A loss-prevention collaboration with the insurance policy holder to motivate financial investments and activities that minimize guaranteed and financial losses from a disaster hazard.

The proposed program would phase in protection requirements hazard by hazard over numerous years and terminate FEMA’s National Flood Insurance Coverage Program (NFIP). It would set protection limits and determine ranking aspects based upon input from a board in which the insurance coverage market is just nominally represented.

And no place in the 22-page proposition do any of the following words or expressions appear:

- ” Actuarial strength”;

- ” Risk-based rates”;

- ” Reserves”; or

- ” Insurance policy holder surplus”.

Actuarially sound risk-based rates and the requirement to preserve sufficient reserves and insurance policy holder surplus to guarantee monetary strength and claims-paying capability are the bedrock of any insurance coverage program deserving of the name– not technical small print to be exercised down the roadway while existing systems are being taken apart and market forces misshaped through federal government participation.

Insurance coverage is a complex discipline, and prior federal efforts at offering protection have actually struggled to stabilize their objective of increasing accessibility and minimizing premiums versus the requirement to base underwriting and rates on actuarially sound concepts to guarantee enough reserves for paying claims.

Actuarially sound risk-based rates and the requirement to preserve sufficient reserves and insurance policy holder surplus … are the bedrock of any insurance coverage program deserving of the name– not technical small print to be exercised down the roadway …

Sean Kevelighan, CEO, Triple-I

Gain from history

NFIP is a strong case in point. Developed in 1968 to secure homeowner for a danger that many personal insurance providers hesitated to cover, NFIP’s “one-size-fits-all” technique to underwriting and rates has actually resulted in the program now owing more than $20 billion to the U.S. Treasury due to the fact that it did not have the reserves to totally pay claims after significant occasions like Typhoon Katrina and Superstorm Sandy. It likewise typically resulted in lower-risk homeowner unjustly supporting protection for higher-risk residential or commercial properties.

Having therefore discovered the significance of risk-based rates, NFIP has actually altered its underwriting and rates method. The brand-new technique– Threat Ranking 2.0, revealed in 2019 and totally executed since April 1, 2023– more equitably disperses premiums based upon home worth and specific residential or commercial properties’ flood danger. As an outcome, premiums of formerly subsidized insurance policy holders– especially in seaside locations with greater worths– have actually increased, resulting in protests from numerous higher-risk owners who have actually seen their aids decreased.

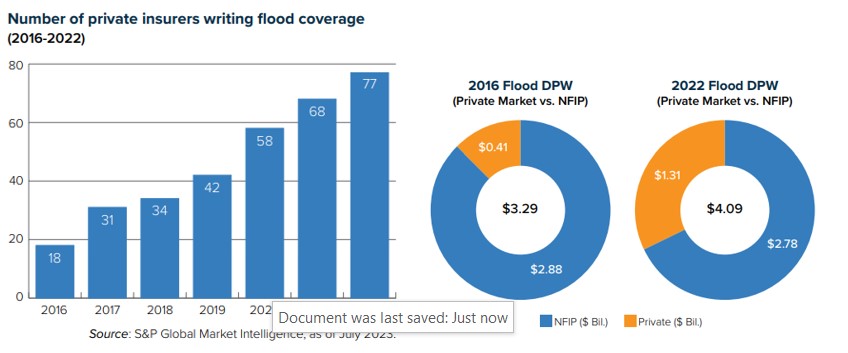

In addition to resulting in fairer rates, Threat Ranking 2.0– by minimizing market distortions– increases rewards for personal insurance providers to get included. For a very long time, personal insurance providers thought about flood an untouchable hazard, however enhanced information modeling and analytical tools have actually increased their convenience composing this company. As the charts listed below program, personal insurance providers have actually been playing a gradually increasing function in the last few years, covering a bigger portion of a growing danger swimming pool.

Gradually, this pattern ought to result in higher accessibility and price of flood insurance protection.

Instead of including the lessons produced by NFIP’s experience with a single hazard, Rep. Schiff’s proposition would terminate the reformed flood insurance coverage program while including a brand-new layer of intricacy to protection throughout all hazards and casting into concern the future of different state insurance coverage programs and recurring market systems presently in location.

