An absence of houses for sale is pressing costs up. Stock published its greatest decrease in 18 months as house owners hold on to reasonably low home loan rates.

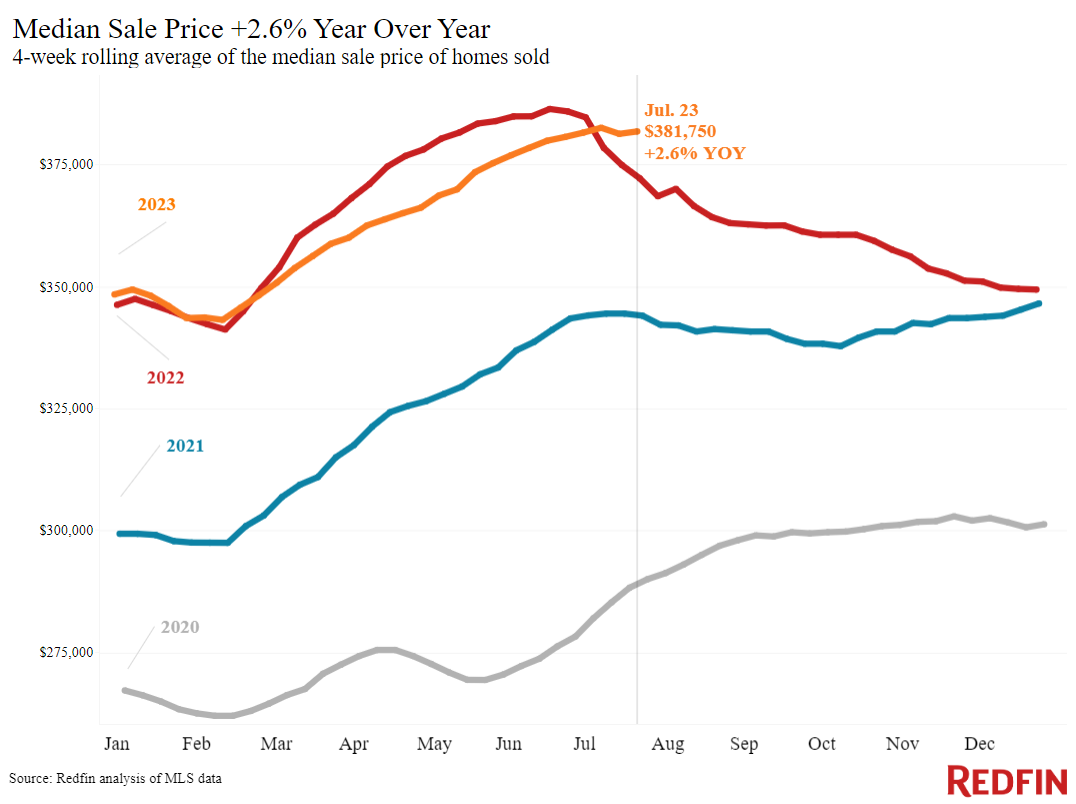

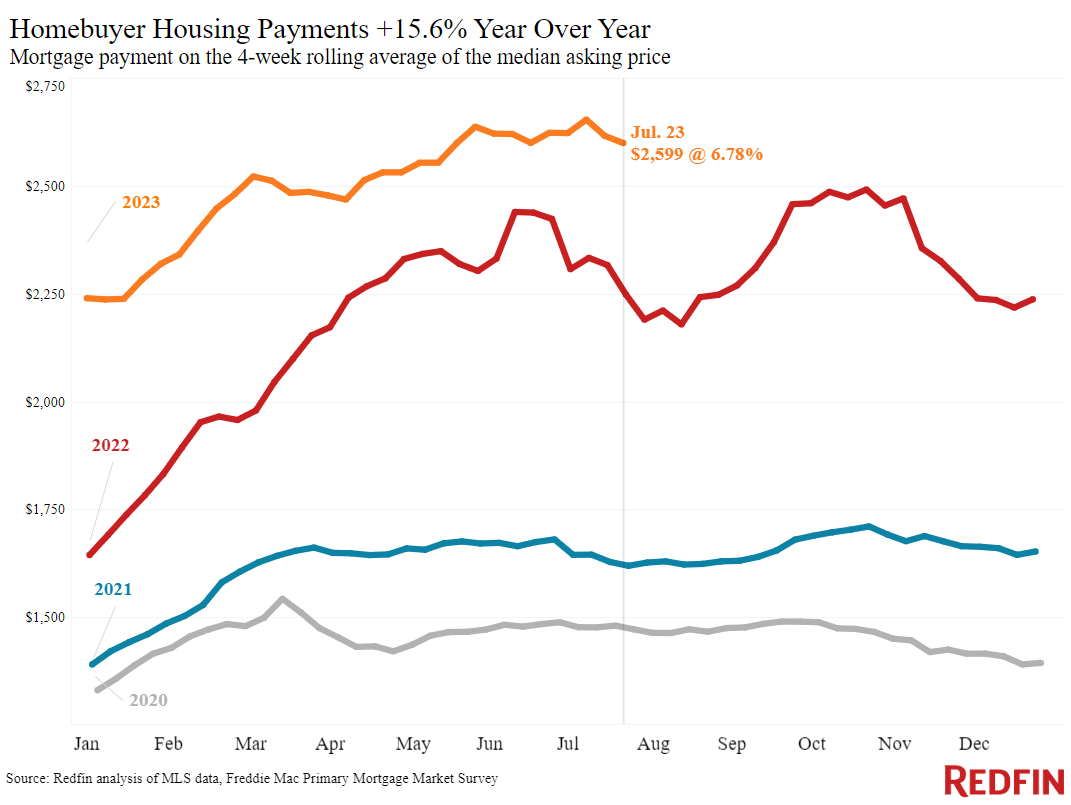

The common U.S. house cost approximately $382,000 throughout the 4 weeks ending July 23, up 2.6% from a year previously, the greatest boost given that November. Still, property buyers are getting a degree of relief as home loan rates inch below the eight-month high hit a couple of weeks earlier. The common regular monthly home loan payment is $2,599 at today’s typical weekly rate, down $55 from the all-time high of $2,654 in early July.

