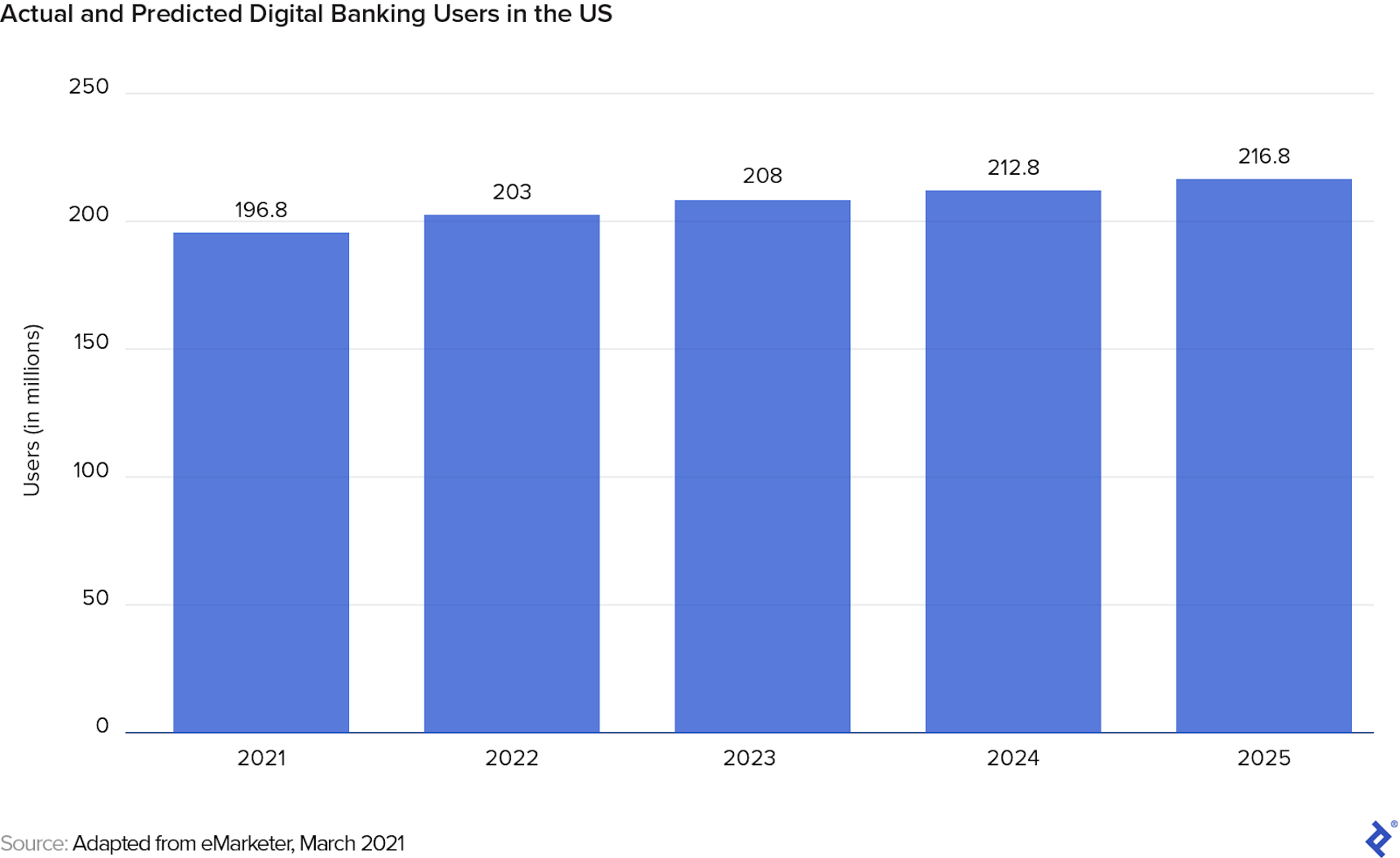

Digital banking is cheaper for banks than keeping brick-and-mortar areas, and tradition banks have actually been diminishing retail branch networks in the United States for more than a years. The COVID-19 pandemic shuttered much more in-person services and sped up the shift towards digital banking, which lets consumers gain access to accounts, items, and services through a site or mobile app

Not remarkably, banks have actually been investing more than ever on innovation, and enhancing client experience and service shipment is their greatest top priority. Nevertheless, banks have not been gaining the optimum return on their digital financial investment due to the fact that of increased costs on contact centers to handle installing client issues.

