Tarek_khouzam/ iStock by means of Getty Images

Financial investment thesis

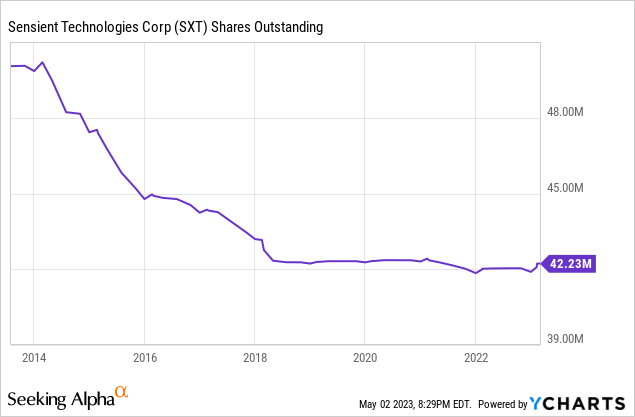

Sensient Technologies ( NYSE: SXT) is among those business that can be purchased and held for years while enjoying an ever-growing dividend. It has actually likewise been a share repurchaser in the past, however an acquisition spree combined with a growing requirement to deleverage the balance sheet will likely put more share repurchases on hold for some more quarters (and even a couple of years). Presently, the business is dealing with a series of headwinds that have actually deflated the rate of its shares, and in this short article, I will discuss why present financiers’ pessimism represents an excellent chance for long-lasting dividend development financiers to balance below present share rates.

The business’s net sales have actually stayed rather stagnant for the previous couple of years as a repercussion of a restructuring procedure that started in 2014, however began to reverse in 2020 and are anticipated to keep increasing through 2024. Still, inflationary pressures, supply chain concerns, and raised energy and product expenses are presently having a moderate effect on earnings margins, for which the business embraced rates actions. However the headwind that the business absolutely could not evade is doubling interest costs in the very first quarter of 2023, and stated boost will have a substantial effect on the business’s operations in the brief and medium term.

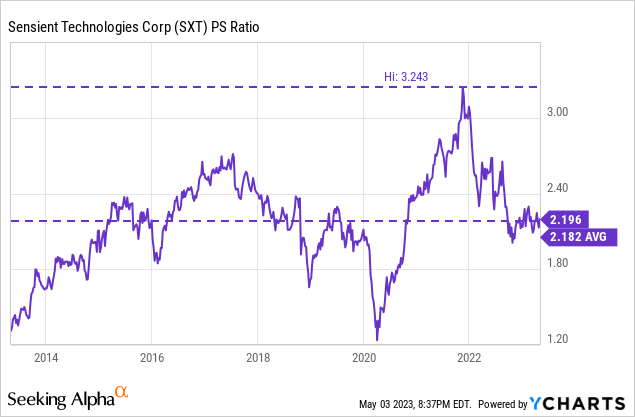

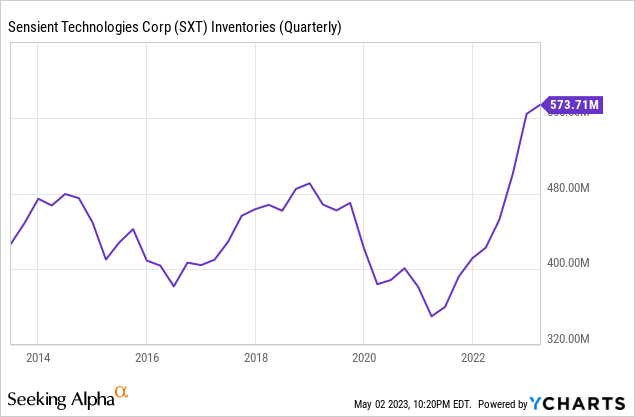

Fortunately, the business holds large stocks in its balance sheet, which will definitely permit high money from operations in the coming quarters with which the business ought to have the ability to substantially pay for its financial obligation stack. However, a P/S ratio that is still somewhat above the average of the previous years recommends that it would be a smart concept to balance down as more share rate decreases might bring more chances to reduce the typical purchase rate and hence increase the general position’s dividend yield on expense in the future, particularly thinking about the growing issues of a possible economic downturn as a repercussion of current rate of interest walkings.