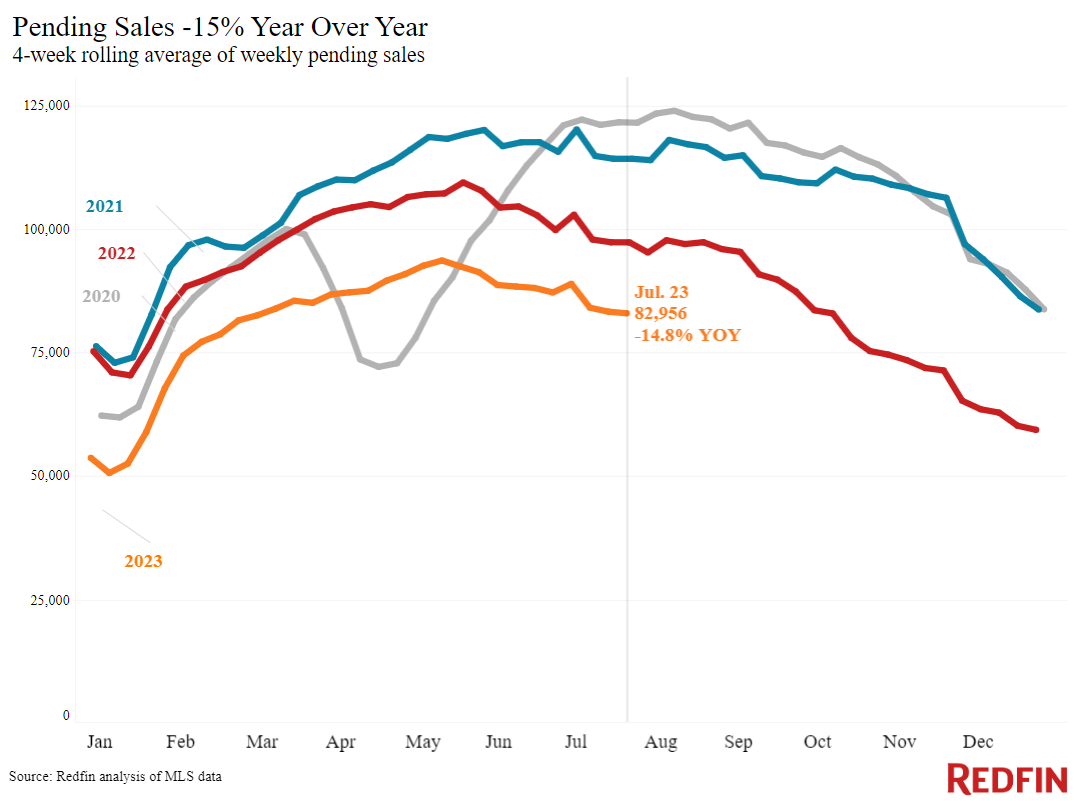

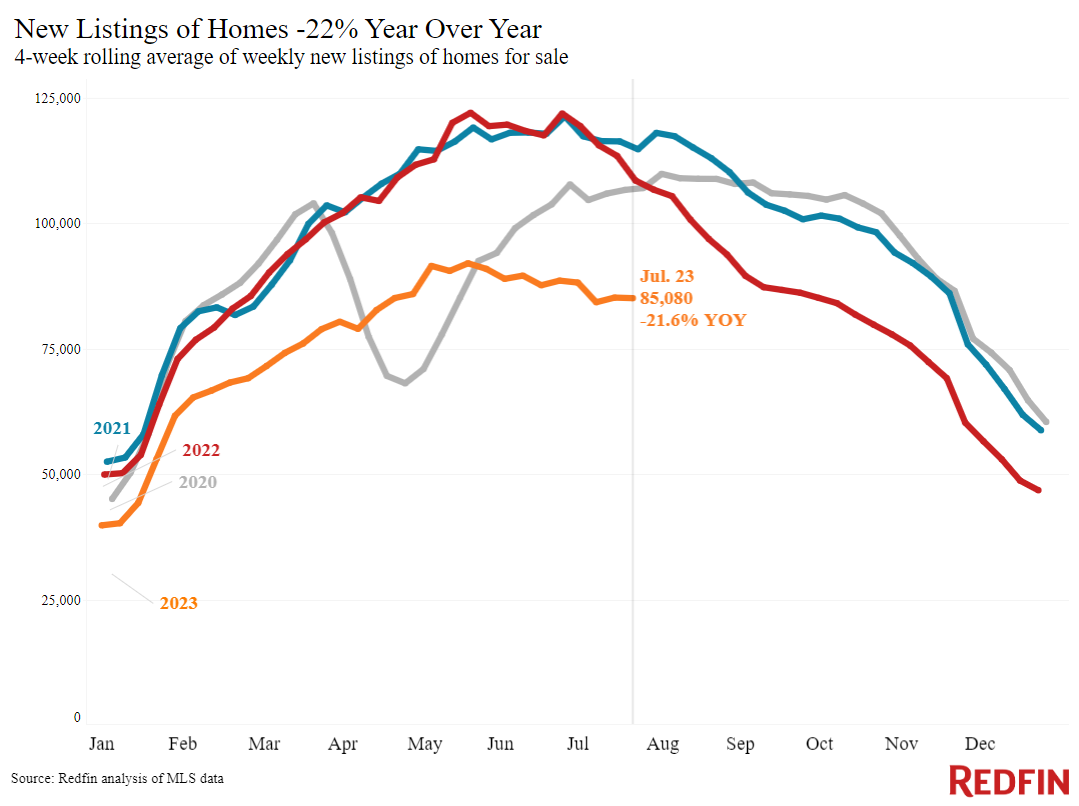

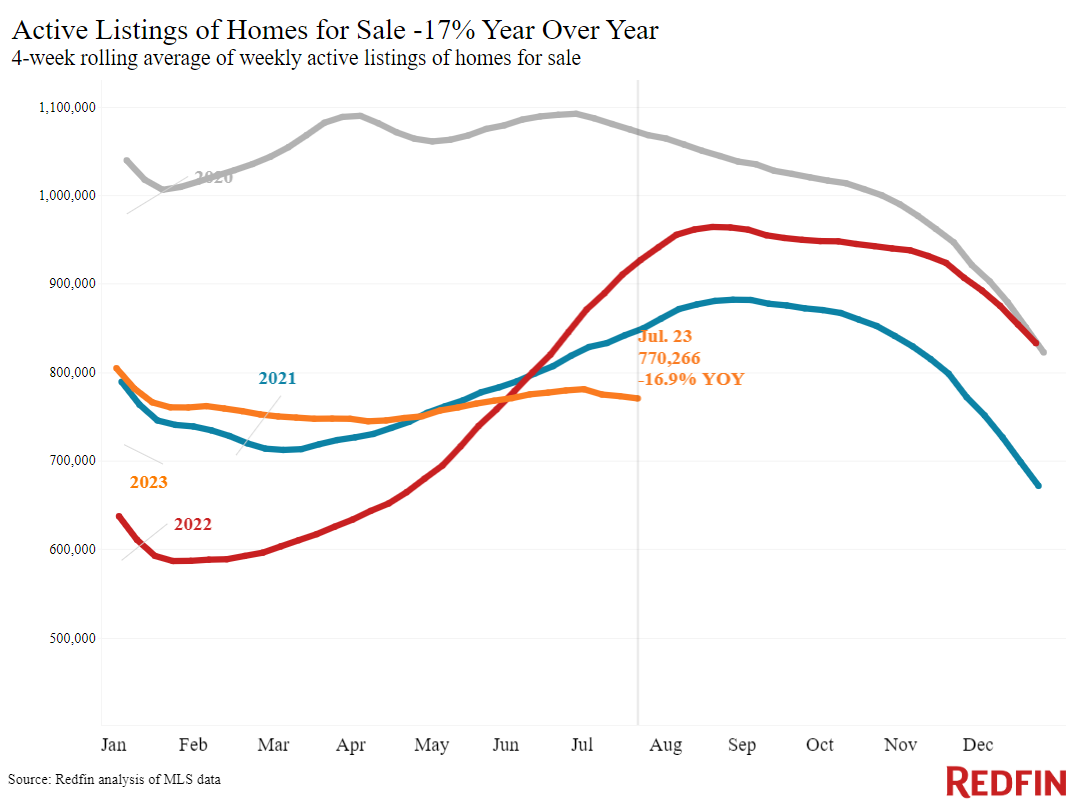

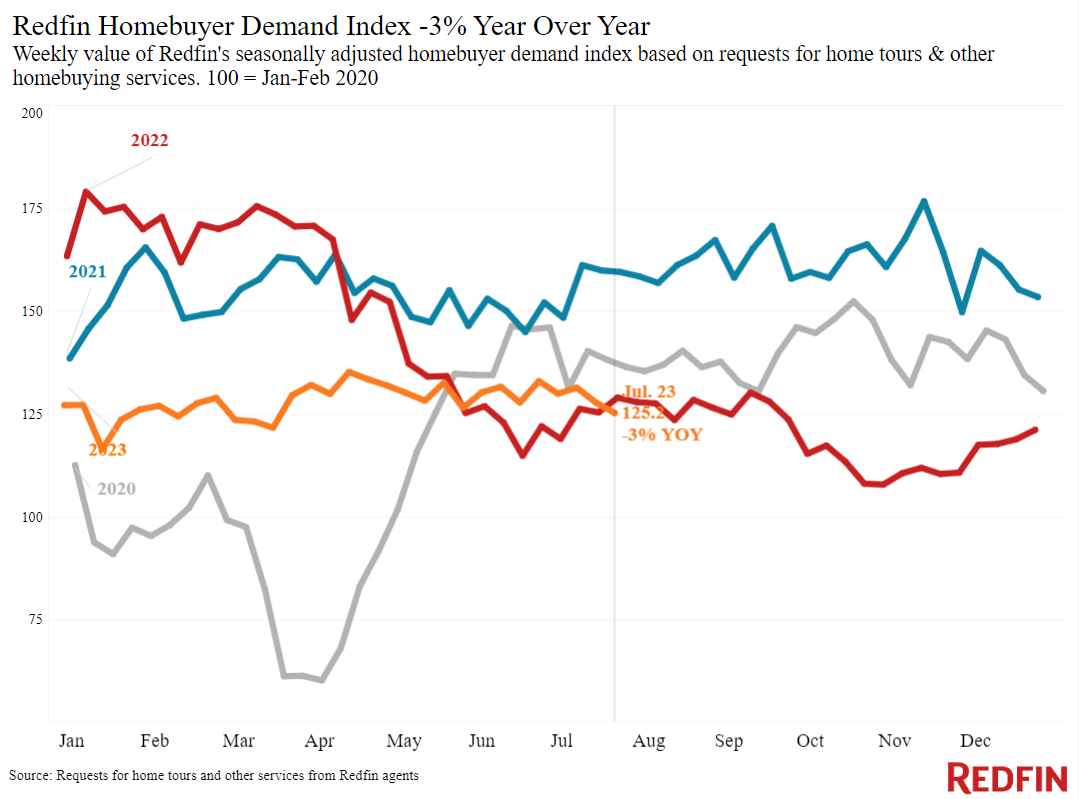

Today’s real estate market is uncommon since costs are increasing in spite of lukewarm need. Redfin’s Property buyer Need Index– a procedure of ask for trips and other homebuying services from Redfin representatives– is down 3% from a year earlier, and mortgage-purchase applications are down about 23%. However stock has actually dropped more than need, with house owners hanging onto their relatively low home loan rates, which is sending out costs up. New listings are down 22% from a year earlier, and the overall variety of houses for sale is down 17%, the greatest decrease in a year and a half. Pending sales are down 15%, partially since the absence of stock is connecting prospective property buyers’ hands.

Today’s news that the Fed is no longer anticipating a broad financial recession is confident for the real estate market, in spite of the synchronised interest-rate walking. The Fed showed