A 2020 study from the management consulting company Capital Efficiency Group discovered that, from completion of 2019 to December 2020, electronic banking activity— consisting of deals and other interactions– increased as much as 30% and mobile banking activity rose as much as 80%. However it likewise exposed that contact center volumes had as much as doubled at some organizations and continued to rise. And a 2021 study carried out by Foundation Advisors revealed that consumers are calling their banks more often due to the fact that they can’t discover responses online, or their banks do not supply the virtual assistance required to resolve issues.

These data highlight the regrettable fact that a number of the digital services and products banks have actually been using for many years– from payment systems like Zelle to authentication– still stop working to satisfy client expectations, frequently due to the fact that utilizing them does not feel instinctive enough. Even even worse, Zelle in specific has actually been afflicted by problems associated with conflicts, specifically those worrying scams, unapproved deals, and mistakenly extreme fund transfers.

As a specialist at numerous of the biggest industrial banks in the United States, I have actually seen the problems of digital change firsthand. Banks have huge chests of info that might assist them establish methods to drive client retention and activation, however the information is underused. Many organizations’ information analytics use isn’t almost robust adequate to record the depth and breadth of info about client habits needed to comprehend users’ requirements and how finest to satisfy them. Assistance groups normally utilize very little sample sizes when they’re taping and listening to require quality control— 1% or less at one bank I dealt with. As a repercussion, theorizing the findings can yield deceptive outcomes.

To genuinely resolve these issues, banks require to establish more comprehensive, holistic client information analytics on a much bigger scale– consisting of all calls. Then they need to utilize the patterns of habits they discover to notify the production and improvement of digital performance that pleases consumers’ requirements. In this post, I’ll stroll you through the actions I require to assist banks do this.

Develop a Technique Group

The primary step to increase customer adoption of digital banking and improve client complete satisfaction is to develop an internal group made up of the bank’s experts and item professionals that will have access to information gathered throughout all channels and items. This group is necessary due to the fact that there’s excessive information for one person to aggregate, research study, and reason from. This group should likewise actively team up with department heads to guarantee its findings can be carried out at the business client level.

I suggest that this group be partitioned into smaller sized cross-functional groups for each item. In my deal with industrial banks, I ‘d inform each of these groups the number of client calls it might get rid of by carrying out specific functions or functions, so it might prioritize its work appropriately. To compute this decrease capacity, I utilized an exclusive client journey analytics platform we had actually established to dissect the user circulation and friction points. (Tealeaf and Google Analytics are comparable tools that you can utilize for the exact same function.)

Identify Classifications of Information and Set Your Objectives

The 2nd action is to identify and get access to the diverse sources of information throughout all platforms and functions. At a common tradition bank, information sources can be burglarized 2 classifications and numerous subcategories. For instance, the groups I established at banks utilized these:

Products and organizations

- Retail, such as inspecting and cost savings accounts

- Charge card

- Home Mortgages

- Automotive financing

- Wealth management

Points of contact

- Contact center phone conversation

- Contact center interactive voice reaction (IVR) interactions

- In-person interactions at retail branches

- ATM interactions

- Desktop application

- Mobile application

- Outgoing notifications/alerts

Much of my analytical work was diving into call data at contact centers, and I consider this the most essential location to concentrate on. It’s where the frustrating bulk of assistance demands are made: Banks normally do not take e-mail questions for customer support any longer due to the fact that it’s too pricey, even when done offshore. Chat has actually changed e-mail however represent just a little part of all customer support interactions amongst leading banks– less than 5% at the organizations where I spoke with. Furthermore, due to the fact that of the high volume of demands, live representative calls are substantially pricey for banks. So this is the location I’ll concentrate on as I describe my procedure.

