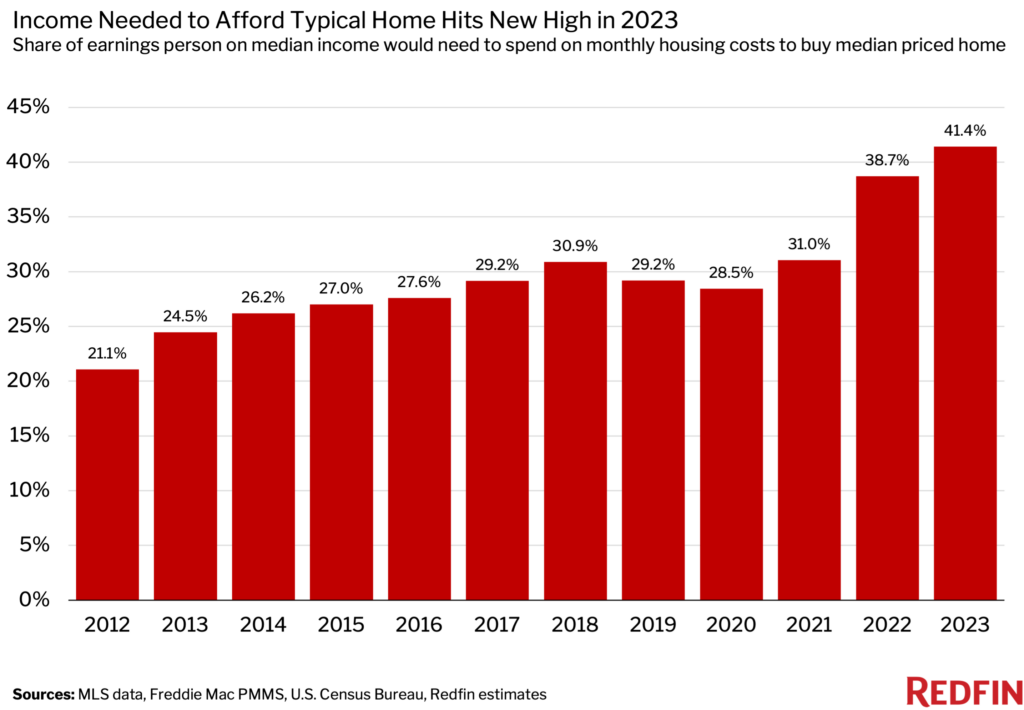

- A property buyer with the average U.S. earnings would’ve needed to invest a record 41% of incomes on regular monthly real estate expenses in 2023, up from 39% in 2022 and 31% in 2021.

- The least budget friendly markets were Anaheim and San Francisco, where property buyers with the normal regional earnings would require to invest over 80% of their pay on regular monthly real estate expenses. Detroit and Pittsburgh were the most budget friendly.

- Austin was the only market that was more budget friendly for property buyers in 2023 than in 2022.

- Price must enhance in 2024 as home rates and home mortgage rates tick down.

2023 has actually been the least budget friendly year to purchase a home in Redfin’s records, however things are searching for for 2024.

Somebody making the $78,642 average U.S. earnings in 2023 would’ve needed to invest 41.4% of their incomes on regular monthly real estate expenses if they purchased the $408,806 median-priced U.S. home. That’s the greatest share on record and is up from 38.7% in 2022.

That’s according to a Redfin analysis that approximates regular monthly real estate payments for the normal property buyer utilizing average home list price, regular monthly home mortgage rates (balancing 6.73% for 2023) and average home earnings, and the presumption of a 20% deposit, principal, interest, taxes and insurance coverage. To approximate 2023 average home earnings, we increased the readily available 2022 earnings information by the 2023 wage development rate. Information for 2023 goes through October, while information from previous years covers the complete year. When we describe a record high, we are referencing records going back to 2012.

A guideline in individual financing is that individuals ought to invest no greater than 30% of their earnings on real estate, however that has actually ended up being less reasonable due to raised home mortgage rates and home rates.

The normal 2023 property buyer required to make a yearly earnings of a minimum of $109,868 if they wished to invest no greater than 30% of their incomes on regular monthly real estate payments for the median-priced home. That’s a record high– up 8.5% from 2022– and is $31,226 more than the normal home makes in a year.