that a soft landing is most likely than they had actually formerly believed, which would imply rates of interest went high sufficient to tame inflation however inadequate to trigger a rise in joblessness and send out the economy into an economic downturn.

” This is confident news for the real estate market in a couple of methods,” stated Redfin Economic Research study Lead Chen Zhao “Preventing an economic downturn indicates Americans will keep their tasks, for the many part, and feel more positive about acquiring big-ticket products like a home. Stable development on taming inflation indicates that while home loan rates will most likely remain raised for a minimum of a couple of months, they’re most likely to begin boiling down prior to the end of the year. That must motivate some sellers and purchasers to delve into the marketplace.”

Leading indications of homebuying activity:

- The day-to-day average 30-year set home loan rate was 6.95% on July 26, up a little from a week previously. For the week ending July 20, the typical 30-year set home loan rate was 6.78%, below a half-year high a week previously.

- Mortgage-purchase applications throughout the week ending July 21 decreased 3% from a week previously, seasonally changed. Purchase applications were down 23% from a year previously.

- The seasonally changed Redfin Property buyer Need Index– a procedure of ask for house trips and other homebuying services from Redfin representatives– was down 3% from a year previously, the very first decrease after 8 straight weeks of boosts.

- Google look for “ houses for sale” were up basically flat from a month previously throughout the week ending July 22, and down about 6% from a year previously.

- Visiting activity since July 23 was up 11% from the start of the year, compared to a 4% decline at the very same time in 2015, according to house trip innovation business ShowingTime

Secret real estate market takeaways for 400+ U.S. city locations:

Unless otherwise kept in mind, the information in this report covers the four-week duration ending July 23 Redfin’s weekly real estate market information returns through 2015.

