-

.(* )The decrease is viewed as a “catch-up” to weaker physical markets post-WTI alternatives expiration and decrease in Middle East danger premium.

- .

- .

- .

Essential indications like weak margins, constant OPEC exports, and weaker spread signals added to the rate drop.

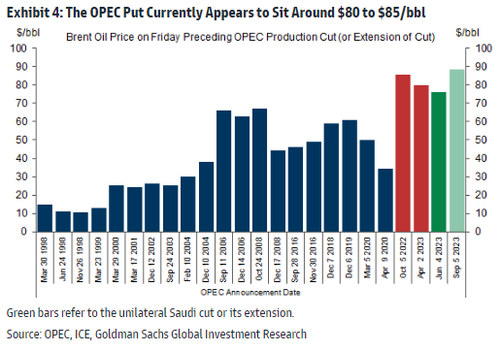

Goldman Sachs’ designs recommend continued selling by CTAs and preserve that OPEC is most likely to keep Brent within an $80-$ 100 variety.

Lots of concerns on the weak point in Crude

— Ideas from our trading desk: think the relocation is more of a “catch-up” to weaker physical markets as we moved previous WTI alternatives expiration the other day & & as Middle East danger premium has actually now come out of the marketplace in our view. Larger photo:

Margins have actually stayed weak for a while

- OPEC continues to export

- Spreads & & DFLs have actually been indicating weaker basics for numerous days now

- Brent breaking through the 200dma … approaching oversold levels (RSI 32.7) …

On the vol front,

- it’s intriguing to keep in mind that front-end gamma is well bid on this selloff which is a re-engagement of the unfavorable spot/vol connection we saw from late September up until the early October Israeli attacks turned that suddenly. We’re likewise seeing put alter rally dramatically here with front-end 25d RR’s quickly approaching the September wides of ~ 5v for puts) Alternatives desk believe there is some gamma around $75 from sov hedging/other prod strikes and worth keeping in mind PMI moved their OSP lower the other day which brings strikes closer to the cash. We have not seen excessive fresh on the basic side.

- There are some ideas that an Iraq streams resolution impends, however absolutely nothing verified which does not call for a sell of this magnitude. Our designs have CTA selling continuing

- and timing of the relocation was around the time that their circulation typically increases. Fitting that GIR Released their 2024 Outlook today:

- ” Our company believe that OPEC will make sure Brent in a $80-$ 100 variety by leveraging its rates power, with a $80 flooring from the OPEC put, and a $100 ceiling from extra capability” ( link) From Goldman flooring trader Michael Nocerino through Zerohedge.com

More Leading Reads From Oilprice.com: