Authored by Egon von Greyerz through GoldSwitzerland.com,

Tectonic shifts lie ahead. These will include a United States and European financial obligation crisis ending in a financial obligation collapse, a sheer fall of the dollar and the Euro with Gold becoming a reserve property however at multiples of the present rate.

The next stage of the fall of the West is here and will quickly speed up. It has actually been both precipitated and worsened by the unreasonable sanctions of Russia. These sanctions are harming Europe severely and impacting the United States in a manner that they didn’t anticipate, however was apparent to a few of us. The Romans comprehended that open market was vital in between all the nations that they dominated. However the United States administration blocks have both the cash and the capability to trade of the nations they do not like.

However shooting yourself in the foot truly harms and the effects remain in front of our eyes. No foreign nation will wish to hold United States financial obligation or dollars. That is a devastating issue for the United States as their deficits will grow tremendously in coming years.

So a financial obligation collapse is not simply a looming catastrophe however a bomb tossing towards the United States economy at supersonic speed.

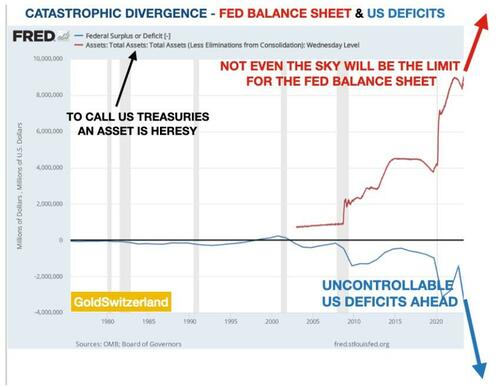

With the impending death of the petrodollar and surge of United States financial obligation, there is just one option for the financing requirements of the United States Federal Government — the FED which will stand as the sole purchaser of United States Treasuries.

A DEVASTATING DEATH SPIRAL

So the financial obligation spiral of greater financial obligation, greater deficits, more Treasuries, greater rates and falling bond rates will quickly become a DEATH spiral with a collapsing dollar, high inflation and most likely devaluation. Seems like default to me however that word will most likely never ever be utilized formally. It is tough to confess defeat even when it looks you in the face!

Yes, the United States will most likely obfuscate the circumstance with CBDCs (Reserve Bank Digital Currencies) however because that is simply another type of Fiat cash, it will at finest purchase a little time however completion outcome will be the very same.

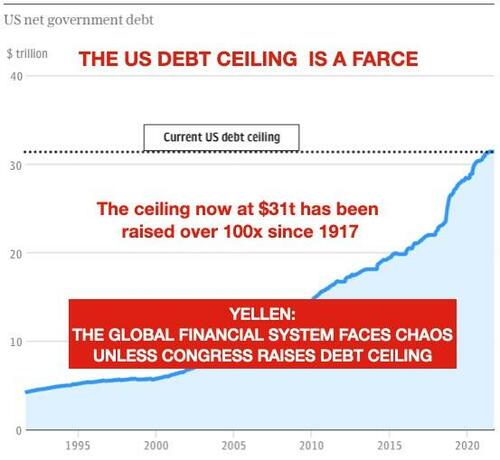

United States Financial obligation Ceiling Farce comes from Broadway instead of Wall Street

The financial obligation ceiling was developed in 1917 as a method of limiting negligent costs by the United States federal government. However this travesty has actually gone on for over 106 years. Throughout that time there has actually been an overall contempt for budget plan discipline by the judgment Administration and congress.

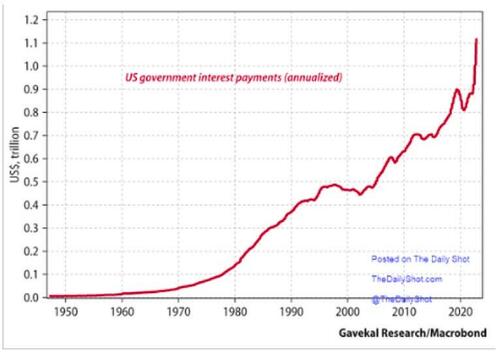

The issue is not simply the financial obligation however the expense of funding it.