Information based upon houses noted and/or offered throughout the duration:

For bullets that consist of metro-level breakdowns, Redfin examined the 50 most populated U.S. cities. Select cities might be left out from time to time to make sure information precision.

- The mean house price was $381,750, up 2.6% from a year previously. That’s the greatest boost given that November.

- List price increased most in Miami (11.9% YoY), Milwaukee (9.3%), Cincinnati (8.9%), Anaheim, CA (8.3%) and West Palm Beach, FL (7.4%).

- Home-sale costs decreased in 20 cities, with the greatest drops in Austin, TX (-8.8% YoY), Detroit (-6.4%), Phoenix (-4.7%), Las Vegas (-3.9%) and Sacramento (-3.8%).

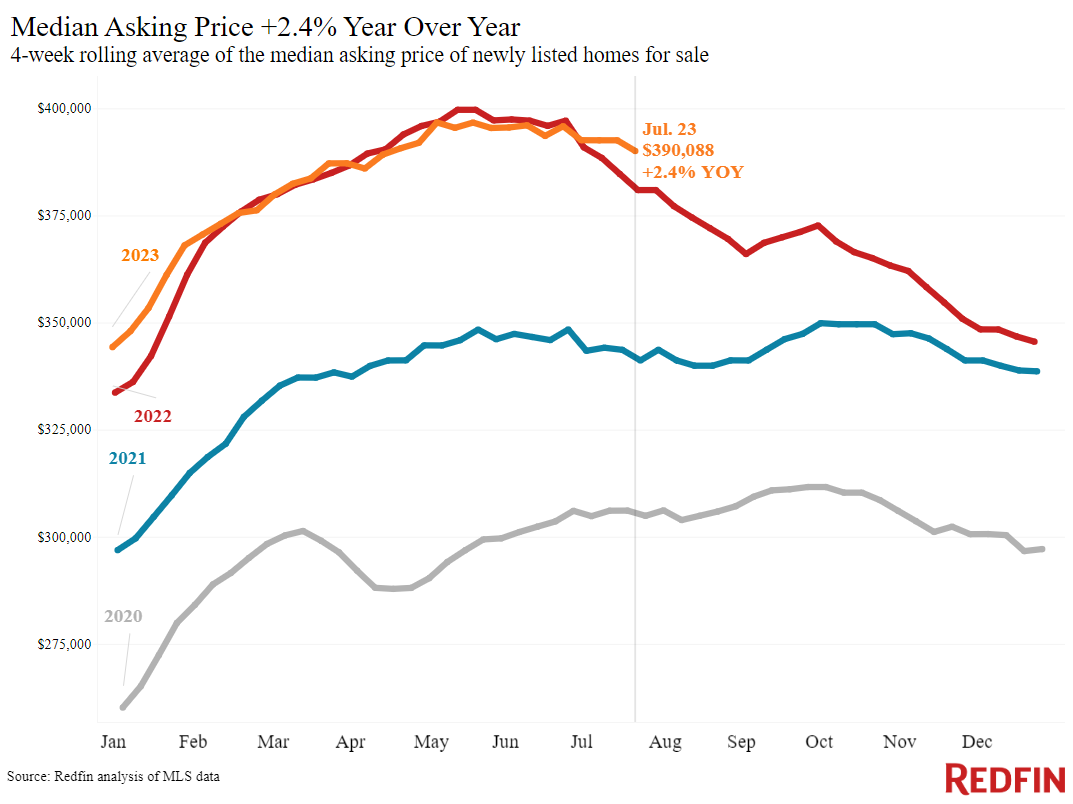

- The mean asking cost of freshly noted houses was $390,088, up 2.4% from a year previously. That’s the greatest boost given that January.

- The regular monthly home loan payment on the median-asking-price house was $2,599 at a 6.78% home loan rate, the average for the week ending July 20. That’s down about 2% from the record high struck 2 weeks previously, however up 16% from a year previously.

- Pending house sales were down 14.8% year over year, continuing a year-plus streak of double-digit decreases.

- Pending house sales fell in all however 2 of the cities Redfin examined. They decreased most in New Brunswick, NJ (-32.7% YoY), Newark, NJ (-32.1%), Providence, RI (-27.8%), Warren, MI (-27%) and Boston (-25.4%). They increased 2.7% in Las Vegas and 1.4% in Austin.

- New listings of houses for sale fell 21.6% year over year. That’s a considerable decrease, however the tiniest in almost 3 months.

- New listings decreased in all cities Redfin examined. They fell most in Las Vegas (-45.2% YoY), Phoenix (-38.9%), Newark, NJ (-34.3%), Providence, RI (-32.9%) and New Brunswick, NJ (-31.7%).

- Active listings (the variety of houses noted for sale at any point throughout the duration) dropped 16.9% from a year previously, the greatest drop given that February 2022. Active listings were down a little from a month previously; generally, they publish month-over-month boosts at this time of year.

