{“page”:0,” year”:2023,” monthnum”:4,” day”:18,” name”:” the-same-only-different”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Fei Mei Chan”,”title”:”Director, Core Product Management”,”image”:”/wp-content/authors/feimei_chan-214.jpg”,”url”:”https://www.indexologyblog.com/author/feimei_chan/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Berlinda Liu”,”title”:”Director, Multi-Asset Indices”,”image”:”/wp-content/authors/berlinda_liu-191.jpg”,”url”:”https://www.indexologyblog.com/author/berlinda_liu/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, ESG Index Product Strategy, Latin America”,”image”:”/wp-content/authors/maria_sanchez-243.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-271.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Ben Leale-Green”,”title”:”Associate Director, Research & Design, ESG Indices”,”image”:”/wp-content/authors/ben_leale-green-342.jpg”,”url”:”https://www.indexologyblog.com/author/ben_leale-green/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-516.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Strategy & Volatility Indices”,”image”:”/wp-content/authors/Ari.Rajendra-400.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Narottama Bowden”,”title”:”Director, ESG Index Intelligence, Index Governance”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

The Very Same, Only Various

In the very first quarter of 2023, the very best carrying out of the 17 aspect indices included in our month-to-month aspect control panel was S&P 500 ® High Beta (up 12.5%), while the worst entertainer was(&*) S&P 500 Momentum(* )( -3.2% ). This might appear odd at very first blush, given that both indices are, in some sense, efficiency chasers– Momentum in outright and High Beta in relative terms. This confessed oversimplification neglects distinctions in rebalancing schedules, lookback durations, and threat modifications, yet financiers who question the space in between the 2 indices’ efficiency are asking a sensible concern. Display 1 reveals the relationship in between the month-to-month returns of Momentum and High Beta. The historic connection was an excellent 0.73, as the indices tend to fluctuate together. This contrast, obviously, neglects the effect of the marketplace as a whole on the motions of both elements. Display 2 remedies for this oversight by deducting the return of the

S&P 500

from those of both aspect indices. The previous strong relationship vaporizes, as the connection of month-to-month excess returns is just -0.15. Internet of the marketplace’s effect, there is basically no relationship in between the returns of Momentum and High Beta. In part, this comes from a subtlety in the building and construction of the 2 indices. High Beta looks for to determine the S&P 500’s highest-beta stocks. If the marketplace has actually increased

, most likely the highest-beta stocks will be amongst the marketplace’s finest entertainers, and for that reason may likewise be anticipated to show up in Momentum. If the marketplace has actually decreased, nevertheless, most likely the highest-beta stocks will be amongst the marketplace’s worst entertainers, leading Momentum to tilt towards lower-beta constituents. This assists describe the particular distinctions observed throughout the very first quarter of 2023, following the S&P 500’s 18% decrease in 2022. If this description is appropriate, it recommends a basic pattern: when the marketplace has actually increased, the efficiency of Momentum and High Beta may be comparable; when the marketplace has actually fallen, their efficiency is most likely to diverge

To evaluate this hypothesis, we formed deciles in our historic database, arranged by the tracking 12-month return of the S&P 500. For each decile, we calculated the average subsequent 12-month outright distinction in between the returns of Momentum and High Beta. As Display 3 programs, when S&P 500 efficiency remained in its worst decile (with a typical decrease of 22.5%), the distinction in between Momentum and High Beta balanced 39.2%. In the 2nd decile (with the S&P 500 down 2.8% usually), the distinction is up to 17.6%. In the other 8 deciles (where the S&P 500’s efficiency balanced 18.3%), the distinction in between Momentum and High Beta was a relatively little 10%. We have actually typically discussed the significance of the marketplace environment in

examining aspect index efficiency

and in thinking about aspect mixes It can be no lesser in illuminating aspect distinctions. The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Classifications Equities,

Equities

-

Tags

Dow Jones Islamic Market (DJIM) World Index, -

equities,

GCC indices, Islamic equities, Islamic indices, MENA, Pan Arab, S&P Global BMI, S&P Global BMI Shariah, S&P Pan Arab Composite, sectors, shariah International equities ended the very first quarter of the year with a gain of 6.9%, as determined by the S&P Global BMI

