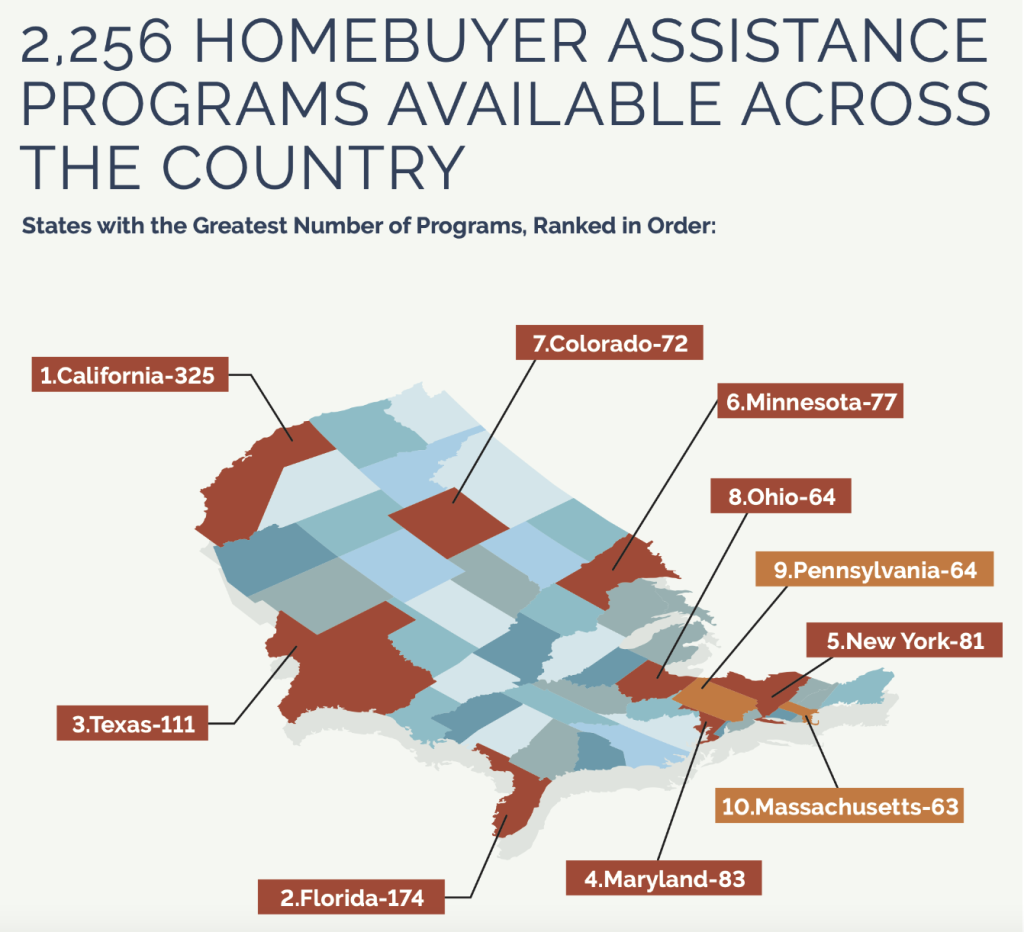

An overall of 2,256 property buyer support programs are offered in the U.S. real estate market after 54 programs were included the 3rd quarter, according to Deposit Resource ( DPR), a property buyer support program information and services company.

Amongst the offered property buyer support programs were 295 that permit customers to decrease their rates of interest by paying an in advance cost, according to DPR’s homeownership program index report

” Program service providers are working all the time to make sure the programs they provide fulfill the requirements of their markets. For this factor, numerous programs now permit funds to be utilized for buydowns and other popular funding methods that soothe of month-to-month home mortgage payments,” Rob Chrane, creator and CEO of DPR, stated in a declaration.

Of the 295 programs, 253 will money irreversible buydowns and 66 will support short-lived buydowns Buydowns have actually ended up being a favored funding technique for customers as home mortgage rates have actually risen.

In a long-term buydown, customers’ rates of interest is decreased by a particular portion for the whole period of the home mortgage. A short-lived rate buydown on a home loan permits property buyers to minimize their rates of interest for a minimal duration, typically a year or 2.

An overall of 224 programs will money specific in advance loan charges consisting of the in advance home mortgage insurance coverage premium on FHA loans, the financing cost on VA loans and the warranty charges on USDA loans

Approximately 71 programs will money home mortgage insurance coverage buydowns– which is needed for all customers of FHA loans and traditional loans with a deposit of less than 20% of the purchase cost.

About 74% of the 2,256 property buyer support programs are deposit and closing expense support programs. Some 10% of the programs are very first home loans and 3% of programs are home mortgage credit certificates (MCCs).

A growing variety of non-bank home mortgage lending institutions have actually presented deposit support programs just recently to increase their origination pie in a difficult home mortgage environment.

Most just recently, loanDepot presented a brand-new deposit support program for FHA loan customers that allows them to put absolutely no cash down upfront.

Other lending institutions that presented deposit support programs consist of Rocket Home Loan, United Wholesale Home Loan, Guild Home Loan and Surefire Rate

Throughout the nation, California (325) provided the best variety of property buyer support programs, followed by Florida (174) and Texas (111 ).