- Increasing house costs and raised home mortgage rates have actually pressed the earnings essential to purchase the common U.S. starter house up 13% over the in 2015.

- New listings of starter houses are down 23%, the most significant decrease given that the start of the pandemic.

- San Francisco, Austin and Phoenix are the just significant U.S. cities where the earnings required to purchase a starter house has actually dropped over the in 2015. It has actually increased over 20% in Fort Lauderdale, FL and Miami, more than anywhere else in the nation.

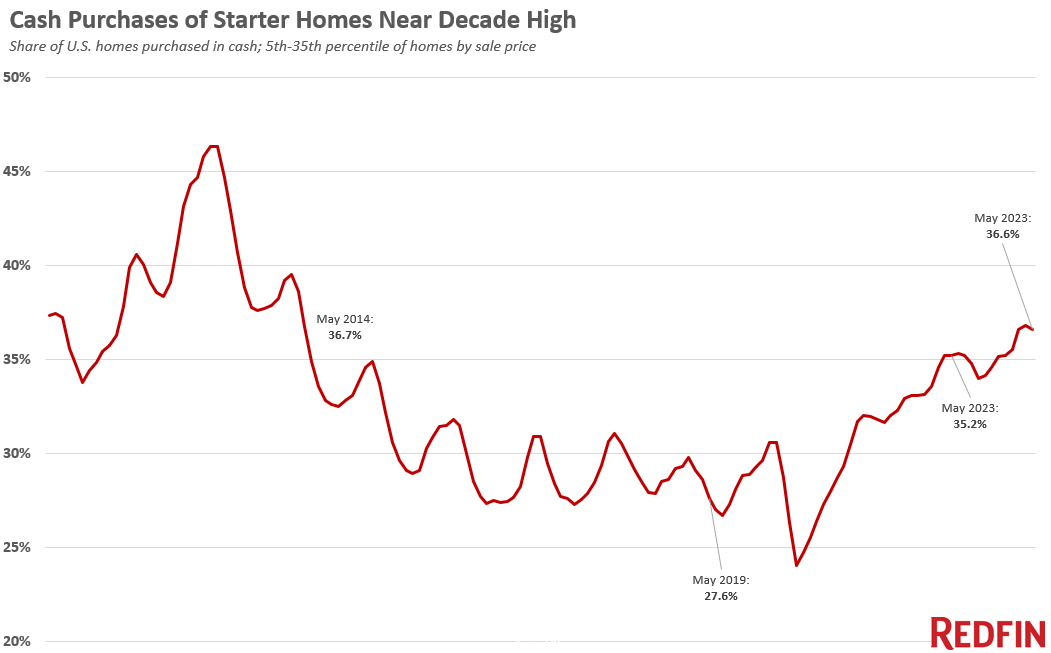

- The share of starter houses going to all-cash purchasers is near a years high.

A novice property buyer should make approximately $64,500 each year to manage the common U.S. “starter” house, up 13% ($ 7,200) from a year earlier. That is because of the one-two punch of greater home mortgage rates and greater house costs.