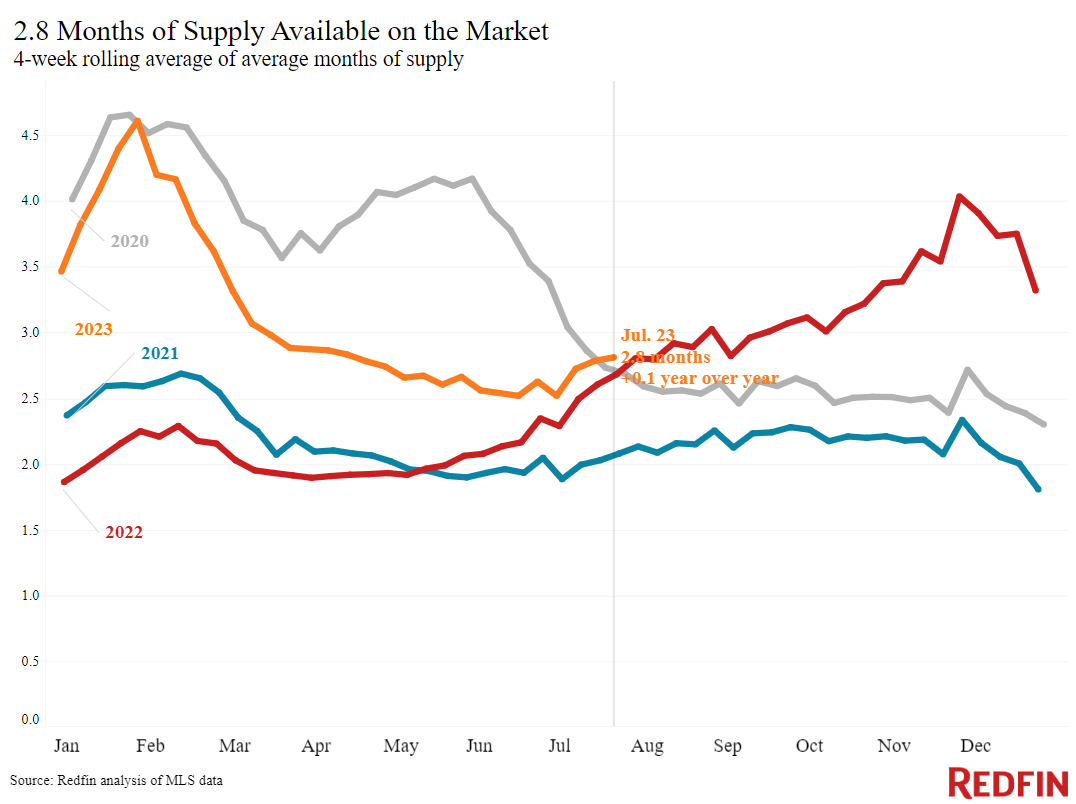

- Months of supply– a procedure of the balance in between supply and need, determined by the variety of months it would consider the present stock to cost the present sales rate– was 2.8 months, the greatest level given that March. 4 to 5 months of supply is thought about well balanced, with a lower number suggesting seller’s market conditions.

