Costs are falling from a year ago in 4 Texas cities– Austin, San Antonio, Houston and Fort Worth– and in Portland, OR. Redfin anticipates cost decreases will end up being more prevalent in the brand-new year.

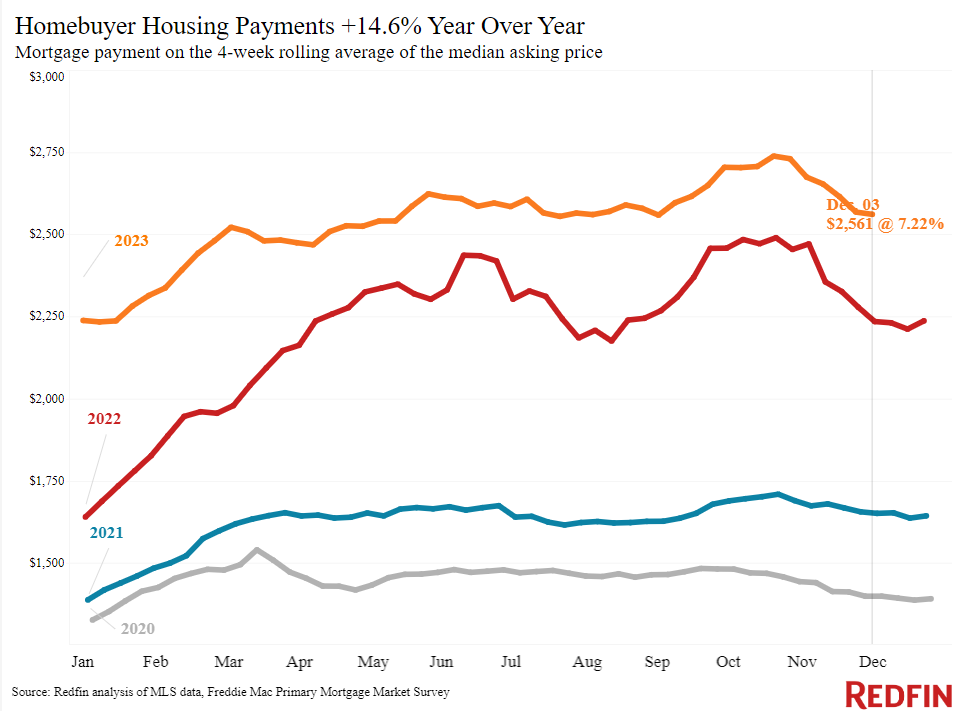

Homebuying is ending up being more economical as home mortgage rates continue decreasing. The average U.S. real estate payment was $2,561 throughout the 4 weeks ending December 3, down $177 from the record high it struck in October. That’s stimulating action from sidelined property buyers and sellers.