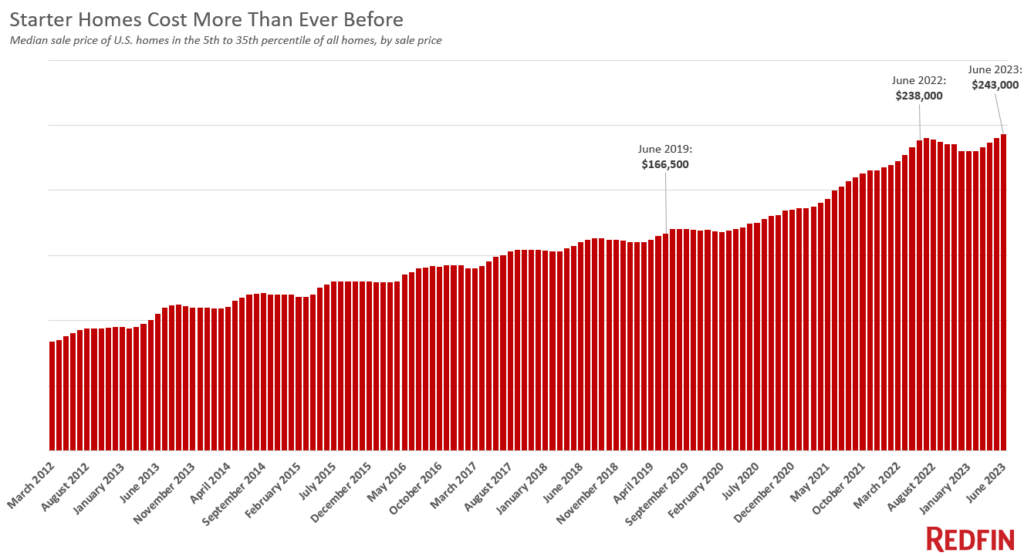

The common starter house cost a record $243,000 in June, up 2.1% from a year previously and up more than 45% from prior to the pandemic. Typical home mortgage rates strike 6.7% in June, up from 5.5% the year prior to and simply under 4% prior to the pandemic.

This is according to an analysis that divides all U.S. homes into 5 pails based upon Redfin Price Quotes of the houses’ market price since June 2023. The information is evaluated utilizing three-month moving durations; when we state “June,” we’re describing April-June. There are 3 equal-sized tiers, along with tiers for the bottom 5% and leading 5% of the marketplace. This report is concentrated on the “budget-friendly” tier, likewise described as “starter” houses in this report, which is comprised of houses approximated to be in the 5th-35th percentile by price. We determined just how much yearly earnings is required to manage a starter house by utilizing the general rule that a house is thought about “budget-friendly” if a purchaser securing a home loan invests no greater than 30% of their earnings on their real estate payment.

Rates for starter houses continue to tick up since there are so couple of houses for sale, typically triggering competitors and rising costs for the ones that do strike the marketplace. New listings of starter houses for sale dropped 23% from a year previously in June, the most significant drop given that the start of the pandemic. The overall variety of starter houses on the marketplace is down 15%, likewise the most significant drop given that the start of the pandemic. Restricted listings and still-rising costs, worsened by high home mortgage rates, have actually suppressed sales activity. Sales of starter houses dropped 17% year over year in June.

” Purchasers looking for starter houses in today’s market are on a wild goose chase since in lots of parts of the nation, there’s no such thing as a starter house any longer,” stated Redfin Senior citizen Economic expert Sheharyar Bokhari “The most budget-friendly houses for sale are no longer budget-friendly to individuals with lower spending plans due to the mix of increasing costs and increasing rates. That’s locking lots of Americans out of the real estate market entirely, avoiding them from developing equity and eventually developing enduring wealth. Individuals who are currently house owners are sitting quite, relatively, since the majority of them have benefited from house worths skyrocketing over the last couple of years. That might cause the wealth space in this nation ending up being a lot more extreme.”

House costs soared throughout the pandemic due to record-low home mortgage rates and remote work, and now increasing home mortgage rates are intensifying the price crisis, particularly for novice purchasers. An individual wanting to purchase today’s common starter house would have a month-to-month home mortgage payment of $1,610, up 13% from a year earlier and almost double the common payment prior to the pandemic. Typical U.S. salaries have actually increased 4.4% from a year earlier and approximately 20% from prior to the pandemic, not almost sufficient to offset the dive in month-to-month home mortgage payments.

Lots of potential novice property buyers are in between a rock and a difficult location since leas stay raised, too. The common U.S. asking lease is simply $ 24 shy of the $2,053 peak hit in 2022.

Purchasers with greater spending plans have actually seen their month-to-month payments increase a fair bit, too. Individuals purchasing today’s common house in the “middle” and “pricey” tiers would have a month-to-month real estate payment 13% greater than they would have a year earlier. List price are up 1.5% year over year for the “middle” tier, and 2.2% for the “high” tier– similar to the boost for starter houses.