As soon as information sources are recognized and accessed, the banks can start developing essential quantifiable goals to assist frame the task’s scope, which can set the phase for its analytical technique. Here are the goals we developed at the banks where I spoke with:

- Enhance client experience– determined by Net Promoter Rating (NPS), a crucial indication of client complete satisfaction that evaluates individuals’ possibility of suggesting a business– throughout all channels

- Boost digital adoption and engagement

- Decrease calls to call centers when they aren’t including much or any worth

- Decrease low-margin, standard banking interactions at branches

- Improve effectiveness throughout service operations while minimizing dangers

As anticipated, the information revealed that the dominant channel in regards to the volume of client interactions is digital. Remarkably, however, at the banks where I worked, extremely active digital consumers were more susceptible to look for assistance than less active digital and conventional banking users. Digital banking led to more than two times as lots of calls and questions into contact centers as conventional banking.

Understand Why Clients Are Calling

As soon as information classifications and objectives are recognized, the group requires to consider what type of questions into the bank’s information will assist it examine the nature and scenarios of the client assistance demands. At the banks where I spoke with, we concentrated on the contact centers, particularly info from consumers’ interactions with phone representatives within an offered period, and created the following concerns:

- The number of consumers talked with a live representative?

- Who were these callers, i.e., what were their profiles in regards to service interactions throughout channels, transactional activities throughout items, and client worth at the business level?

- What portion of those callers were digitally active?

- What, if any, banking activities had happened prior to the call?

- If there had been a banking activity prior to the call, in which channel did it happen?

- What did the consumers call about?

- Did any of them call more than as soon as? If so, the number of times?

- The length of time did the calls last?

- For consumers who made numerous calls, just how much time expired in between them?

While banks normally do track the variety of calls fielded by contact centers, they typically do not explore a number of these secondary data. This follows what I have actually seen more broadly in monetary services: Companies track occasions however do a bad task of determining activities around occasions that can describe habits and assist them make enhancements. Understanding that a consumer invested 20 minutes trying to fix a conflict or trigger cash-back benefits prior to they called would provide call center staff members useful context and notify their interactions.

At the banks where I spoke with, I dealt with the technique groups I developed to assist the organizations record each call’s function through a system of record. For instance, we might see that a person client, whose identity was anonymized, had actually browsed the web minutes prior to calling and attempted unsuccessfully to close their account– the experience that had actually triggered the call. Then we designated each call a label representing its function and a time stamp. We were likewise able to identify secondary and tertiary factors for the calls by determining occasions that had actually happened around the main driver, enabling us to draw up a complete image.

We consequently determined a crucial metric referred to as call-to-contact spread, which we utilized to examine the experience of the total population of callers. It likewise acted as a standard for enhancing effectiveness.

- Call rate: the overall variety of calls made, revealed as a portion of the whole client base

- Contact rate: the variety of consumers who made calls, likewise revealed as a portion of all consumers

- Call-to-contact spread: the call rate minus the contact rate

Our very first objective was to lower both the call rates and contact rates, due to the fact that they were trending greater than the market standards for leading banks, which typically run around 20% and 10%, respectively, for an offered month, based upon my experience and reports from third-party benchmarking companies like Finalta from McKinsey. Second, we wished to make the 2 metrics equivalent, suggesting that we had actually removed repeat calls. As soon as we ‘d achieved that, we ‘d have the ability to state that we had actually accomplished initially call resolution, suggesting customers just required to make one call to get their issues fixed– a crucial criteria in client relationship management.

The other associated metrics we examined and intended to reduce consisted of:

- Call periods

- Call transfers

- Escalations

- Grievances

Many contact centers utilize the call factors gotten from client relations management systems or call recordings, however extremely couple of utilize the system of record to drive enhancements on these metrics. The upstream conditions in the system of record can get rid of some calls completely and, in other cases, aid match callers with the best call representatives, based upon their activities prior to the call, their client profiles, and the levels of service required.

Many banks use client experience management software application that surveys individuals after interactions, producing a Net Promoter Rating. At the banks I dealt with, we set (and achieved) an objective of increasing the contact centers’ ratings to 55%.

Examine Call Patterns to Develop Profiles

The next action includes examining call patterns utilizing numerous systems of tape-recorded information indicate find out what’s driving consumers to call. The extensive customer-level information sets we utilized where I was seeking advice from consisted of:

- Monetary deals, such as big point of sale (POS) charges along with payments and turnarounds.

- Non-monetary deals, such as address modifications, cards being decreased, and conflicts.

- Channel interaction occasions, like call, IVR interactions, desktop activity, mobile activity, branch gos to, ATM deals, and outgoing notifies.

- Consumer profile/segmentation, such as period, high-value flag (suggesting a high level of engagement), and variety of licensed users.