” A best storm of inflation, high rates, skyrocketing home mortgage rates and low real estate supply triggered 2023 to decrease as the least budget friendly year for real estate in current history,” stated Redfin Elder Financial expert Elijah de la Campa “Fortunately is that cost is currently enhancing heading into the brand-new year. Home mortgage rates are boiling down, more individuals are noting homes for sale, and there are still lots of sidelined purchasers all set to take a bite of the fresh stock. We anticipate these conditions to continue to enhance in 2024.”

Property buyers’ regular monthly payments have actually grown more than two times as quick as incomes

Real estate cost has actually diminished since incomes have not increased as rapidly as homebuying expenses. The average regular monthly real estate payment for property buyers in 2023 was a record $2,715, up 12.6% from 2022. Over the exact same duration, the average home earnings increased simply 5.2% to an approximated $78,642– likewise a record high, however low enough to balance out the dive in real estate expenses.

Month-to-month home mortgage expenses for property buyers skyrocketed this year as the Federal Reserve raised rate of interest to fight inflation. The typical 30-year-fixed home mortgage rate struck a 23-year high of 7.79% in October, and while it has actually considering that been up to 7.22%, that’s still more than double the 2.65% record low hit throughout the pandemic.

Raised home mortgage rates have actually cooled property buyer need, however real estate rates stay high since there aren’t adequate homes for sale. The $408,806 average home price in 2023 is the greatest of any year on record. Lots of house owners are deciding to sit tight since selling and purchasing a brand-new home would imply losing their low home mortgage rate.

Austin is the only city that ended up being more budget friendly; Anaheim and Miami saw the greatest declines in cost

In Austin, TX, somebody making the $99,523 average earnings in 2023 would have needed to invest 36.6% of their incomes on regular monthly real estate expenses if they purchased the $456,950 median-priced home, below 37.7% in 2022. That’s the only decrease amongst the 50 most populated U.S. cities.

The tiniest boosts remained in Detroit (+0.7 ppts to 18.5%), Oakland, CA (+0.7 ppts to 53.3%), Phoenix (+0.9 ppts to 40.2%) and Las Vegas (+1.2 ppts to 43.8%).

The majority of these locations have something in typical: Price can’t get much even worse since it has actually currently ended up being so stretched. Austin, Phoenix and Las Vegas blew up in appeal throughout the pandemic as remote employees gathered in, triggering home rates to increase. With numerous individuals now evaluated, expenses have actually begun returning down to earth. Austin published a larger home rate decrease than any other significant city this year (-9.2% YoY). It is followed by Oakland (-5%), Phoenix (-4.1%) and Las Vegas (-3.6%).

In Anaheim, CA, somebody making the $92,306 average earnings in 2023 would’ve needed to invest 88.3% of their incomes on regular monthly real estate expenses if they purchased the $1,022,075 median-priced home, up from 80.2% in 2022. That’s the greatest dive amongst the 50 most populated cities. Next came Miami (+7.1 ppts to 54.1%), West Palm Beach, FL (+6.2 ppts to 49.1%), San Diego (+5.9 ppts to 64.6%) and Newark, NJ (+5.6 ppts to 42.8%).

Much of those cities have something in typical: Home rates are still increasing since there’s still require from purchasers who are being available in from more costly locations to get more bang for their dollar. Miami and West Palm Beach are likewise bring in out-of-staters who choose Florida’s low taxes, warm weather condition and politics. Miami published the 2nd greatest boost in home rates amongst the 50 most populated cities this year, up 8.2% from 2022 (Milwaukee preceded). It is followed by Newark (+8.2%) and West Palm Beach (+7.6%).

California controls list of least budget friendly cities; midwest cities rank amongst the majority of budget friendly

In Anaheim, somebody making the average earnings in 2023 would’ve needed to invest 88.3% of their incomes on regular monthly real estate expenses if they purchased the average priced home– the greatest share amongst the 50 most populated cities. Next come 4 other costly California cities: San Francisco (85.4%), San Jose, CA (73%), Los Angeles (72.9%) and San Diego (64.6%).

The majority of people who make the average earnings in these locations are required to lease since it’s not economically possible to get a home loan if your regular monthly payment represents 70% or 80% of your regular monthly earnings.