The annualised expense of funding the Federal financial obligation is presently $1.1 trillion. If we presume conservatively that the financial obligation grows to $40 trillion within 2 years, the interest expense at 5% would be $2 trillion. That would be 43% of present tax profits. However as the economy weakens, interest will quickly go beyond 50% of tax profits. Which is at 5% which will most likely be much too low as inflation increases and The Fed loses control of rates.

Therefore a really alarming circumstance lies ahead which is definitely not a worst case circumstance.

THE FED IS BETWEEN A ROCK AND A TOUGH LOCATION

The Fed and the therefore United States federal government are now in between Scylla and Charybdis (Rock and a Difficult Location).

As it looks today, the United States will bounce in between Scylla and Charybdis in coming years up until the United States monetary system and likewise the economy takes ever more difficult knocks and goes under simply as every financial system has in history.

Undoubtedly the remainder of the West consisting of an incredibly weak Europe will follow the United States down.

BRICS AND SCO– RISING POWERS

The entire world will suffer however the product abundant countries in addition to the less indebted ones will ride the coming storm far much better.

This consists of much of South America, Middle East, Russia and Asia. The broadening power blocks of BRICS and SCO (Shanghai Cooperation Organisation) will be the strong powers where a much increasing part of international trade will happen.

Disallowing significant political and geopolitical turmoils, China will be the dominant country and the primary factory of the world. Russia is likewise most likely to be a significant financial power. With $85 trillion of natural deposit reserves, the capacity is plainly there for this to take place. However initially the political system of Russia requires to be “modernised” or reorganized.

What I lay out above is naturally structural shifts that will take some time, most likely years. However whether we like it or not, the very first stage, which is the fall of the West, might take place faster than we like.

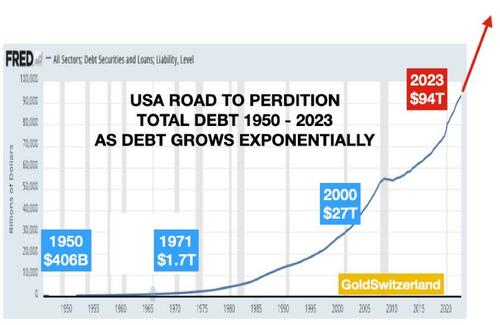

A MONETARY SYSTEM ALWAYS ENDS IN A FINANCIAL OBLIGATION SURGE

In 1913, overall United States financial obligation was minimal, and in 1950, it had actually grown to $406 billion. By the time Nixon closed the gold window in 1971, financial obligation was $1.7 trillion. Afterwards the curve has actually ended up being ever steeper as the chart listed below programs. From September 2019 when the United States banking system began to split, the Repo crisis informed us that there were genuine issues although nobody wished to confess. Easily for the United States federal government, the Repo crisis ended up being the Covid crisis which was a far better reason for the Federal government to print unrestricted quantities of cash together with the banks.

Therefore, simply in this century, overall United States financial obligation has actually grown from $27 trillion to $94 trillion!

However that was history and we understand we can’t do anything about the past. Today comes the enjoyable.

I have actually been alerting about a coming financial obligation surge for a long time. Well, I think this is it.

In a current short article about the rate of gold I described that the lasts of devaluation are rapid.

We will see a really comparable rapid pattern with the coming financial obligation surge. If we presume that the last 5 minutes of the rapid stage began in September 2019, the arena was then just 7% complete and will in the next couple of years grow from 7% to 100% complete or 14X from here.

This is undoubtedly simply a presentation and no specific science, however it reveals that in theory United States financial obligation might now blow up.

So let’s take a glimpse at a couple of aspects that will trigger the financial obligation surge.