However the effect of quickly increasing month-to-month real estate payments is more extreme for purchasers looking for an inexpensive starter house. A number of those individuals– typically novice property buyers– are evaluated of the real estate market completely since there’s no space to reduce their budget plan. Purchasers looking for higher-priced houses can reduce their rate variety and maybe look for smaller sized houses in more economical areas.

San Francisco, Austin and Phoenix are the only U.S. cities where starter-home purchasers require less earnings than they did a year ago

First-timers and other lower-budget purchasers in a couple of cities are getting some relief: San Francisco, Austin and Phoenix purchasers do not require to make rather as much as they did a year ago to manage a starter house, as those are the only 3 significant U.S. cities where costs have actually decreased.

A property buyer in San Francisco need to make $241,200 to manage the common “starter” house, down 4.5% ($ 11,300) from a year previously. Austin purchasers need to make $92,000, down 3.3% year over year, and Phoenix purchasers need to make $86,100, down about 1%. Those are likewise the cities where costs of starter houses have actually decreased most, with mean price down 13.3% to $910,000 in San Francisco, down 12.2% to $347,300 in Austin, and down 9.7% to $325,000 in Phoenix.

Starter-home costs are falling in those 3 cities after increasing in 2020 and 2021. Bay Location costs skyrocketed since purchasers utilized record-low home mortgage rates as a chance to delve into the pricey market, and Austin and Phoenix costs went wild since of the increase of remote employees moving into those locations.

Now that home mortgage rates have more than doubled, the preliminary rise of remote-work movings has actually passed, and brand-new listings are limited due to house owners secured by low rates, the real estate markets in Austin and Phoenix have actually fallen back down to earth. Need in San Francisco dropped since increasing rates made ultra-expensive houses a lot more pricey, and lots of tech employees aren’t as incentivized to live near town hall as they when were.

Starter-home costs are down year over year in 13 other cities, mainly pricey West Coast markets, with the next-biggest decreases in San Jose, CA (-8.7% to $925,000), Sacramento, CA (-7.3% to $417,000) and Oakland, CA (-7.3% to $630,000). Starter-home costs likewise dropped in Las Vegas, Seattle, Denver, Los Angeles, Portland, OR, Anaheim, CA, San Diego, Riverside, CA, Pittsburgh and Minneapolis. However the earnings essential to purchase a starter house has actually still increased, since in those locations lower costs do not offset greater home mortgage rates.

Miami novice property buyers require 25% more earnings

The earnings essential to purchase a starter house has actually increased most in Florida. Fort Lauderdale purchasers require to make $58,300 each year to acquire a $220,000 house, the common rate for a starter house in that location, up 28% from a year previously. That’s the most significant uptick of the 50 most populated U.S. cities.

Next comes Miami, where purchasers require to make $79,500 (up 24.8%) to manage the common $300,000 starter house. Completing the leading 3 is Newark, NJ, where purchasers require $88,800 (up 21.1%) to manage a $335,000 house. Fort Lauderdale, Miami and Newark likewise had the most significant starter-home rate boosts, with costs up 15.8% year over year, 13.2% and 9.8%, respectively.

Although starter-home costs have actually increased most in Florida, they’re still more economical than a location like Austin or Phoenix, where house costs increased throughout the pandemic and have actually given that boiled down some.

Rates are increasing in Florida since regardless of increasing environment threats, out-of-town remote employees and senior citizens are gathering in. That’s mostly due to warm weather condition and relative price; although costs there skyrocketed throughout the pandemic, houses are still generally more economical than a location like New York, Boston or Los Angeles. 5 of the 10 most popular cities for moving property buyers remain in Florida.

All-cash purchasers purchase almost 40% of starter houses in the U.S.

More than one-third (36.6%) of the nation’s starter houses were bought in money in Might, down simply a little from the previous month’s decade-high and up from 35.2% a year previously.

Keep in mind that this all-cash information is from Might, the most current month for which information is readily available, while the other information in this report is from June.

Investor are purchasing up a large portion these days’s budget-friendly houses. A record 41% of financier purchases were little houses– those with 1,400 or less square feet– in the very first quarter. That’s up from 37% a year previously.