On the other hand, Shariah-compliant criteria, consisting of the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, likewise increased throughout the quarter and outshined their traditional equivalents by 3.5% and 3.4%, respectively. In general, local broad-based Shariah and traditional equity criteria had a favorable quarter, regardless of current volatility in the banking market. Nevertheless, the Pan Arab area decreased partially by 0.5% in Q1, while its Shariah criteria completed the quarter with a boost of 2.5%. Motorists of Shariah Index Efficiency in Q1 2023

Shariah criteria outshined their traditional equivalents throughout Q1, in contrast to previous quarter returns. Sector structure can offer some description for this quarter’s outcomes. Greater direct exposure to Infotech stocks within Islamic indices and having no direct exposure to traditional monetary services, consisting of banks, were the primary chauffeurs of this outperformance. The Infotech sector was up 22.6% and represents 29.3% of the index’s weight, driving the greatest return contribution amongst all sectors.

On the other hand, other sectors experienced double-digit gains, such as Interaction Providers and Customer Discretionary, which increased 24.6% and 14%, respectively, in Q1, contributing substantially to the index’s outperformance, regardless of having a fairly smaller sized weight compared to other sectors.

Energy and Energies were the only sectors that reduced significantly throughout Q1, however the effect was restricted by their little weight.

MENA Equities Post Mixed Lead To Q1 2023

MENA equities experienced blended lead to Q1, with the local

S&P Pan Arab Composite

was down 0.5%. GCC nation efficiency was likewise blended, with favorable returns for Oman (5.0%), Bahrain (4.9%) and Saudi Arabia (1.6%), and losses in the UAE (-5.2%), Kuwait (-3.5%) and Qatar (-1%). For additional information on how Shariah-compliant criteria carried out in Q1 2023, read our most current Shariah Scorecard https://www.spglobal.com/spdji/en/documents/performance-reports/scorecard-sp-shariah-djim.pdf

This post was very first released in IFN Volume 20 Concern 15 dated April 12, 2023.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

Tags Dow Jones Islamic Market (DJIM) World Index,

Handling Director, Index Financial Investment Technique

®(* )in the ten years leading up to the start of 2022, in 2015 brought an interesting modification in the market winds, consisting of completion of near-zero rate of interest and, together with it, greater hopes for stock-picking There was greater dispersion and, with worth stocks beating their peers, there were definitely chances for outperformance for those supervisors focusing on basics. As it ends up, the year might well decrease as one to forget for most active European equity supervisors, especially in the pan-European equity classification– in which 87% and 83% of funds underperformed

in the euro-denominated and pound sterling-denominated classifications, respectively. While many significant markets completed the year with decreases, for supervisors with a “go anywhere, do anything” method, there were likewise plain chances to produce relative worth. Even in nearby classifications– big- and small-cap U.K. equities, for instance– there were substantial distinctions in efficiency. Display 1, replicated from the scorecard, sums up full-year 2022 efficiency throughout a series of popular fund criteria. Versus this background, Display 2 sums up the 1 year underperformance rates throughout all the fund classifications consisted of in the year-end 2022 scorecard. The scorecard likewise supplies a raft of more information and analysis on the marketplace conditions that accompanied such efficiency, in addition to much deeper data on the efficiency of actively handled funds. Readers can likewise dig much deeper into the brief- and long-lasting information on actively handled set earnings funds– consisted of in our European scorecard for the very first time this year– in a supporting

blog site

by the report’s primary author.