At the other end of the spectrum is Detroit, where somebody making the average earnings in 2023 would’ve needed to invest 18.5% of their incomes on regular monthly real estate expenses if they purchased the average priced home– the most affordable share amongst the cities Redfin examined. It’s followed by Pittsburgh (23.5%), Cleveland (23.8%), Philadelphia (23.9%) and St. Louis (25.2%). These 5 cities have lower average home list price than anywhere else in the country– all listed below $300,000.

Wish For 2024: Home mortgage payments fall, real estate supply increases

Real estate expenses have actually begun to decrease as home mortgage rates have actually fallen; the normal property buyer’s regular monthly payment was $ 2,575 throughout the 4 weeks ending November 26, below its peak last month however still up 13% year over year. New listings published the greatest yearly uptick in more than 2 years.

In 2024, Redfin forecasts listings will climb up even more, home mortgage rates will be up to about 6.6%, and rates will drop 1%.

Metro-level summary: 2023

Table listed below consists of 50 most populated U.S. cities; 2023 information covers Jan. 1-Oct. 31 and year-over-year modifications compare to the complete year of 2022. Typical earnings are relative to each city.

| U.S. city location | Share of incomes somebody on average earnings would’ve needed to invest in regular monthly real estate expenses to purchase average priced home | YoY modification in share of incomes somebody on average earnings would’ve needed to invest in regular monthly real estate expenses to purchase average priced home | Typical regular monthly real estate payment for property buyers | Typical approximated home earnings | Typical home price | YoY modification in average home price |

|---|---|---|---|---|---|---|

| Anaheim, CA | 88.3% | 8.1 ppts | $ 6,794 | $ 92,306 | $ 1,022,075 | 3.1% |

| Atlanta, GA | 34.2% | 2.6 ppts | $ 2,542 | $ 89,290 | $ 382,673 | 1.7% |

| Austin, TX | 36.6% | -1.2 ppts | $ 3,033 | $ 99,523 | $ 456,950 | -9.2% |

| Baltimore, MD | 30.0% | 2.7 ppts | $ 2,381 | $ 95,211 | $ 358,335 | 3.1% |

| Boston, MA | 49.3% | 4.9 ppts | $ 4,503 | $ 109,723 | $ 677,695 | 4.4% |

| Charlotte, NC | 38.2% | 2.4 ppts | $ 2,586 | $ 81,166 | $ 389,373 | 0.3% |

| Chicago, IL | 29.1% | 2.6 ppts | $ 2,116 | $ 87,226 | $ 318,578 | 3.1% |

| Cincinnati, OH | 27.3% | 3.4 ppts | $ 1,796 | $ 78,965 | $ 270,280 | 7.3% |

| Cleveland, OH | 23.8% | 1.9 ppts | $ 1,362 | $ 68,588 | $ 204,773 | 2.4% |

| Columbus, OH | 32.2% | 3.6 ppts | $ 2,136 | $ 79,717 | $ 321,500 | 6.0% |

| Dallas, TX | 38.5% | 2.1 ppts | $ 2,794 | $ 87,130 | $ 420,845 | -0.5% |

| Denver, CO | 44.0% | 2.2 ppts | $ 3,815 | $ 104,122 | $ 574,500 | -1.2% |

| Detroit, MI | 18.5% | 0.7 ppts | $ 1,155 | $ 74,971 | $ 173,785 | -2.6% |

| Fort Lauderdale, FL | 44.1% | 5.3 ppts | $ 2,734 | $ 74,449 | $ 411,700 | 6.9% |