” Lots of home hunters looking for an inexpensive location to call house on their own and/or their household run out alternatives, particularly in more pricey parts of the nation,” Bokhari stated. “As costs for the most budget-friendly houses continue to climb up and rates stay raised, it’s ending up being more real that you need to be rich to purchase a house– particularly if it’s your very first one. That’s why we have actually seen the share of budget-friendly houses going to cash purchasers, either people or financiers, tick up: Due to the fact that they’re the only ones who can manage them.”

Money purchasers likewise have another benefit. They do not need to pay high home mortgage rates, suggesting it’s eventually more economical for them to purchase houses, deepening the wealth space in the nation.

However although month-to-month payments on starter houses are ending up being more pricey and an increasing share are going to cash purchasers, in some methods the marketplace is much easier to burglarize than it was throughout the pandemic purchasing boom. Some novice property buyers have the ability to purchase a house without a bidding war, and in some cities costs have actually boiled down, as kept in mind above.

Other metro-level highlights for starter houses, June 2023

The most significant rate decreases and boosts are kept in mind in the text above

Rates are greatest in California. Starter houses have the greatest mean price in San Jose ($ 925,000), San Francisco ($ 910,000) and Anaheim ($ 680,000).

Rates are least expensive in the Rust Belt. The common starter house costs $60,000 in Detroit, the most affordable of the 50 most populated U.S. cities. It’s followed by Pittsburgh ($ 100,000) and Cleveland ($ 115,000).

New listings decreased most in pandemic migration hotspots. New listings of starter houses dropped from a year previously in all however among the 50 most populated U.S cities, with the most significant decreases in migration magnets. New listings fell most in Sacramento, CA (-44.8%), Phoenix (-44.3%) and Las Vegas (-43.2%). They increased 7% in Detroit.

Sales fell most on the West Coast. Sales of starter houses dropped in 45 of the 50 most populated cities. They decreased most year over year in Seattle (-36.5%), Sacramento (-35.9%), San Francisco (-35.4%), San Jose, CA (-34.5%) and Portland, OR (-33.9%).

Sales increased in Texas. Sales increased from a year previously in San Antonio, TX (11.6%), Detroit (10.1%), Philadelphia (3.4%), Dallas (2.5%), and Fort Worth, TX (0.6%).

| Metro-level summary: Earnings require to manage a starter house, June 2023

50 most populated U.S. cities Ranked by modification in earnings required to manage a starter house, YoY, with most significant decrease at the top Earnings required = earnings essential to manage the common month-to-month home mortgage payment on the median-priced starter house. Beginner house = 5th-35th percentile of houses offered, by price |

||||

| U.S. city location | Earnings required | Average price | Average home mortgage payment | Modification in earnings required, YoY |