- Clients’ active vs. non-active item holding, i.e., the variety of items each client has and whether they’re utilizing them, which suggests the possibility that they’ll connect with the bank for service. (Note: We concentrated on active consumers to determine contact and call rates.)

From these classifications, we recorded some essential and quickly available information aspects to much better comprehend the following:

- Channel containment: client tendency to remain within a channel for brief time periods, normally 15 to 20 minutes

- Channel self-service activity: what the client did to self-serve, through digital, ATM, or IVR

- Channel mode or choice: the main channel that the client utilized

After examining these upstream conditions, we concentrated on the downstream impacts by determining and examining what was happening with live representative calls. Omitting calls that lasted less than one minute, we took a look at call patterns and types, determining time varieties, determining how calls were made, and identifying whatever chauffeurs we could. We likewise collected the information so we might see the channels where consumers had actually been banking.

After using advanced analytics and determining time in between calls, we organized the population into sections:

-

Cluster callers: These were consumers experiencing problems who might not self-serve, required human aid with numerous interactions, and put a high variety of calls within a brief time duration. (We specified this as 2 or more calls within 24 hr.)

-

Spread callers: These transaction-driven callers made a lower variety of calls than the cluster group, at a routine cadence and with comparable kinds of questions. Spread callers put 3 or more calls throughout 6 months with a typical time in between calls of more than 2 days and a coefficient of variation of typical time in between calls higher than 100%.

-

Random callers: This sector was made up of information-seeking consumers identified by an irregular volume of calls with various kinds of questions.