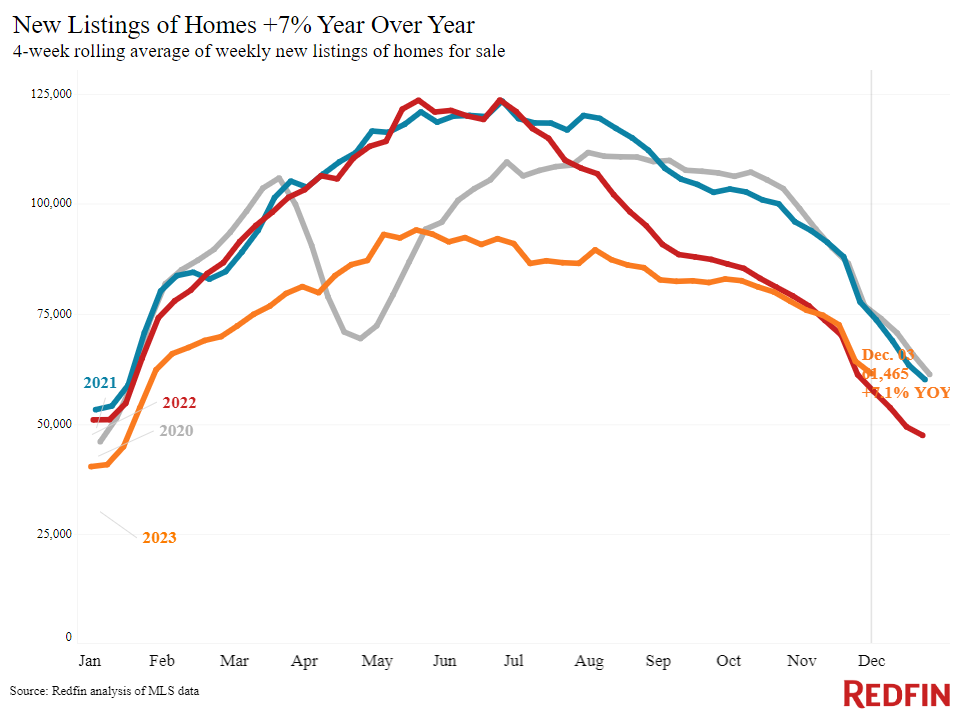

Mortgage-purchase applications are up 15% from the 28-year low they dropped to at the start of November. New listings are up 7% year over year, the greatest boost considering that August 2021, and the variety of house owners getting in touch with Redfin for assistance offering their home is up by double digits from a year earlier.

Home mortgage rates are boiling down since financial occasions are tilting in the real estate market’s favor. Today, a softer-than-expected report on task openings is another piece of proof on a growing stack that the Fed might cut rate of interest earlier than prepared for. The everyday average 30-year set rate was 7.04% on December 6, below 8% 6 weeks previously and its most affordable level considering that the start of August.

” With the hope of a couple of more homes beginning the marketplace, purchasers who can pay for 7% home mortgage rates or pay in money have some bargaining power,” stated Phoenix Redfin Premier Van Welborn “Individuals are taking their time taking a look at numerous homes, and they have the ability to back out if the evaluation reveals issues since they can await something much better to come on the marketplace. However there isn’t much wiggle space on cost: I’m recommending purchasers to be affordable with their deals since home worths are still fairly high and sellers do not wish to release their home for less than what they feel it deserves.”

Home rates are falling from a year ago in 5 of the 50 most populated U.S. cities. Redfin anticipates rates will begin decreasing in more cities in 2024, though they still have space to grow in economical parts of the nation.

Leading indications

| Indicators of homebuying need and activity | ||||

| Worth (if appropriate) | Current modification | Year-over-year modification | Source | |

| Everyday typical 30-year set home mortgage rate | 7.04% (Dec. 6) | Down from 7.22% a week previously; most affordable level considering that the start of August | Up from 6.33% | Home Loan News Daily |

| Weekly typical 30-year set home mortgage rate | 7.22% (week ending Nov. 30) | Down from two-decade high of 7.79% 6 weeks previously | Up from 6.49% | Freddie Mac |

| Mortgage-purchase applications (seasonally changed) | Basically the same from a week previously (since week ending Dec. 1) | Down 17% | Home Loan Bankers Association | |