Reliable concepts

Any effort by the federal government to deal with insurance coverage accessibility and price issues need to be made with an understanding of how insurance coverage works– from rates and underwriting to booking and claim settlement. For instance, the Schiff expense proposes piloting an all-perils policy with a regard to 5 years. There are excellent factors for property/casualty policies to be composed with a 1 year term. Particularly, the conditions that impact claims expenses can alter rapidly, and insurance providers– as referenced above– need to reserve enough reserves to be able to pay all genuine claims. If they can not review rates each year, the monetary outcomes might be devastating.

” Who would have believed in 2019 that replacement expenses would increase 55 percent within 3 years?” asked Dale Porfilio, Triple-I’s chief insurance coverage officer. Supply-chain interruptions associated with the COVID-19 pandemic and Russia’s intrusion of Ukraine added to simply such a replacement-cost spike. “Needing five-year terms for policies would have resulted in an enormous drain on insurance policy holder surplus.”

Insurance policy holder surplus is the monetary cushion representing the distinction in between an insurance company’s properties and its liabilities.

In revealing his suggested legislation, Rep. Schiff stated it is meant to “insulate customers from unrestrained boost by providing insurance providers a transparent, relatively priced public reinsurance option for the worst climate-driven disasters.”

This language disregards the truth that, under state-by-state guideline, premium rate boosts are anything however “unrestrained” and ratemaking is based upon actuarially sound concepts that are transparent and reasonable. Property/casualty insurance coverage currently is among the most greatly controlled markets in the United States.

Customers should have genuine services

Insurance policy holders have genuine issues about price and, sometimes, accessibility of insurance coverage. These issues can develop pressure for politicians at both the state and federal levels to advance steps that are viewed as guaranteeing to assist. Regrettably, numerous current propositions start by mischaracterizing present patterns as an “insurance coverage crisis,” instead of what they actually represent: A danger crisis

Insurance coverage premium rates tend to relocate line with the frequency and intensity of the hazards they cover. They likewise are impacted by aspects like scams and lawsuits abuse; environment, population, and advancement patterns; and worldwide economics and geopolitics. That is why insurance providers employ actuaries and information researchers and use advanced modeling innovation to guarantee that insurance coverage rates is actuarially sound, reasonable, and certified with regulative requirements in all states in which they operate.

That is how insurance providers keep lower-risk insurance policy holders from unjustly supporting higher-risk ones.

To its credit, the federal government is working to minimize climate-related dangers and buying strength through programs like Neighborhood Catastrophe Strength Zones (CDRZ) and FEMA’s Structure Durable Facilities and Neighborhoods (BRIC) program. The Bipartisan Facilities Law consists of considerable financing to promote environment strength. These merit ventures focused on attending to dangers that increase insurance coverage expenses.

However history has actually revealed that direct federal government participation in the underwriting and rates of insurance coverage items tends not to end well. Any strategy that would try to micromanage insurance providers’ protection of all hazards through a lens that disregards reliable, actuarially sound risk-based rates concepts raises a host of warnings that need to be gone over and dealt with before such a strategy is permitted to end up being law.

Find Out More:

It’s Not an “Insurance coverage Crisis”– It’s a Threat Crisis

Miami-Dade, Fla., Sees Flood Insurance Coverage Rate Cuts, Thanks to Strength Financial Investment

Illinois Expense Emphasizes Required for Education on Risk-Based Prices of Insurance Coverage

Education Can Get Rid Of Doubts on Credit-Based Insurance Coverage Ratings, IRC Study Recommends

Matching Cost to Hazard Assists Keep Insurance Coverage Readily Available and Budget Friendly

Insurance Policy Holder Surplus Matters: Here’s Why

Triple-I Concerns Quick: Flood

Triple-I Concerns Quick: Proposal 103 and California’s Threat Crisis

Triple-I Concerns Quick: Risk-based Prices of Insurance Coverage

Triple-I Concerns Quick: How Inflation Impacts P/C Insurance Coverage Prices– and How It Does Not