BANK FAILURES

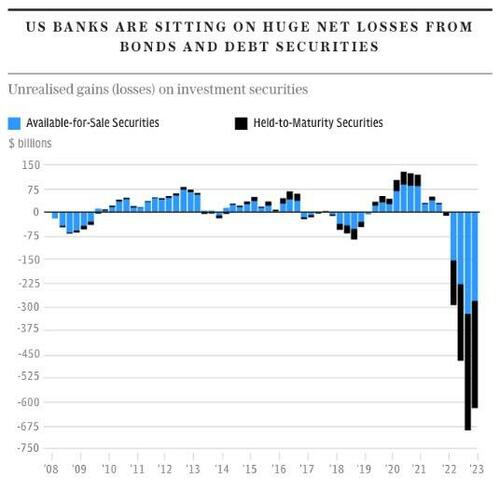

A Hoover Institute report determines that more than 2,315 United States banks presently have properties worth less than their liabilities. The marketplace worth of their loan portfolios are $2 trillion lower than the book worth. And remember this is prior to the REAL fall of the property worths which is still to come.

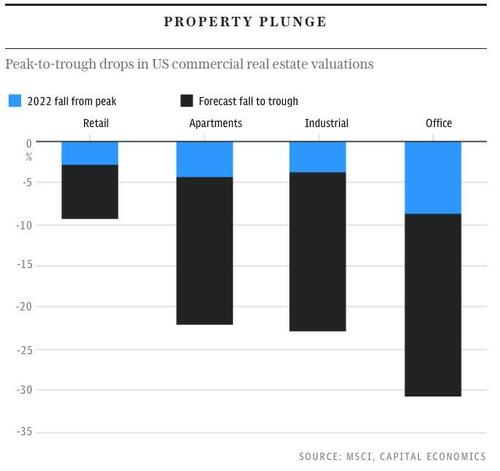

Simply take United States residential or commercial property worths which are considerably misestimated by the lending institutions:

So the 4 United States banks that have actually gone under just recently are plainly simply the start. And nobody should think that it is simply little banks. Larger banks will follow the very same path.

Throughout the 2006-9 subprime crisis, bailouts were the standard. However at the time, it was stated that the next crisis would include bail-ins.

However as we have actually seen up until now in the United States, there were no bail-ins. Plainly the federal government and the Fed were worried about a systemic crisis and did not have the guts to bail in the bank consumers, not even above the FDIC limitation.

As the crisis spreads, I question that bank depositors will be dealt with so leniently. Neither the FDIC, nor the federal government can pay for to rescue everybody. Rather depositors will be provided a deal they can’t decline which is mandatory purchase of United States treasuries equivalent to their credit balance.

The European banking sector remains in an even worse state than the United States one. European banks are resting on big losses from bond portfolios obtained when rate of interest were unfavorable. Nobody understands at this phase the magnitude of the losses which are most likely to be significant.

Both in industrial residential or commercial property and real estate, the circumstance is even worse in Europe than in the United States because the European banks are moneying the majority of these loans straight themselves, consisting of EUR 4 trillion of house mortgages.

The banks likewise have an inequality in between low rates gotten on home loans versus high rates paid to fund them.

The ex-governor of the Bank of France and ex-head of the IMF, Jacques de Larosière implicates the authorities of overturning the personal banking system with psychopathic volumes of QE after it had actually ended up being hazardous:

” Reserve banks, far from promoting stability, have actually provided a Masterclass in how to arrange monetary crisis”

$ 3 QUADRILLION OF GLOBAL FINANCIAL OBLIGATION & & LIABILITIES

If we include the unfunded liabilities and the overall impressive derivatives to the international financial obligation, we get to around $3 quadrillion as I went over in this short article:

” This is it! The monetary system is terminally broken”

Unfortunately, the Western monetary system is now both too huge to conserve and too huge to stop working.

Still all the king’s horses and all the king’s guys can not wait. So even if the system is too huge to stop working, it will with really alarming effects.

GOLD TO BE CONSIDERABLY REVALUED IN THE DISORDERLY RESET

Simply over a century after the development of the Fed and the start of the financial obligation ceiling, the magnificent dollar has actually lost 99% of its worth in buying power terms.

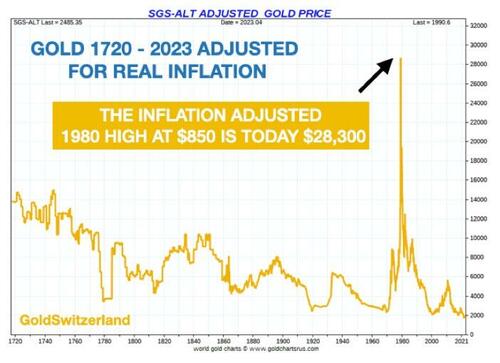

And determined versus the only cash which has actually endured in history– Gold — the dollar has actually likewise lost 99%.