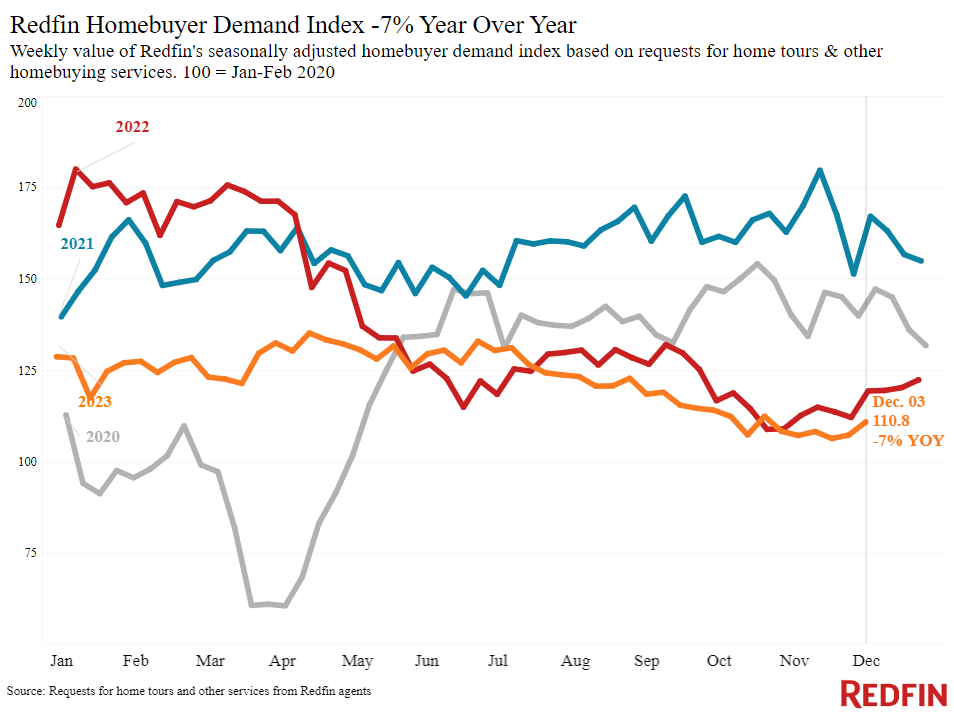

| Redfin Property Buyer Need Index (seasonally changed) | Up 3% from a month previously (since the week ending Dec. 3) | Down 7% | Redfin Property Buyer Need Index, a procedure of ask for trips and other homebuying services from Redfin representatives | |

| Google look for “home for sale” | Down 4% from a month previously (since Dec. 2) | Down 4% | Google Trends | |

| Exploring activity | Down 30% from the start of the year (since Dec. 3) | At this time in 2015, it was down 37% from the start of 2022 | ShowingTime, a home exploring innovation business | |

Secret housing-market information

| U.S. highlights: 4 weeks ending December 3, 2023

Redfin’s nationwide metrics consist of information from 400+ U.S. city locations, and is based upon homes noted and/or offered throughout the duration. Weekly housing-market information returns through 2015. Topic to modification. |

|||

| 4 weeks ending December 3, 2023 | Year-over-year modification | Notes | |

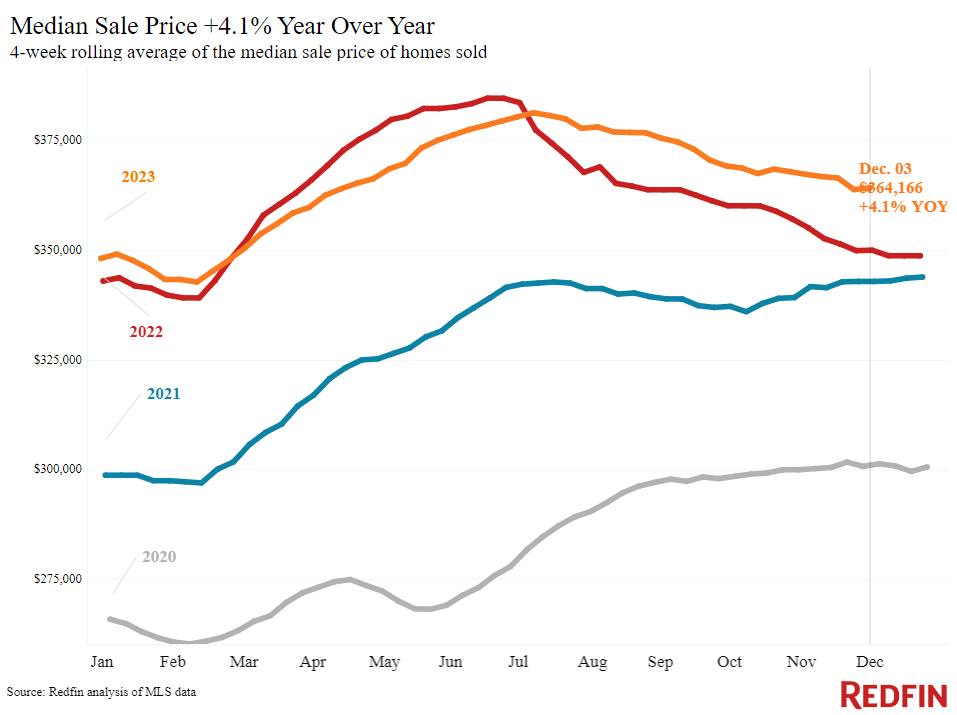

| Mean price | $ 364,166 | 4.1% | Costs are up partially since quickly increasing home mortgage rates were obstructing rates throughout this time in 2015 |