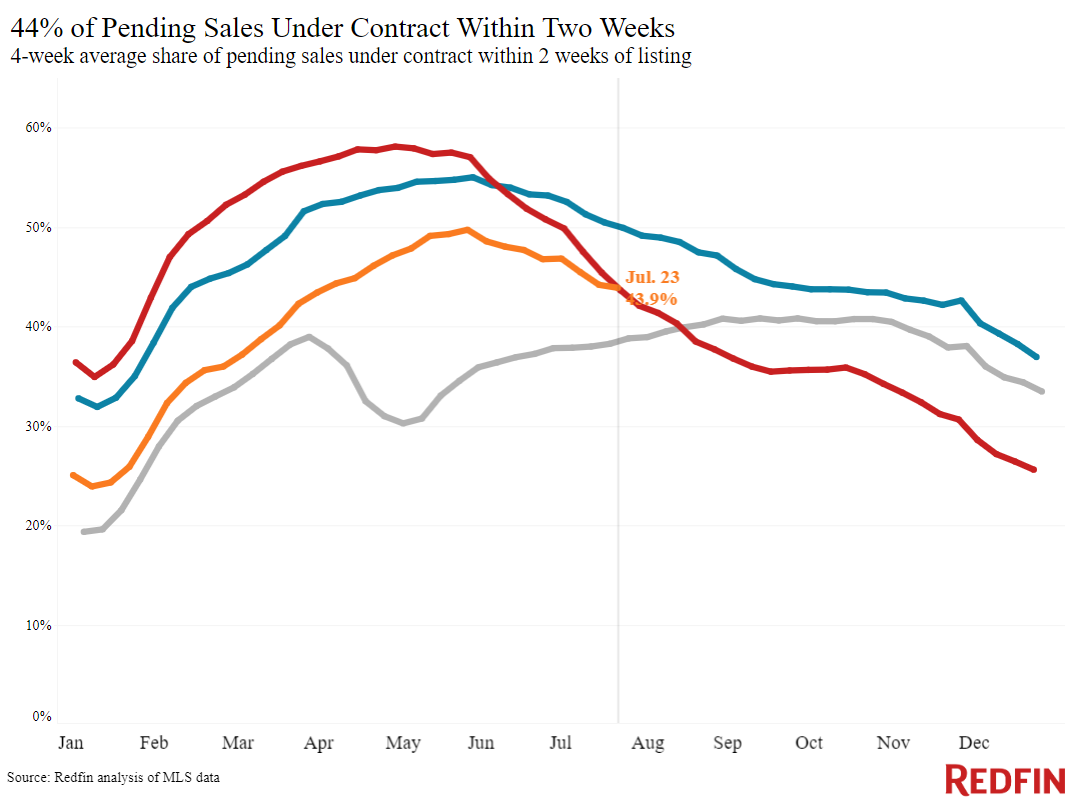

- 43.9% of houses that went under agreement had actually an accepted deal within the very first 2 weeks on the marketplace, on par with the share a year previously.

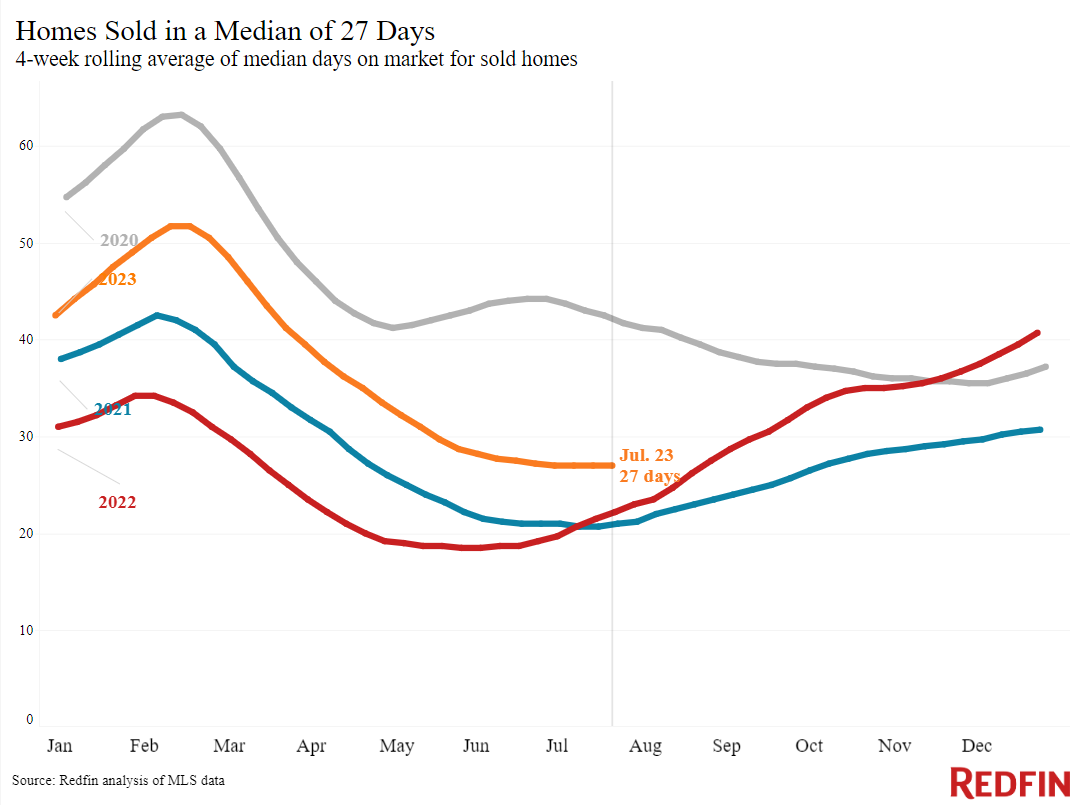

- Residences that offered were on the marketplace for a mean of 27 days, up from 22 days a year previously.