A quick introduction of the business

Sensient Technologies is a worldwide leading maker and online marketer of colors, tastes, and scents for food, pharmaceuticals, home items, and inks, along with other specialized and great chemicals. The business was established in 1882, and its market cap presently stands at $3.18 billion, using over 4,000 employees around the globe. In this regard, the business has factory in California, Illinois, Michigan, Wisconsin, New Mexico, Belgium, Costa Rica, Mexico, Germany, and the UK.

Sensient (Very first quarter 2023 financier discussion)

The business runs under 3 primary company sectors: Flavors & & Extracts, Color, and Asia Pacific. Under the Flavors & Extracts sector, which supplied 49.45% of the business’s overall net sales in 2022, the business offers tastes and scents for much of the world’s best-known customer items. Under the Color sector, which supplied 40.60% of the business’s overall net sales in 2022, the business offers natural and artificial colors for foods, drinks, pharmaceuticals, cosmetics, inks, and other commercial applications. And under the Asia Pacific sector, which supplied 9.96% of the business’s overall net sales in 2022, the business offers its items to the Pacific Rim.

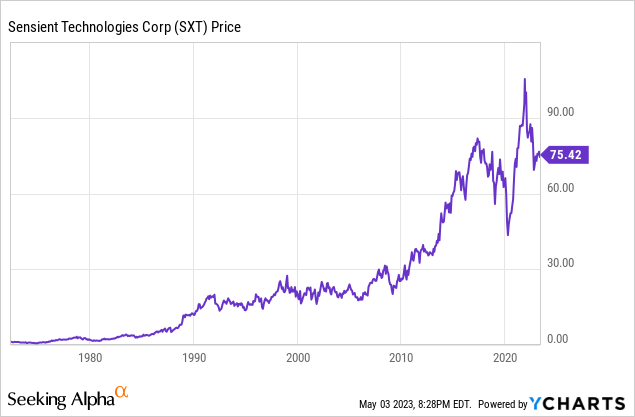

Presently, shares are trading at $75.42, which represents a 29.06% decrease from all-time highs of $106.32 in November 2021. While this decrease is not too substantial offered current macroeconomic headwinds affecting a large range of markets around the globe, this represents, in my viewpoint, an excellent chance to begin including shares of Sensient to any dividend development portfolio with the objective of including more shares as the share rate decreases, if it does, as the business’s operations and basics stay undamaged while the outlook is extremely favorable.

Acquisitions and divestitures

Recently, the business has actually reorganized its operations by divesting less rewarding companies and keeping the most rewarding ones while targeting possible acquisitions to keep its profits, which substantially enhanced earnings margins without jeopardizing profits in exchange for a fairly high financial obligation level.

In March 2018, the business gotten the natural color company of GlobeNatural, a leading healthy food and component business based in Lima, Peru, for $10.8 million. Throughout the very same year, In July 2018, the business likewise gotten Mazza Development, a worldwide leader in botanical extraction innovation.

After some deleverage, in June 2020, the business divested its digital ink line of product for $12.1 million to Sun Chemical and its moms and dad business, DIC Corporation ( OTCPK: DICCF). Later on, in September 2020, it likewise offered specific possessions connected to the production of its yogurt fruit preparations line of product to Frulact for $2 million.

The deleveraging procedure continued as the business offered its scent company to Symrise AG ( OTCPK: SYIEF) for $36.3 million in April 2021, simply after getting New Mexico Chili Products, a dehydrated chili production center situated in Deming, New Mexico, that processes capsicums and a range of specialized chilies for industrial sale to CPG food makers, spice mixers, and foodservice consumers in March 2021. Acquisitions continued in July 2021 when the business gotten the possessions of Taste Solutions for $13.9 million, which supplied Sensient with tastes and taste innovations for the food, drink, and nutraceutical markets.

And when it comes to more just recently, in October 2022, the business gotten Endemix DoÄal Maddeler, a vertically incorporated natural color and extracts business servicing the food and drink markets, for $23.3 million. The business lies in Turkey and deals with multinationals that export their items to consumers throughout Europe, the Middle East, and Asia.

The management is presently trying to find more little acquisitions in order to keep driving profits development in the long term, however higher-than-usual interest costs recommend these will be in some way restricted for a couple of years.