Nevertheless, it is in some cases worth going back from the granular information to make a more comprehensive, easy observation, and there is a clear one meant by the SPIVA Europe Year-End 2022 Scorecard Simply put:

while unstable and falling markets may provide active supervisors higher chances to include worth, there is no assurance that they will have the ability to do so As compared to European active supervisors in specific, the year-end 2022 scorecard contributes to a growing library of proof that, contrary to the typical conception, an index-based method to investing can be far much better than “going for average.” The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Tags active funds, active supervisors,

S&P Dow Jones Indices

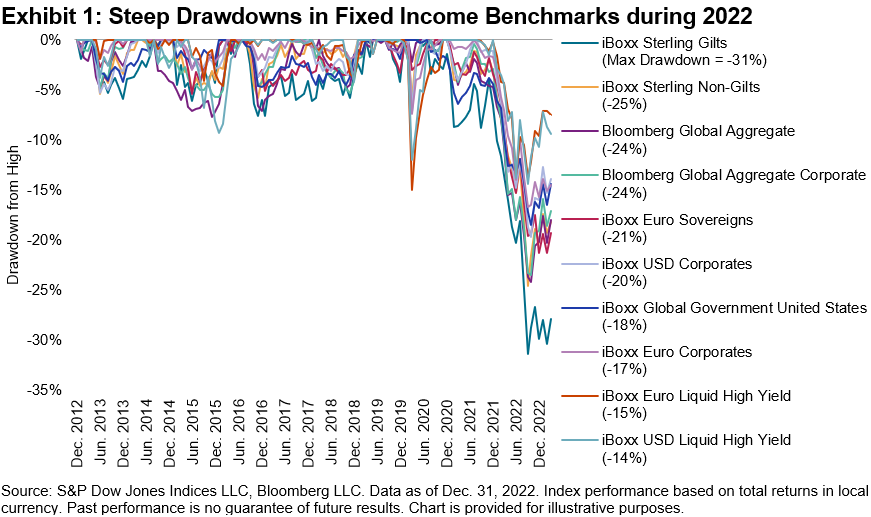

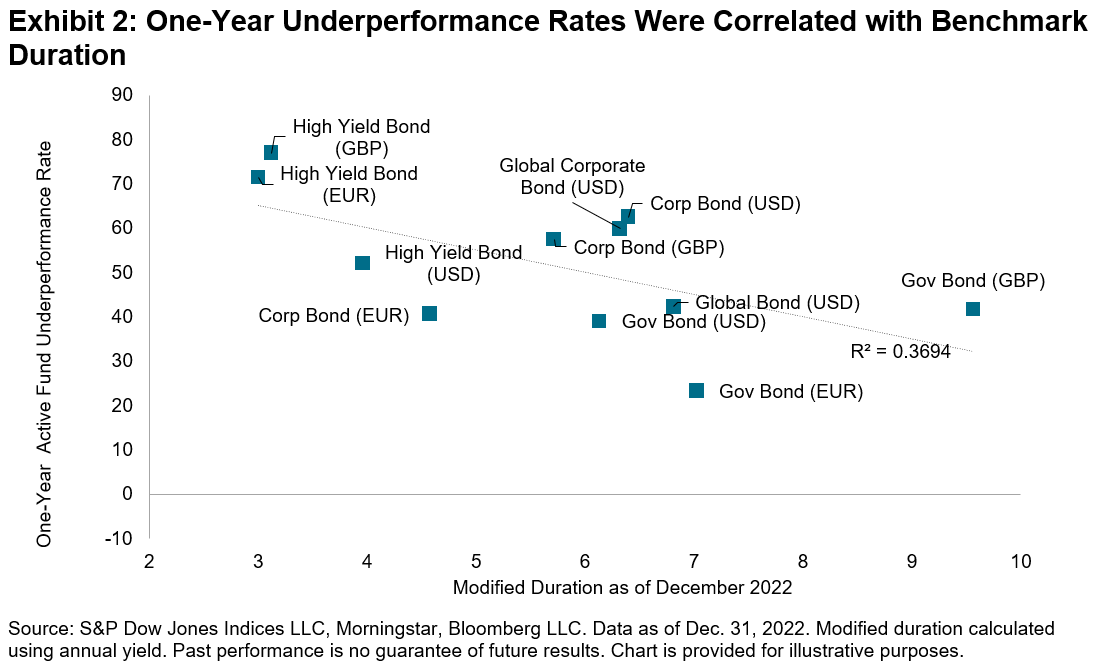

Europe Year-End 2022 Scorecard determines the efficiency of actively handled set earnings funds, covering 11 classifications throughout currencies and credit quality. Set earnings funds had a much better record than their equity brethren in 2022, with a bulk of funds surpassing in 5 reported classifications over a 1 year horizon (compared to none of our 22 equity classifications). At the front of the pack, simply 23% of euro-denominated federal government mutual fund underperformed the iBoxx Euro Sovereigns in 2022. Undoubtedly, the outcomes were less remarkable as the time horizon extended: a cross-category average of 84% of active set earnings funds underperformed their appointed criteria over the 10-year duration, consisting of 88% of euro-denominated federal government mutual fund. To state that 2022 was a tough year for bonds worldwide is an understatement. Reserve banks around the globe tightened up rate of interest to fight