International Silver Industrial Need Projection to Accomplish New High in 2023

Silver Market Anticipated to Register Another Sizeable Structural Deficit

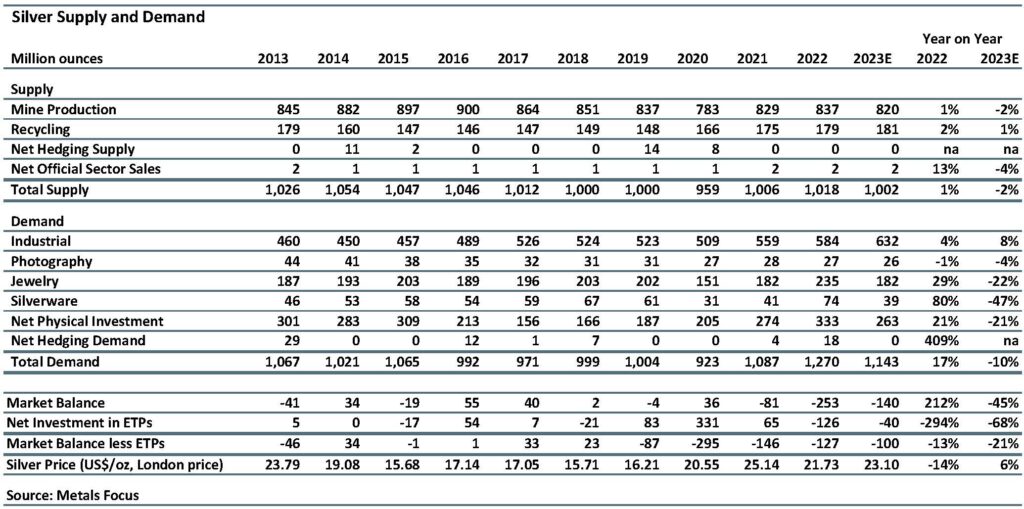

( November 15, 2023– New York City)– Silver Commercial need is anticipated to grow 8% to a record 632 million ounces (Moz) this year. Secret motorists behind this efficiency consist of financial investment in photovoltaics, power grid and 5G networks, development in customer electronic devices, and increasing automobile output. These essential findings were reported by Philip Newman, Handling Director at Metals Focus, and Sarah Tomlinson, Director of Mine Supply, throughout the Silver Institute’s Yearly Silver Market Supper in New york city tonight, including historic supply and need data and quotes for 2023. Other essential highlights from their discussion consist of:

- Worldwide, overall silver need is anticipated to relieve by 10% to reach 1.14 billion ounces in 2023. Gains in commercial applications will be balanced out by losses in all other essential sectors. Regardless of the fall, overall need stays raised by historic requirements, making the 2023 figure the 2nd greatest in Metals Focus’ information series.

- Commercial need in 2023 will accomplish a brand-new yearly high. As kept in mind above, essential motorists in this development are being driven by a strong green economy, consisting of financial investment in photovoltaics (PV), power grids and 5G networks, along with increased usage of automobile electronic devices and supporting facilities. Improvements in (PV) were especially obvious as the boost in cell production went beyond silver thrifting, which assisted drive electronic devices and electrical need greater.

- Silver fashion jewelry and flatware need is set to fall by 22% and 47%, respectively, to 182 Moz and 39 Moz this year. For both, losses are led by India, where full-year need is anticipated to stabilize after a rise in 2022. Omitting India, worldwide fashion jewelry need is anticipated to edge a little greater in 2023, while flatware will fall by a significantly smaller sized 12%.

- Physical financial investment in 2023 is forecasted to fall by 21% to a three-year low of 263 Moz. While a lot of markets have actually seen weaker volumes, losses have actually been focused in India and Germany. In India, record high regional rates both hindered brand-new financier purchases and caused benefit taking, leading to a 46% decrease. In Germany, financier belief was struck hard by the barrel trek to some silver coins at the start of 2023. United States financial investment has actually likewise turned lower, however just decently, thanks to resilient safe house need following the local banking crisis. The durability of the United States market assists describe why the worldwide overall stays traditionally high.

- Exchange-traded items are anticipated to tape-record net outflows for the 2nd year in a row. As held true in 2022, the bulk of year-to-date redemptions show ongoing financial tightening up and its substantial increase to yields, particularly in genuine terms. Nevertheless, the decrease in holdings is anticipated to be more limited at 40 Moz in 2023, approximately a 3rd of 2022’s record outflows.

- In 2023, worldwide mined silver production is anticipated to fall by 2% year-on-year to 820 Moz, driven by lower output from operations in Mexico and Peru. Production from Mexico is anticipated to fall by 16 Moz due to the effect of the suspension of operations at Peñasquito in Q2 and Q3 in reaction to the labor strike. However, total production from main silver mines will still increase this year, driven by the anticipated ramp-up at the Juanicipio mine. Output from lead/zinc mines will likewise increase as Udokan in Russia comes on-stream. A decline in spin-off credits, a boost in sustaining capital costs and inflation of input expenses will all cause double-digit year-on-year development in AISC.

- In general, regardless of weaker need and a minor drop in overall supply, the worldwide silver market is anticipated to see another considerable physical deficit in 2023, marking the 3rd successive year of a yearly deficit. At 140 Moz, this will be 45% lower than 2022’s all-time high, however this is still raised by historic requirements. Simply as essential, Metals Focus thinks the deficit will continue the silver market for the foreseeable future.

- Metals Focus anticipates the typical silver rate to increase by 6% year-on-year to $23.10 this year. Through November 7, rates have actually grown by 8% year-on-year. Moving forward, Metals Focus are securely in the ‘greater for longer’ camp, as far as United States rate of interest expectations are worried. This background is not beneficial for zero-yielding properties such as silver. The white metal’s financial investment appeal will likewise be injured by bad self-confidence in commercial products due to a slowing Chinese economy. With this in mind, Metals Focus keeps a careful outlook for the silver rate in the meantime and for much of 2024.

Disclaimer & & Copyright. The Silver Institute and Metals Focus

We (and where appropriate, any determined factors or co-authors) are the owner or the licensee of all copyright rights in this file. This file is safeguarded by copyright laws and treaties worldwide. All such rights are scheduled. No company or person is allowed to recreate or send all or part of this file (consisting of without constraint extracts such as tables and charts), whether by copying or keeping in any medium by electronic ways or otherwise, without the composed authorization of The Silver Institute and Metals Focus. In cases where we have actually offered our file digitally, just the licensed customer, in regard of whom a specific user license has actually been approved, might download a copy of this file. Extra user licenses might be bought on demand.

While every effort has actually been made to guarantee the precision of the details in this file, the material of this file is offered with no assurances, conditions, or service warranties regarding its precision, efficiency, or dependability. It is not to be interpreted as a solicitation or a deal to purchase or offer rare-earth elements, associated items, products, securities, or associated monetary instruments.

Press Contact Information

Michael DiRienzo

The Silver Institute

Phone: +1.202.495.4030

Email: [email protected]

Philip Newman

Metals Focus

Phone: +44.20.3301.6510

Email: [email protected]