| San Francisco, CA | $ 241,181 | $ 910,000 | $ 6,030 | -4.5% |

| Austin, TX | $ 92,057 | $ 347,340 | $ 2,301 | -3.3% |

| Phoenix, AZ | $ 86,136 | $ 325,000 | $ 2,153 | -0.5% |

| San Jose, CA | $ 245,157 | $ 925,000 | $ 6,129 | 0.6% |

| Sacramento, CA | $ 110,519 | $ 417,000 | $ 2,763 | 2.2% |

| Oakland, CA | $ 166,972 | $ 630,000 | $ 4,174 | 2.2% |

| Las Vegas, NV | $ 76,860 | $ 290,000 | $ 1,922 | 3.1% |

| Seattle, WA | $ 141,794 | $ 535,000 | $ 3,545 | 4.4% |

| Denver, CO | $ 109,989 | $ 415,000 | $ 2,750 | 4.7% |

| Los Angeles, CA | $ 151,070 | $ 570,000 | $ 3,777 | 4.7% |

| Portland, OR | $ 109,327 | $ 412,500 | $ 2,733 | 5.8% |

| Anaheim, CA | $ 180,224 | $ 680,000 | $ 4,506 | 6.3% |

| San Diego, CA | $ 161,671 | $ 610,000 | $ 4,042 | 6.7% |

| Riverside, CA | $ 104,689 | $ 395,000 | $ 2,617 | 7.5% |

| Pittsburgh, PA | $ 26,424 | $ 99,700 | $ 661 | 8.8% |

| Minneapolis, MN | $ 68,909 | $ 260,000 | $ 1,723 | 9.8% |

| Detroit, MI | $ 15,902 | $ 60,000 | $ 398 | 10.2% |

| Dallas, TX | $ 72,885 | $ 275,000 | $ 1,822 | 10.6% |

| Washington, DC | $ 90,894 | $ 342,950 | $ 2,272 | 11.5% |

| Philadelphia, PA | $ 34,985 | $ 132,000 | $ 875 | 11.9% |

| Nashville, TN | $ 82,161 | $ 310,000 | $ 2,054 | 12.0% |

| Atlanta, GA | $ 68,909 | $ 260,000 | $ 1,723 | 12.4% |

| Nassau County, NY | $ 124,566 | $ 470,000 | $ 3,114 | 12.6% |

| Baltimore, MD | $ 54,332 | $ 205,000 | $ 1,358 | 12.7% |

| Boston, MA | $ 121,916 | $ 460,000 | $ 3,048 | 12.7% |

| Tampa, FL | $ 66,259 | $ 250,000 | $ 1,656 | 12.9% |

| Chicago, IL | $ 48,987 | $ 184,833 | $ 1,225 | 13.2% |

| Orlando, FL | $ 67,584 | $ 255,000 | $ 1,690 | 13.3% |

| Warren, MI | $ 46,381 | $ 175,000 | $ 1,160 | 13.5% |

| Kansas City, MO | $ 43,731 | $ 165,000 | $ 1,093 | 13.7% |

| Houston, TX | $ 57,513 | $ 217,000 | $ 1,438 | 13.9% |

| New York City, NY | $ 116,615 | $ 440,000 | $ 2,915 | 14.1% |

| St. Louis, MO | $ 31,804 | $ 120,000 | $ 795 | 14.1% |

| Cleveland, OH | $ 30,479 | $ 115,000 | $ 762 | 14.2% |

| Fort Worth, TX | $ 64,933 | $ 245,000 | $ 1,623 | 14.4% |

| Virginia Beach, VA | $ 59,633 | $ 225,000 | $ 1,491 | 15.4% |

| Charlotte, NC | $ 62,283 | $ 235,000 | $ 1,557 | 15.4% |

| Brand-new Brunswick, NJ | $ 87,461 | $ 330,000 | $ 2,187 | 16.2% |

| Providence, RI | $ 86,666 | $ 327,000 | $ 2,167 | 17.4% |

| Cincinnati, OH | $ 42,406 | $ 160,000 | $ 1,060 | 17.6% |

| Indianapolis, IN | $ 42,406 | $ 160,000 | $ 1,060 | 17.6% |

| Columbus, OH | $ 48,501 | $ 183,000 | $ 1,213 | 18.7% |

| San Antonio, TX | $ 55,657 | $ 210,000 | $ 1,391 | 18.7% |

| West Palm Beach, FL | $ 64,933 | $ 245,000 | $ 1,623 | 19.0% |

| Jacksonville, FL | $ 63,608 | $ 240,000 | $ 1,590 | 19.2% |

| Montgomery County, PA | $ 82,161 | $ 310,000 | $ 2,054 | 19.9% |

| Milwaukee, WI | $ 46,381 | $ 175,000 | $ 1,160 | 20.6% |

| Newark, NJ | $ 88,787 | $ 335,000 | $ 2,220 | 21.1% |

| Miami, FL | $ 79,510 | $ 300,000 | $ 1,988 | 24.8% |

| Fort Lauderdale, FL | $ 58,308 | $ 220,000 | $ 1,458 | 27.6% |

| National– U.S.A. | $ 64,403 | $ 243,000 | $ 1,610 | 12.6% |

| Regular monthly mean home mortgage payments are determined presuming the purchaser made a 20% deposit, and they take that month’s mean price and typical mortgage-interest rate into account. They consist of primary, interest, taxes and insurance coverage. | ||||