Address Callers’ Requirements by Group

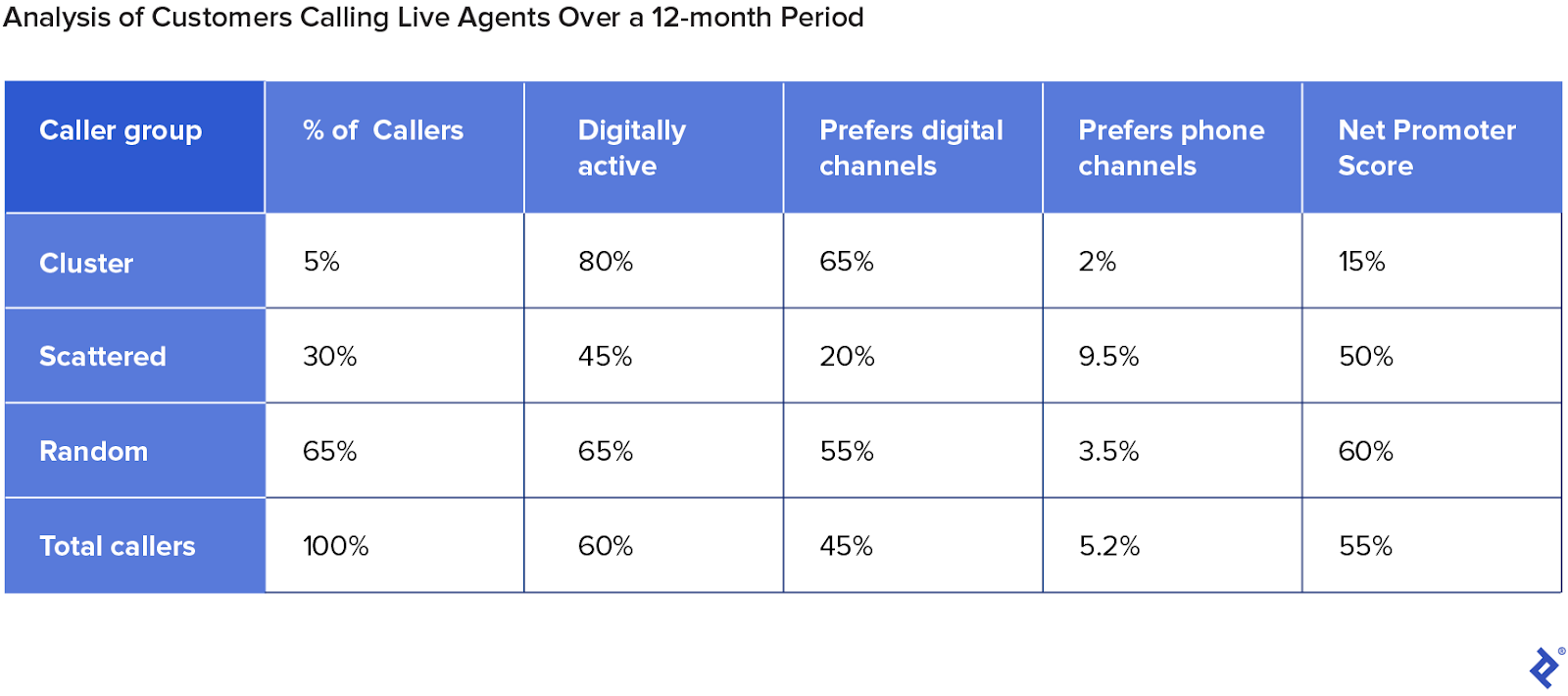

As soon as call pattern analysis is total, it’s time to parse the information even more by group. At the banks where I worked, this job exposed intriguing and possibly actionable insights. At one of them, for instance, the analytics revealed that 5% of the population were cluster callers, 30% were spread, and the staying were random. The cluster population was mainly digital, while the spread showed less digital activity, with a part being regular or heavy callers.

This table highlights a 12-month view of the live representative caller population taken at the end of the three-year accumulation around this effort:

The cluster population, while little in number, has a huge impact on NPS and problems. We followed these findings by producing a series of insights with suggested methods to satisfy essential goals, beginning with the cluster group. Here’s a breakdown of the problems that were discovered to be driving calls:

- Password/username authentication

- Fraud/unauthorized deal

- Zelle payment

- Undelivered outgoing notifies

- Overdraft/insufficient funds charge

Based upon our boosted understanding of callers’ inspirations, the primary step we required to lower cluster callers was to suggest particular methods to enhance the online experience and consist of consumers within the digital channel they chose. I likewise dealt with the client experience group to much better style targeted studies to examine discomfort points and concern resolution, and we tapped a line of completely empowered phone representatives to manage this group. These representatives might waive charges or charges, whereas others might just refer callers to more senior agents.

For a high percentage of the cluster population, one bank had inaccurate e-mail addresses on file, which triggered a larger appearance that revealed inaccurate e-mail addresses for more than 10% of all digitally active consumers. A project was presented through push alerts and safe and secure e-mails to trigger consumers to validate and alter these addresses.

Spread callers were driven more by regular services like payments, deposits, and money withdrawals, and less by digital activities like Zelle fund transfers. Their channel choice was phone, and nearly 10% of them were identified as heavy or regular. The technique for this group was targeted messaging and assistance towards digital adoption and engagement.

Lots of random callers were asking about brand-new functions, items, and hours of operation for specific branches. A few of this info was contributed to the online experience to lower calls. At the height of the pandemic, consumers needed to make consultations to go to branches. The call focuses at one of the banks where I spoke with were fielding countless calls to set these up, so I dealt with the digital group to make it possible for consumers to make consultations online, getting rid of lots of calls and conserving cash.

By organizing callers into 3 pails, we had the ability to develop a call pattern effort that assisted the banks I dealt with much better comprehend the chauffeurs of habits and how various channels were being utilized, specifically digital versus phone. This technique was main to cutting contact center expenditures, which were increasing even as the client base stayed flat. It likewise intended to enhance client experience and service levels while reducing wait times, transfers, escalations, and callbacks. The arise from one bank in specific were extensive after 3 years.

- Digitally active rate increased by 10%

- Contact rate reduced by 12%

- Call rate reduced by 15%

- NPS increased by 5%

The drop in contact and call rates likewise decreased numerous essential danger elements. In determining calls that didn’t include worth to the bank, we discovered that lots of live representative phone functions might rather be carried out by the consumers in self-service channels, which conserved cash and reduced the possibility of human mistake around disclaimers, item modifications, account openings and closures, and other services that consumers asked about.

There’s no lack of information offered for analytics in banking and other monetary services, and minimizing contact center calls and expenditures is simply one example of how you can utilize it to drive favorable change: You might well discover another focus or utilize a multipronged method. The difficulty is to change your info into insights that improve client experience, boost digital engagement, and conserve cash. Completely comprehending what’s working– and what’s not– can eventually result in nuanced modifications that make the system work much better for everybody.