inflation, resulting in double-digit losses for many European set earnings criteria, accompanied by especially big decreases in longer-dated bonds, which are more conscious modifications in rate of interest. Display 1 reveals the degree of 2022’s decreases in our set earnings criteria in a decade-long historic context At the back of the pack, the iBoxx Sterling Gilts taped an optimum drawdown equivalent to a 31% decrease from its 2020 high, ending up the year not far from its lows.

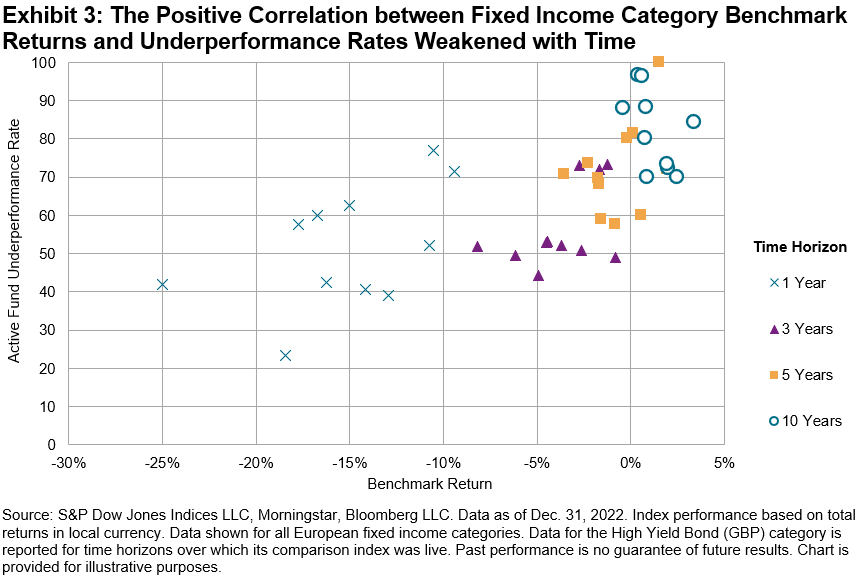

Regardless of the carnage, there were a couple of intense areas for actively handled funds, especially in classifications with criteria that were more conscious modifications in the yield environment. Display 2 plots the relationship in between the 1 year active underperformance rate in each set earnings classification and rate level of sensitivity because classification’s criteria, as determined by customized period. The 2 series are adversely associated, which recommends that some active supervisors might have produced their relative outperformance by holding bonds with much shorter maturities, usually, than their classification criteria. While conditions were especially advantageous for set earnings supervisors with inadequately carrying out criteria in 2022, such tailwinds might not continue over the long-lasting. Display 3 reveals that the relationship in between benchmark returns and underperformance rates gradually deteriorates as the time horizon reaches 3, 5, and after that ten years. Simply as Tim Edwards observes within European equities

,

the proof recommends that is no simple job to recognize active set earnings supervisors who can beat criteria over the long term. The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