Earnings is revealing indications of enhancement

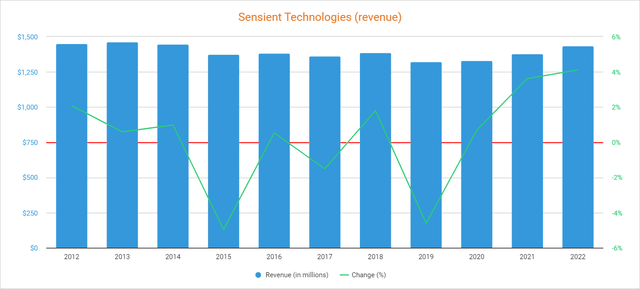

The business’s restructuring procedure considering that 2014 has actually been accompanied by decreasing profits as an outcome of the mergers and acquisitions that have actually happened over the last few years. Still, profits began to reveal indications of enhancement in 2020 as they increased by 0.69% compared to 2019. Incomes likewise increased by 3.62% throughout 2021, and by a more 4.11% in 2022 to $1.44 billion.

Sensient Technologies profits (10-K filings)

When it comes to the very first quarter of 2023, profits increased by 3.79% year over year (and by 5.82% quarter over quarter), increased by low-double-digit rate boosts that were partly balanced out by a mid-single-digit profits headwind as a repercussion of client destocking and a 1% forex headwind effect.

Presently, the business’s consumers are stabilizing their stocks to pre-pandemic levels as supply chains are alleviating, which is triggering a momentary decline in client order preparation. However, profits are anticipated to enhance in the short-term as destocking is anticipated to moderate in the 2nd half of 2023. In this regard, net sales are anticipated to increase by 5.56% in 2023 to $1.52 billion, and by a more 5.26% to $1.90 billion in 2024.

Utilizing 2022 as a referral, 59% of the business’s overall profits are produced within The United States and Canada, whereas 19% are produced in Europe, 16% in Asia Pacific, and 7% in the remainder of the world. The rise in sales experienced in 2021 and 2022, combined with the current decrease in the share rate, has actually triggered a high decrease in the P/S ratio to 2.196, which indicates the business produces net sales of $0.46 for each dollar kept in shares by financiers, yearly.

This ratio is still 0.64% greater than the average of the previous years however represents a 32.28% decrease from years highs of 3.243 reached in 2021, which recommend that although financiers’ pessimism has actually grown substantially in the previous year, shares might continue to fall as financiers’ pessimism has actually been greater for a substantial part of the previous ten years, and issues about a possible economic downturn as a repercussion of increasing rate of interest are growing as time passes. Nevertheless, enhanced earnings margins and profits development expectations for 2023 and 2024 make me think about the current share rate decrease as an excellent chance to get a good yield on expense in spite of an increased danger originated from increasing interest costs as the business has adequate resources to pay for a substantial part of its financial obligation stack in a fairly brief amount of time.

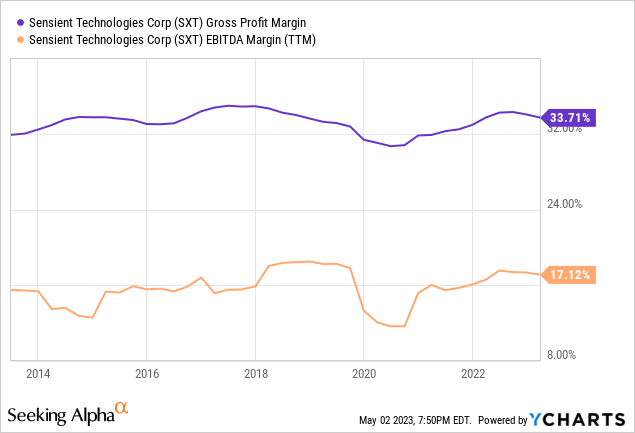

The business is extremely rewarding thanks to the restructuring procedure performed

The business started a restructuring procedure in 2014 in order to remove underperforming operations, combine making centers, and enhance performances, and both gross earnings and EBITDA margins enhanced substantially (in spite of coronavirus-related contractions) ever since. However, inflationary pressures, supply chain concerns, and raised energy and product expenses in specific geographical areas have actually triggered a small decrease in the business’s margins, however strong rates actions are presently balancing out the majority of these effects. In this regard, the tracking twelve months’ gross earnings margin presently stands at 33.71%, whereas the EBITDA margin stands at an extremely healthy 17.12%.