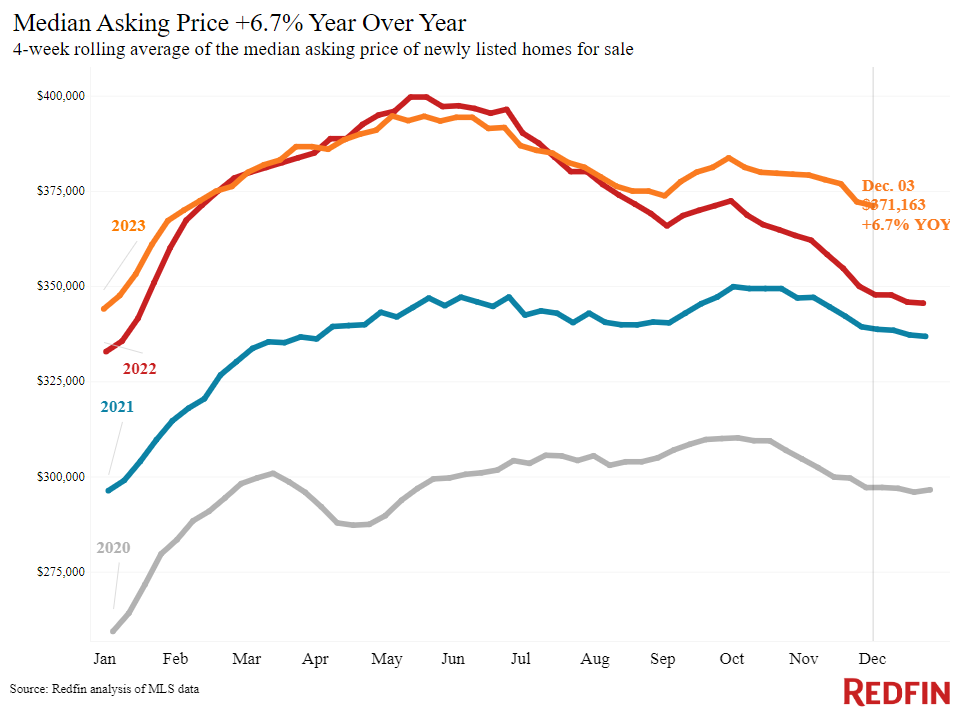

| Mean asking cost | $ 371,163 | 6.7% | Most significant boost considering that Sept. 2022 |

| Mean regular monthly home mortgage payment | $ 2,561 at a 7.22% home mortgage rate | 15% | Down $177 from all-time high set throughout the 4 weeks ending Oct. 22. Most affordable level considering that August. |