This is undoubtedly not a mishap. Not just is gold the only cash which has actually endured however likewise the only cash which has actually kept its buying power throughout the centuries.

For instance, a Roman Toga expense 1 ounce of gold 2000 years earlier, which today is likewise the rate for a high quality male’s match.

You would have believed that losing 99% of its worth for the reserve currency of the world would be a catastrophe. Well it is naturally, however the United States, in addition to the majority of the Western world, has actually changed by increasing financial obligation tremendously to offset the dreadful debasement of the currencies.

What is much more intriguing, gold is up 8-10X this century versus many currencies.

That is an exceptional efficiency to practically all significant property classes.

And still no one owns gold which is just 0.5% of international monetary properties.

More just recently gold is at all-time-highs in all currencies consisting of the dollar.

However in spite of the exceptionally strong efficiency of gold or more properly put, the ongoing debasement of all currencies, nobody speaks about gold.

Simply taking a look at the variety of posts covering gold in journalism in the chart listed below (white bars), it verifies that the most current rate boost of gold (blue line) is fulfilled by a yawn.

This is undoubtedly really bullish. Picture if all stock exchange made brand-new highs. It would be all over the media.

So what this is informing us is that this gold booming market, or currency bearishness, has a long method to go.

As I typically mention, no fiat cash however just gold has actually endured throughout history.

Gold’s increase in time is constantly ensured as federal governments and reserve banks will without stop working ruin their currency by producing practically unrestricted phony cash.

Considering That this has actually been going on for 1000s of years, history informs us that this pattern of continuously debasing fiat cash is solid due to the greed and mismanagement of federal governments.

And now with the financial obligation crisis speeding up, so will the gold rate.

Luke Groman makes a really intriguing point in his conversation with Grant Williams ( grant-williams. com by membership). Luke recommends that although the dollar will not yet pass away as a transactional currency, that it is most likely to be changed by gold as the reserve property currency.

The mix of dedollarisation and liquidation of United States treasuries by foreign holders will cause this advancement.

Product nations will cost example oil to China, get yuan and alter the yuan to gold on the Shanghai gold Exchange. They will then hold gold rather of dollars. This will prevent the dollar as a trading currency when it concerns products.

In order for gold to work as a reserve property, it will require to be revalued with an absolutely no at the end and a larger figure at the start as Luke states. The entire concept would be that gold will end up being a neutral reserve property which drifts in all currencies.

The inverted triangle of International financial obligation resting on just $2 trillion of Reserve bank gold revealed above makes the revaluation of gold apparent.

A drifting gold rate as a reserve property is naturally far more practical than a repaired gold rate backing the currencies and would be the closest to Free Gold

See my 2018 short article, ” Free Gold will eliminate the Paper Gold Gambling Establishment”

So the repercussion of gold ending up being a reserve property might include an increase of say 25X or 50X the present level. Definitely not an unlikely result in today’s cash. The debasement of the dollar and other Western currencies is most likely to have a comparable result however then we are not talking in today’s cash. Time will inform.

As gold is now in a velocity stage, we are most likely to see much greater levels nevertheless long it takes and whatever the factor is for the increase.

The 1980 gold rate of $850, changed genuine inflation would today be $28,300

As gold is now in a velocity stage, we are most likely to see much greater levels nevertheless long it takes.

What is clear is that fiat cash, bonds, residential or commercial property and stocks will all decrease precipitously versus gold.

What is necessary for financiers is to take security now versus the most substantial RESET in history which is a disorderly reset.

So if you do not hold gold yet, please, please safeguard your household, and your wealth by obtaining physical gold.

Gold rearranging as a Global Reserve Possession might take place slowly or it might take place unexpectedly. However please be prepared due to the fact that when it occurs you do not wish to hold useless paper currency or properties.

Packing …