When It Comes To the initially quarter of 2023, the gross earnings margin revealed a limited enhancement to 33.78% and the EBITDA margin revealed a slighter much better enhancement at 17.61% as the business keeps raising the rate of its items in order to balance out continuous inflationary pressures, which indicates the business stays extremely rewarding. This reveals fantastic versatility in Sensient’s operations and substantial rates power by Sensient as headwinds still continue the macroeconomic landscape.

Such earnings margins will be necessary over the next couple of quarters as the business has substantial stocks that will require to utilize in order to pay for its financial obligation and continue to carry out more acquisitions in order to continue growing its company.

The business’s financial obligation does not represent a substantial danger as stocks are extremely high

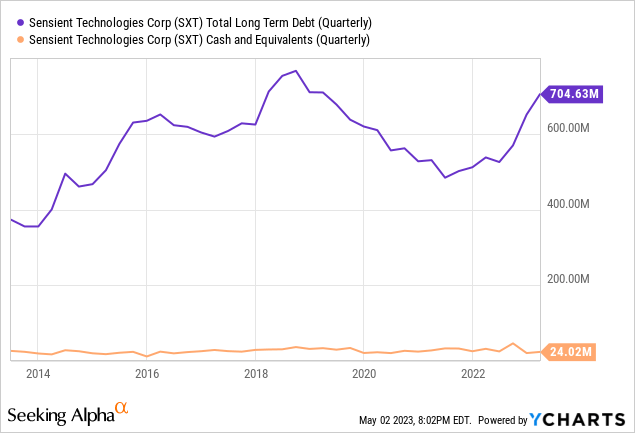

As a repercussion of the restructuring procedure that started in 2014, long-lasting financial obligation substantially increased to over $700 million in 2018 however decreased to around $500 million in 2021. In current quarters, long-lasting financial obligation has actually increased to $705 million as the business has actually been building up stocks as consumers are holding off orders due to continuous destocking. In this regard, the management anticipates to begin lowering its long-lasting financial obligation stack as it utilizes its abnormally high stocks when client stocks stabilize.

On the other hand, money and equivalents is extremely low at $24.02 million, and interest cost increased to $6 million throughout the very first quarter of 2023 compared to $3 million throughout the very same quarter of 2022. In this regard, utilizing enormous stocks of $573.7 million will be vital to assist the business substantially decrease its impressive long-lasting financial obligation in order to decrease these yearly interest costs to more workable levels.

Throughout the very first quarter 2023 incomes call, the management mentioned that it anticipates to handle the business’s stocks down as quickly as possible in order to produce strong money from operations in the coming quarters as capital investment are anticipated to be high at around $95 million in 2023 while the dividend money payment ratio increased in 2022.

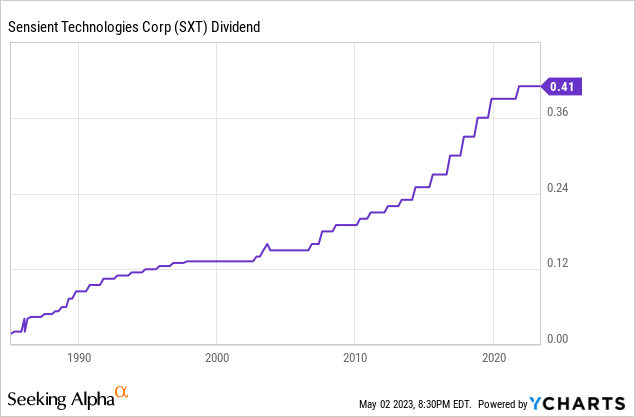

The dividend is safe in spite of a high money payment ratio

If one takes a look at the chart below, it can be seen how the business has a long performance history of growing dividends for many years. The business raised its quarterly dividend by 5.1% to $0.41 per share in October 2021 for the last time. If we include the current decrease in the share rate, the dividend yield presently stands at 2.17%, which is, in my viewpoint, extremely sensible due to the business’s traditionally low dividend money payment ratio and its high capacity once the balance sheet gets deleveraged.