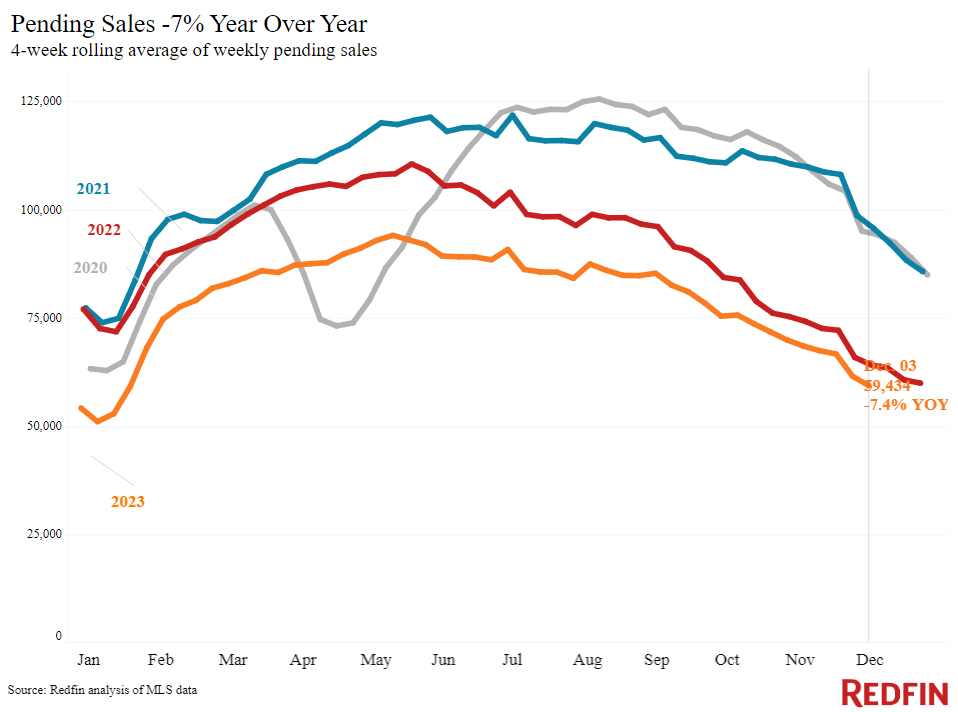

| Pending sales | 59,434 | -7.4% | |

| Brand-new listings | 61,465 | 7.1% | Most significant uptick considering that August 2021. The boost is partially since brand-new listings were falling at this time last year. |