A Quick Start to 2023 for the S&P China 500– Returning 5.0% in Q1

Sean Freer Director, International Equity Indices

S&P Dow Jones Indices

-

Asia,

China, -

Chinese equities,

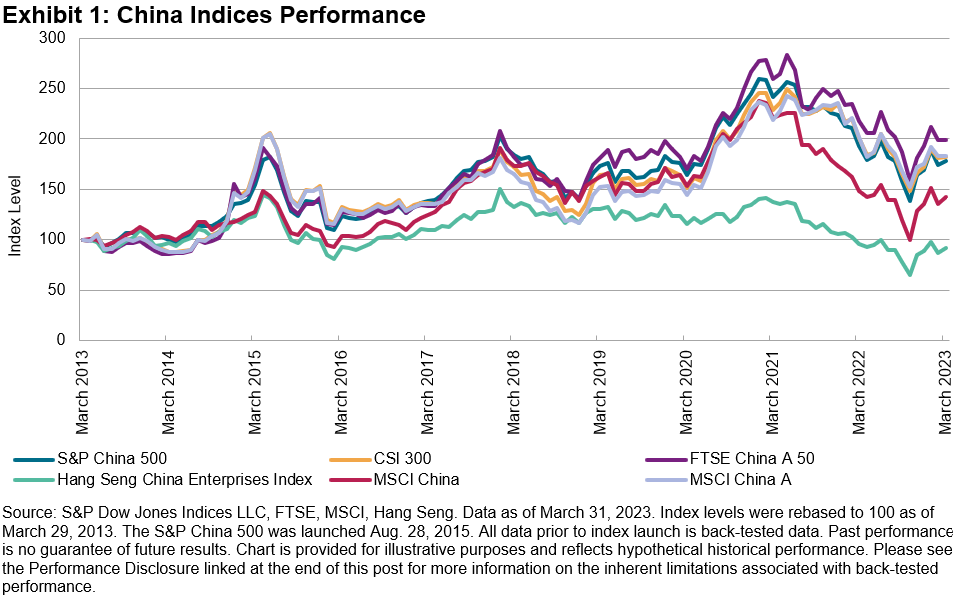

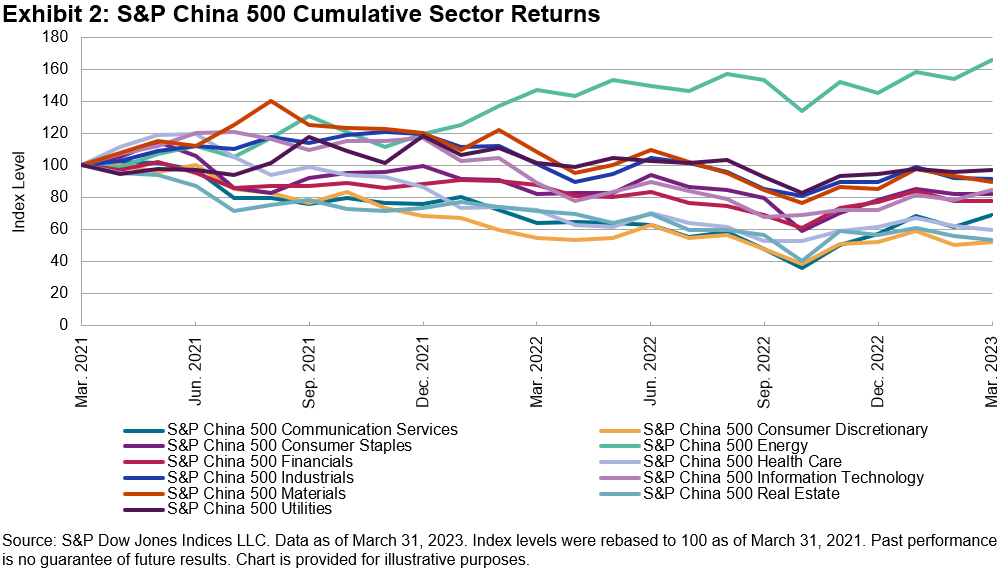

interaction services, energy, equities, infotech, S&P China 500, S&P Emerging BMI, S&P Hong Kong BMI, S&P India BMI, S&P Korea BMI, S&P Taiwan BMI, sectors The S&P China 500 acquired 5.0% in Q1 2023, continuing to claw back a few of the losses displayed in 2022. Established markets broadly had a strong quarter, with Chinese equities underperforming worldwide equities while surpassing emerging markets. Interaction Providers led sector efficiency for the start of 2023, up over 20%. Energy and Infotech likewise had a strong quarter, adding to favorable returns.