In order to compute the business’s dividend sustainability, in the next table I have actually computed what portion of the money from operations has actually been designated to the payment of dividends and interest costs every year. In this method, one can evaluate the business’s capability to cover both costs through real operations.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Money from operations (in millions) | $ 189.19 | $ 128.05 | $ 222.48 | $ 36.31 | $ 83.52 | $ 177.18 | $ 218.78 | $ 145.22 | $ 12.07 |

| Dividends paid (in millions) | $ 47.89 | $ 48.11 | $ 49.64 | $ 54.04 | $ 57.41 | $ 62.19 | $ 66.06 | $ 66.69 | $ 68.92 |

| Interest costs (in millions) | $ 16.07 | $ 16.95 | $ 18.32 | $ 19.38 | $ 21.85 | $ 20.11 | $ 14.81 | $ 12.54 | $ 14.55 |

| Money payment ratio | 33.81% | 50.81% | 30.55% | 202.22% | 94.90% | 46.45% | 36.96% | 54.56% | 691.48% |

As you can see in the table above, the business has actually traditionally made a conservative usage of its money by paying a fairly little portion of the money from operations in the type of dividends. Still, the money payment ratio increased to a tremendous 691% in 2022 as money from operations was extremely low at $12.07 million. This is since stocks increased by $152.5 million compared to 2021, and receivable by $41 million while accounts payable increased by just $16.9 million, which indicates the business stays extremely rewarding and the dividend and interest costs do not represent a significant problem for the business as it can cover both costs with ease in spite of present headwinds.

When it comes to the very first quarter of 2023, the business reported money from operations of -$ 3.0 million, however stocks increased by $9.6 million quarter over quarter and receivables by $10.4 million while accounts payable reduced by $21.1 million, which shows extremely healthy earnings margins as the business reported earnings of $33.7 million for the quarter.

Buybacks might be on hold for longer as financial unpredictabilities stay

Historically, the business has actually redeemed its own shares when operations permitted it, although in 2018 this practice stopped to form part of the capital allotment method as the management has actually been making acquisitions while deleveraging the balance sheet, which has actually assisted to substantially decrease yearly interest costs (in spite of the current rise) while getting some small companies in order to keep profits in the middle of the restructuring procedure.

Once the management pays for an excellent part of its long-lasting financial obligation, it is most likely, in my viewpoint, that we will see a brand-new share bought program as a method of fulfilling investors by increasing their positions passively thanks to a reducing variety of shares impressive, which would ultimately cause enhanced per-share metrics. However prior to this takes place, I think that the management will rather attempt to maintain money as recessionary threats ought to initially reduce and consumers ought to finish their destocking procedures prior to thinking about more share buybacks.

Dangers worth pointing out

While I see Sensient Technologies’ threats as relatively little thanks to stocks bigger than its long-lasting financial obligation and extremely durable earnings margins in the middle of present macroeconomic and industry-related headwinds, there are specific threats I want to highlight.

- Already, the business has actually handled to keep extremely healthy earnings margins in spite of inflationary pressures thanks to the boost in the rate of its items, which have actually continued to increase throughout the very first quarter of 2023. If inflationary headwinds continue to affect the business’s operations for a lot longer, it might experience problems to keep raising rates without adversely affecting item need.

- A possible economic downturn as a repercussion of increasing rate of interest would probably have a negative effect on the business’s operations due to decreasing volumes and rates power.

- The business might be required to make use of more financial obligation if retail stock destocking takes longer than anticipated, which would cause even greater interest costs.

Conclusion

Definitely, some clouds are starting to be seen on the horizon for Sensient Technologies as need has actually slowed in current quarters as an outcome of high retail stocks while earnings margins are somewhat impacted by inflationary pressures, supply chain concerns, and increased energy and basic material expenses. Still, the business’s strong rates power has actually permitted it to pass the increased production expenses on to consumers. In this regard, the business’s operations continue essentially undamaged in spite of such a complicated macroeconomic environment. The issue is that interest costs have actually doubled year over year throughout the very first quarter of 2023 as long-lasting financial obligation keeps increasing while issues about a possible economic downturn as an outcome of current rate of interest walkings in order to fight high inflation rates are appearing amongst financiers.

Still, I think that this is not the time to forget that the business has actually been running considering that 1882, that it offers necessary products to significant gamers in essential markets, that its present stocks will enable it to substantially decrease its financial obligation levels, the dividend is safe thanks to high money from operations (in spite of lower figures throughout 2022 and the very first half of 2023 due to client destocking), and profits is anticipated to grow at a moderate rate in 2023 and 2024 as client stocks stabilize. Still, I highly think that balancing below present rates is an ideal method as the P/S ratio is somewhat above the average of the previous years and a possible economic downturn might lastly emerge, hence possibly driving down the share rate substantially.