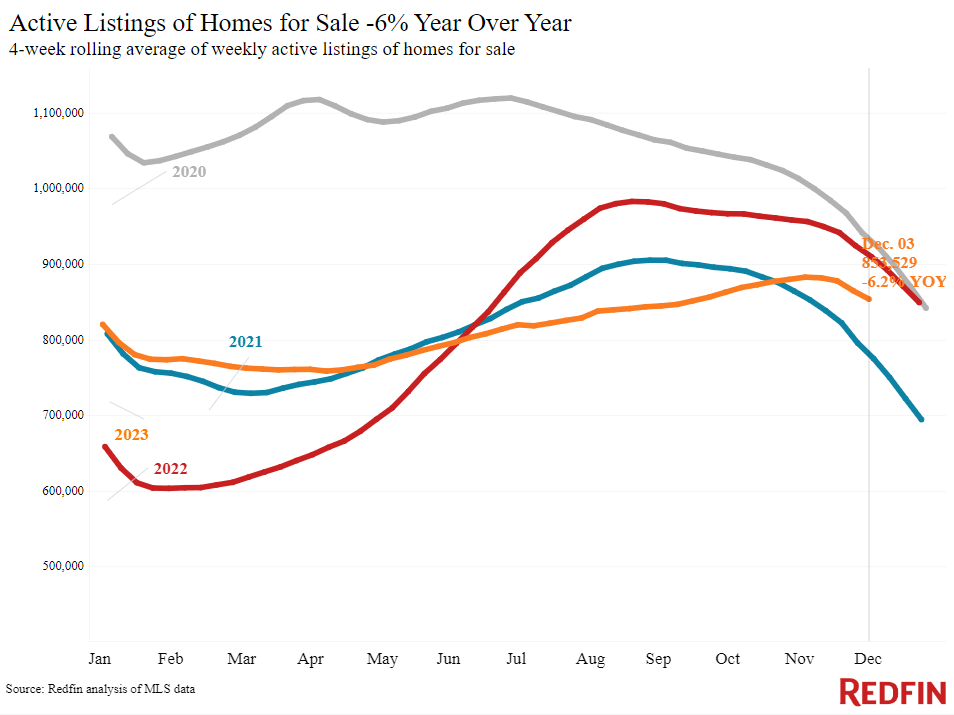

| Active listings | 853,529 | -6.2% | Tiniest decrease considering that June. |

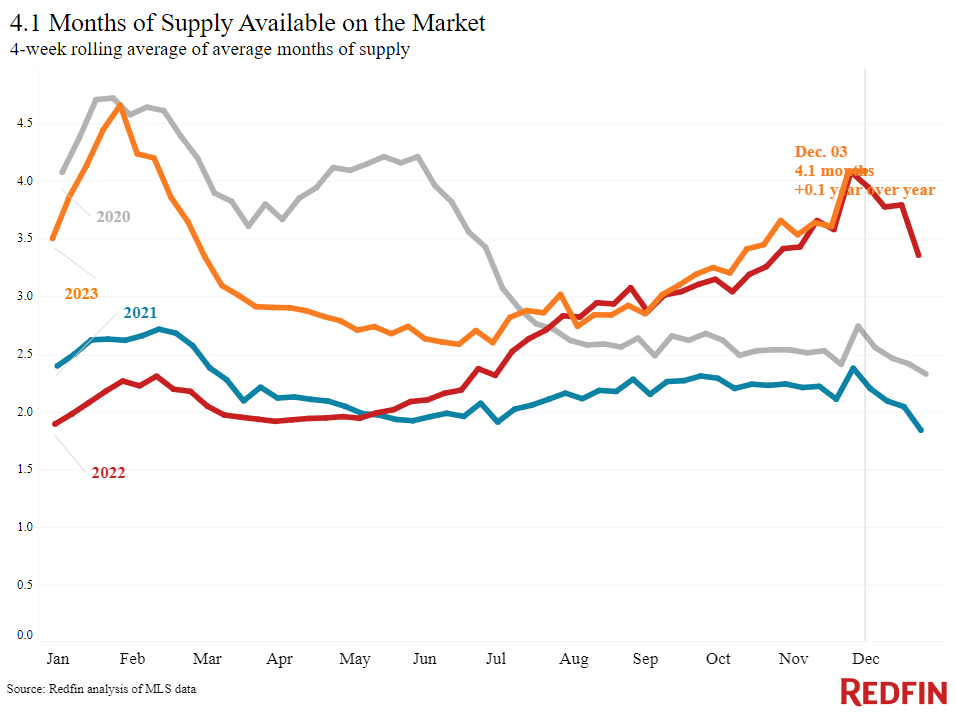

| Months of supply | 4.1 months | +0.1 pt. | 4 to 5 months of supply is thought about well balanced, with a lower number suggesting seller’s market conditions. |