| Fort Worth, TX | 32.5% | 1.2 ppts | $ 2,359 | $ 87,130 | $ 355,359 | -2.2% |

| Houston, TX | 33.5% | 1.6 ppts | $ 2,199 | $ 78,756 | $ 331,251 | -1.2% |

| Indianapolis, IN | 29.0% | 3.0 ppts | $ 1,929 | $ 79,767 | $ 290,462 | 5.2% |

| Jacksonville, FL | 35.0% | 1.9 ppts | $ 2,380 | $ 81,617 | $ 358,481 | -0.6% |

| Kansas City, MO | 31.2% | 2.9 ppts | $ 2,059 | $ 79,195 | $ 309,900 | 3.7% |

| Las Vegas, NV | 43.8% | 1.2 ppts | $ 2,718 | $ 74,478 | $ 409,237 | -3.6% |

| Los Angeles, CA | 72.9% | 3.9 ppts | $ 5,611 | $ 92,306 | $ 844,500 | -1.0% |

| Miami, FL | 54.1% | 7.1 ppts | $ 3,354 | $ 74,449 | $ 504,990 | 8.2% |

| Milwaukee, WI | 32.0% | 4.3 ppts | $ 1,989 | $ 74,585 | $ 299,300 | 9.0% |

| Minneapolis, MN | 30.4% | 2.2 ppts | $ 2,433 | $ 96,091 | $ 366,350 | 1.3% |

| Montgomery County, PA | 39.8% | 4.3 ppts | $ 2,935 | $ 88,497 | $ 441,671 | 5.5% |

| Nashville, TN | 41.7% | 2.3 ppts | $ 2,928 | $ 84,196 | $ 440,981 | -0.4% |

| Nassau County, NY | 50.9% | 3.7 ppts | $ 4,084 | $ 96,323 | $ 614,355 | 1.2% |

| Brand-new Brunswick, NJ | 39.7% | 4.5 ppts | $ 3,191 | $ 96,323 | $ 479,854 | 6.0% |

| New York City, NY | 56.7% | 3.7 ppts | $ 4,548 | $ 96,323 | $ 684,750 | 0.5% |

| Newark, NJ | 42.8% | 5.6 ppts | $ 3,434 | $ 96,323 | $ 516,500 | 8.2% |

| Oakland, CA | 53.3% | 0.7 ppts | $ 5,983 | $ 134,815 | $ 900,575 | -5.0% |

| Orlando, FL | 41.7% | 3.5 ppts | $ 2,627 | $ 75,594 | $ 395,722 | 2.9% |

| Philadelphia, PA | 23.9% | 1.2 ppts | $ 1,761 | $ 88,497 | $ 265,100 | -1.0% |

| Phoenix, AZ | 40.2% | 0.9 ppts | $ 2,924 | $ 87,194 | $ 440,266 | -4.1% |

| Pittsburgh, PA | 23.5% | 1.7 ppts | $ 1,456 | $ 74,279 | $ 218,973 | 1.5% |

| Portland, OR | 45.6% | 2.3 ppts | $ 3,571 | $ 93,956 | $ 537,783 | -1.1% |

| Providence, RI | 40.1% | 4.5 ppts | $ 2,872 | $ 86,037 | $ 432,225 | 6.0% |

| Riverside, CA | 49.8% | 2.8 ppts | $ 3,615 | $ 87,109 | $ 544,375 | -0.7% |

| Sacramento, CA | 47.5% | 2.0 ppts | $ 3,714 | $ 93,877 | $ 558,975 | -2.2% |

| San Antonio, TX | 33.7% | 1.3 ppts | $ 2,085 | $ 74,206 | $ 314,048 | -2.1% |

| San Diego, CA | 64.6% | 5.9 ppts | $ 5,604 | $ 104,072 | $ 843,450 | 3.2% |

| San Francisco, CA | 85.4% | 2.4 ppts | $ 9,597 | $ 134,815 | $ 1,444,700 | -3.5% |

| San Jose, CA | 73.0% | 5.1 ppts | $ 9,528 | $ 156,643 | $ 1,433,625 | 0.7% |

| Seattle, WA | 54.3% | 2.6 ppts | $ 5,086 | $ 112,468 | $ 765,760 | -1.4% |

| St. Louis, MO | 25.2% | 2.4 ppts | $ 1,647 | $ 78,407 | $ 247,852 | 4.1% |

| Tampa, FL | 40.6% | 2.4 ppts | $ 2,464 | $ 72,893 | $ 371,024 | 0.1% |

| Virginia Beach, VA | 33.5% | 3.6 ppts | $ 2,188 | $ 78,433 | $ 329,340 | 5.5% |

| Warren, MI | 30.5% | 3.0 ppts | $ 1,904 | $ 74,971 | $ 286,465 | 4.2% |

| Washington, DC | 34.2% | 2.9 ppts | $ 3,521 | $ 123,538 | $ 530,375 | 2.6% |

| West Palm Beach, FL | 49.1% | 6.2 ppts | $ 3,047 | $ 74,449 | $ 458,807 | 7.6% |

| National– U.S.A. | 41.4% | 2.7 ppts | $ 2,715 | $ 78,642 | $ 408,806 | 0.5% |