There was a big return dispersion amongst Asian markets in Q1. The S&P Korea BMI and

S&P Taiwan BMI were the greatest markets, publishing returns of 13.3% and 13.2%, respectively. The S&P China 500 outshined the S&P Hong Kong BMI and S&P India BMI, which pulled back 2.4% and 5.5%, respectively. The S&P China 500 continued to preserve favorable efficiency over the long term. With annualized gains of 5.9% in USD terms over the 10-year duration ending in March 2023, the index has actually quickly outshined the S&P Emerging BMI, which acquired just 2.9% each year over the exact same duration.

Onshore Stocks Exceeded Offshore The distinct sector structure of overseas and domestic China listing types can in some cases lead to efficiency variations. Nevertheless, both provided favorable returns throughout the quarter, with China A-Shares surpassing China H-Shares. The S&P China 500 is diversified with both onshore and overseas listings and hence outshined indices with greater weights in Hong Kong-listed Chinese business. Interaction Providers and Infotech Led the Gains

Interaction Providers and Infotech business led efficiency in Q1 2023, getting 20.6% and 17.0%, respectively. Energy likewise had a strong quarter, up 14.4%. Realty was the biggest drag on the S&P China 500 efficiency, as it decreased by 5.1%. All other sectors provided a favorable return throughout the quarter.

At the business level, the biggest factor to index return throughout the quarter was Tencent, which was up 20.9%, continuing the favorable momentum from Q4 2022. Alibaba was likewise a significant factor, up over 10%, and Kweichow Moutai had a strong quarter also. In regards to standout entertainers, 360 Security Innovation Inc, Zhongji Innolight and Zhejiang Dahua Innovation each acquired over 100% throughout the quarter. A variety of innovation stocks have actually outshined in the middle of financier interest over the commercialization capacity of generative AI items.

Meituan (down 18.3%), JD.com Inc (down 21.8%) and PDD Holdings (down 6.9%) were amongst the couple of notable relative critics to index return throughout the quarter.

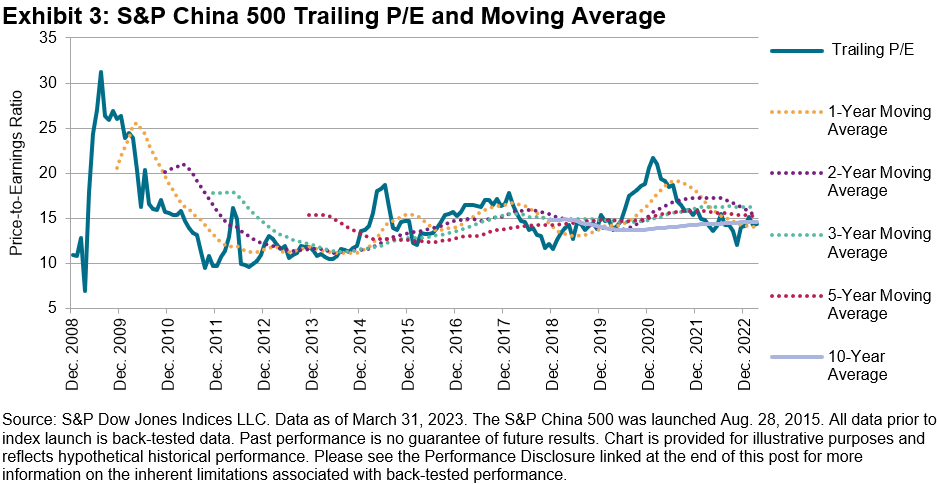

Evaluation Metrics Stay Appealing

The S&P China 500 tracking P/E increased to 14.3 x in Q1 2023 (14.1 x in the previous quarter); nevertheless, it stayed listed below the 3-, 5- and 10-year average. The rolling 1-, 3- and 5-year P/E ratios stayed somewhat above the longer-term average.

The tracking P/E for the S&P Emerging BMI likewise increased to 13.5 x, as security cost gains exceeded the losses throughout emerging markets. The S&P China 500 dividend yield, on the other hand, reduced from 2.44% to 2.34% on a quarterly basis.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

Tags Asia, China,