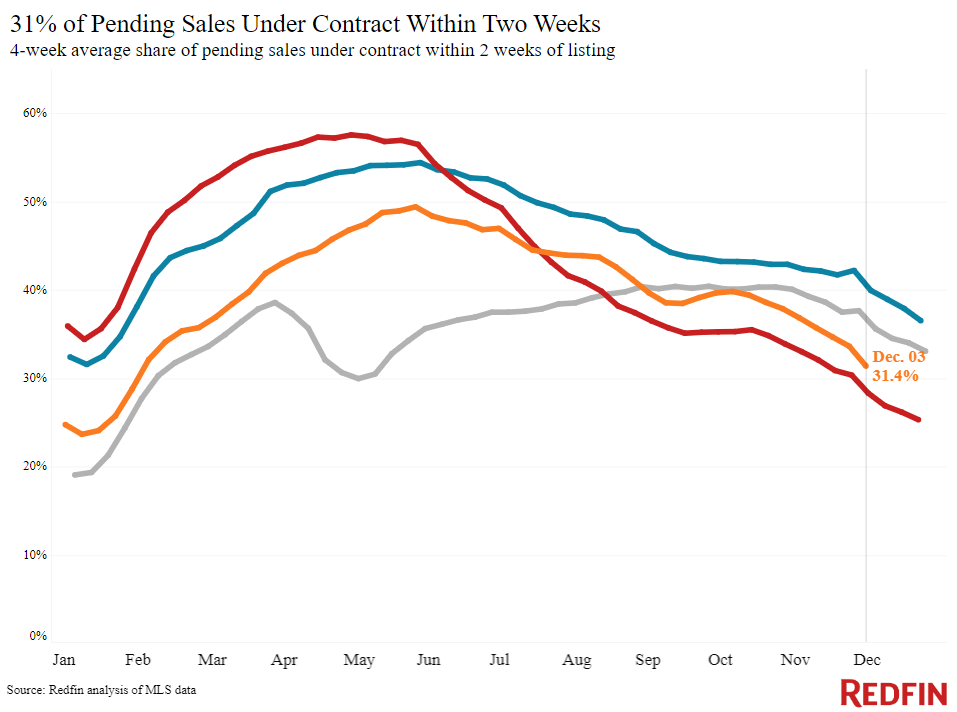

| Share of homes off market in 2 weeks | 31.4% | Up from 28% | |

| Mean days on market | 35 | -3 days | |

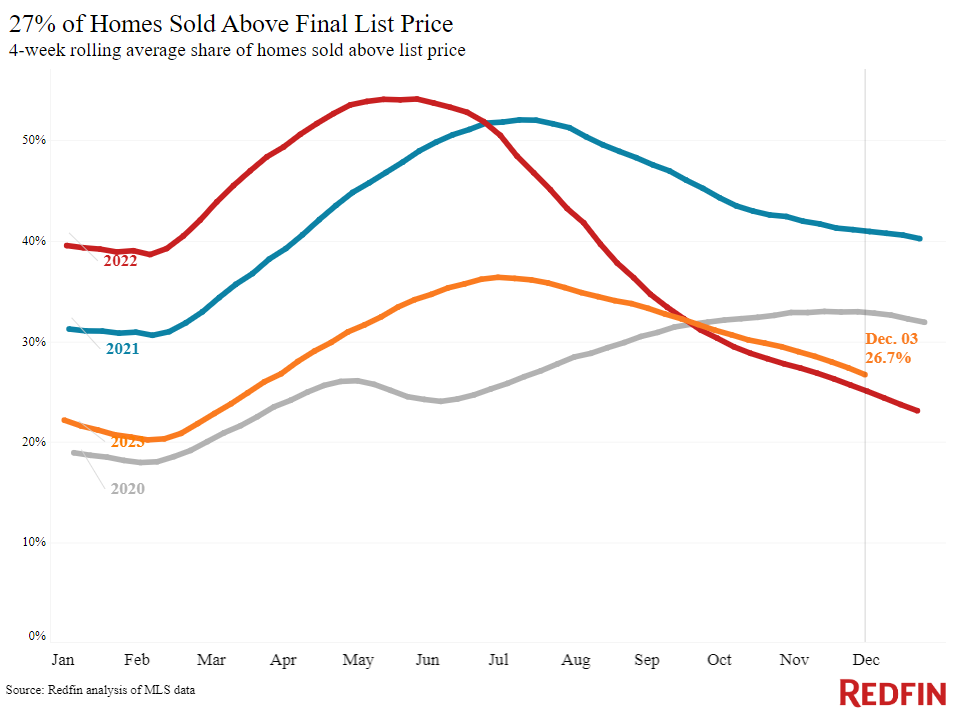

| Share of homes offered above market price | 26.7% | Up from 25% | |

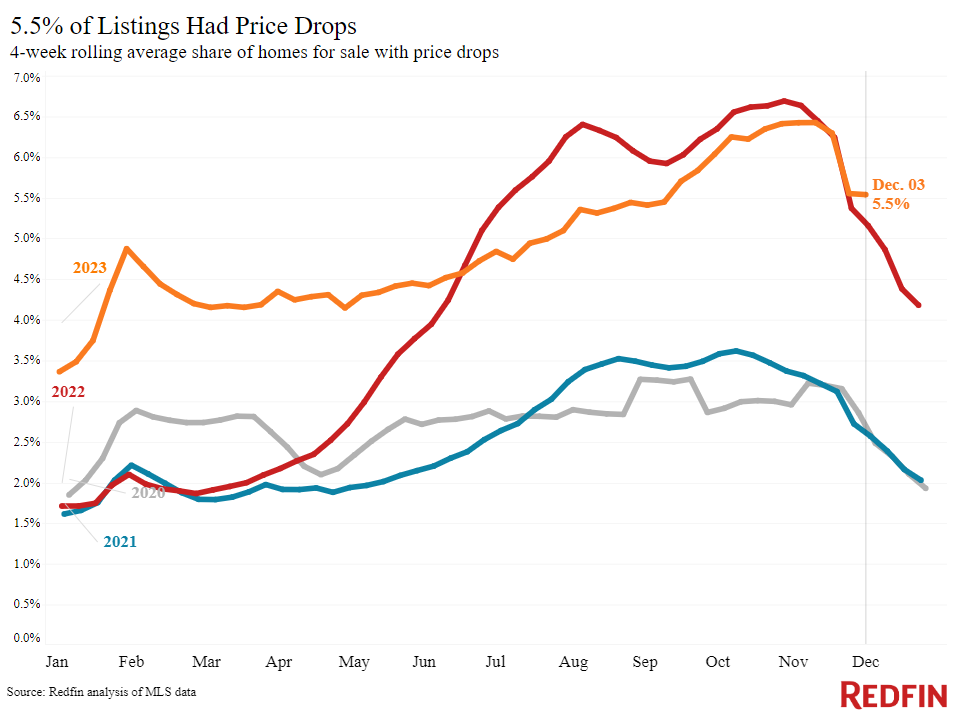

| Share of homes with a rate drop | 5.5% | +0.3 pts. | |

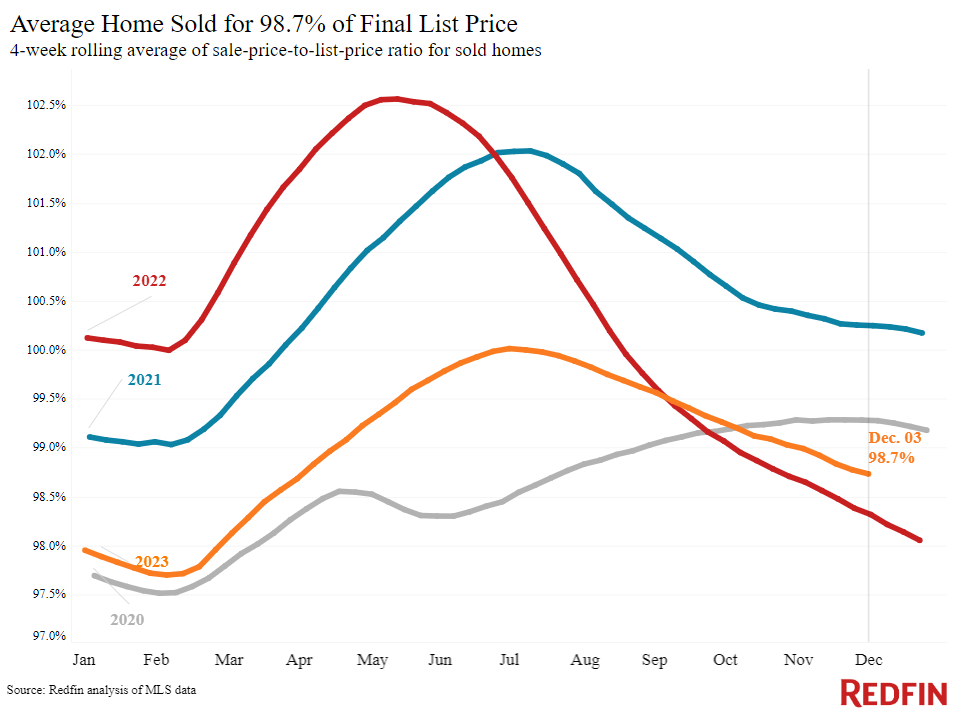

| Typical sale-to-list cost ratio | 98.7% | +0.4 pts. | |

| Metro-level highlights: 4 weeks ending December 3, 2023

Redfin’s metro-level information consists of the 50 most populated U.S. cities. Select cities might be omitted from time to time to guarantee information precision. |

|||

| Metros with greatest year-over-year boosts | Metros with greatest year-over-year reductions | Notes | |

| Mean price | Anaheim, CA (18.6%)

Fort Lauderdale, FL (12%) Newark, NJ (11.4%) New Brunswick, NJ (10.5%) San Diego, CA (10.3%) |

Austin, TX (-9.6%)

San Antonio, TX (-2.1%) Houston (-0.9%) Portland, OR (-0.8%) Fort Worth, TX (-0.5%) |

Decreased in 5 cities |

| Pending sales | San Jose, CA (7.3%)

Austin, TX (2.1%) Milwaukee (1%) Fort Worth, TX (0.6%) Los Angeles (0.4%) |

Cleveland, OH (-21.9%)

Cincinnati, OH (-21.8%) New York City (-17.9%) Providence, RI (-17.4%) Boston (-16.1%) |

Increased in 5 cities |

| New listings | Orlando, FL (27.6%)

Phoenix (20.7%) West Palm Beach, FL (16.2%) Las Vegas (14.8%) Miami (14.7%) |

Cleveland, OH (-17.8%)

Atlanta (-16.1%) San Francisco (-15%) Oakland, CA (-7.2%) Boston (-7.1%) |

Decreased in 12 cities |

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.