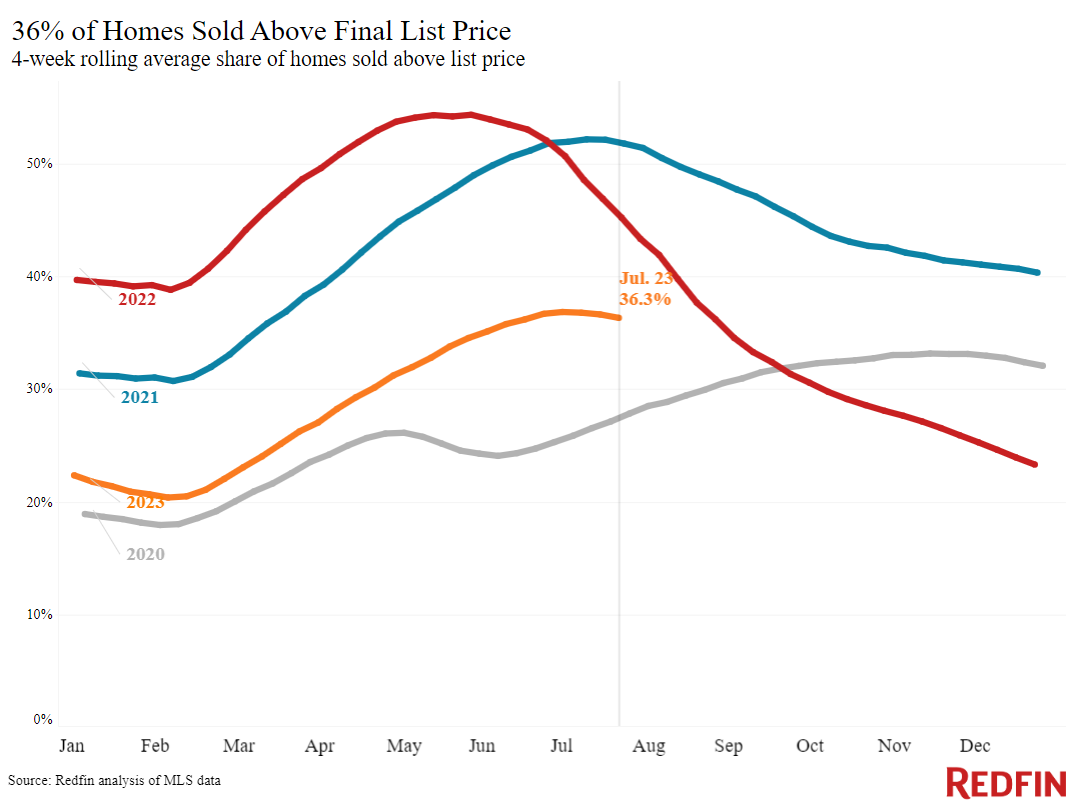

- 36.3% of houses offered above their last sticker price, below 45% a year previously.

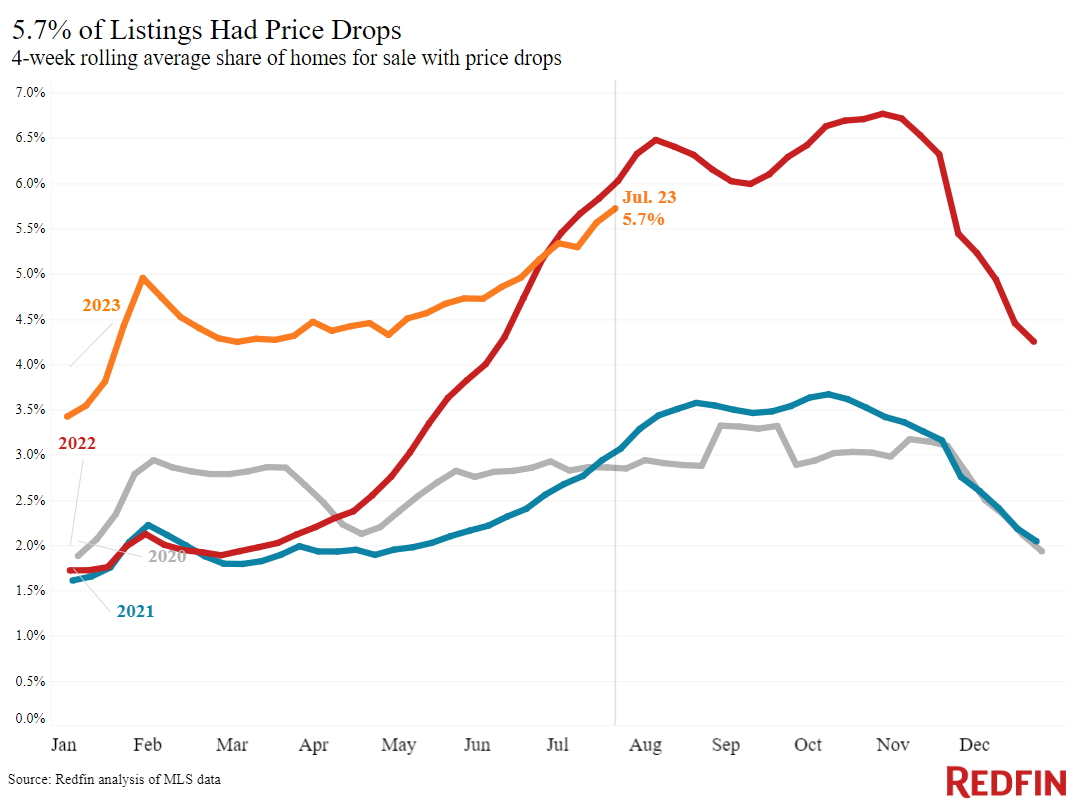

- Usually, 5.7% of houses for sale weekly had a rate drop, a little listed below 6% a year previously.

- The typical sale-to-list cost ratio, which determines how close houses are offering to their last asking costs, was 100%. That’s below 101% a year previously.

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.