CVS Health on Wednesday reported first-quarter outcomes that beat revenues and income expectations, however the business decreased its full-year earnings assistance due to expenses associated with current acquisitions.

Shares fell more than 1% in premarket trading Wednesday.

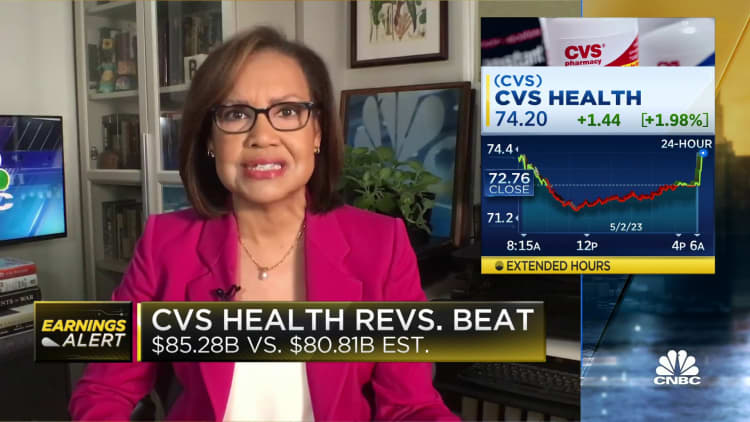

Here’s what CVS reported compared to Wall Street’s expectations, based upon a study of experts by Refinitiv:

- Incomes per share: $2.20 changed, vs. $2.09 anticipated

- Profits: $85.28 billion, vs. $80.81 billion anticipated

For the quarter ended March 31, CVS published earnings of $2.14 billion, or $1.65 a share, compared to $2.35 billion, or $1.77 a share, a year previously. Omitting one-time products, the business reported revenues of $2.20 per share for the duration.

CVS reported overall income of $85.28 billion, an 11% boost over the $76.83 billion a year previously.

CVS decreased its 2023 adjusted revenues assistance to a variety of $8.50 to $8.70, which is 20 cents lower than its previous forecast of $8.70 to $8.90.

The business decreased its assistance due to expenses related to its $8 billion acquisition of Signify Health and its $10.6 billion purchase of Oak Street Health, to name a few products.

CVS’ health services sector reserved income of $44.59 billion, a 12.6% boost over sales of $39.62 billion in the exact same quarter in 2015. The department includes its drug store advantage supervisor CVS Caremark and health-care services provided in medical centers, through telehealth and in your home.

Drug store declares processed in this department increased 3.7% compared to very first quarter 2022 due in part to a raised cough, cold and influenza season.

CVS’ medical insurance sector produced income of $25.88 billion, a 12% boost from the year prior to. The department consists of Aetna Affordable Care Act, Medicare Benefit, Medicaid and oral and vision strategies. Overall subscription in CVS medical strategies increased by 1.1 million to 25.5 million.

The insurance coverage strategies’ medical advantage ratio increased to 84.6% from 83.4% a year previously. This ratio is a procedure of overall medical costs paid relative to premiums gathered. A lower ratio generally suggests that the business gathered more in premiums than it paid in advantages, leading to greater success.

And CVS’ retail sector reserved profits of $27.92 billion, and boost of 7.8% compared to sales of $25.89 billion in the very first quarter of 2022. The department consists of prescriptions given in its 9,900 brick-and-mortar drug shops, infusion services, screening and vaccine administration.

Prescriptions filled increased 2.5% compared to the exact same duration in 2015, once again due in part to the raised cough, influenza and winter season. The boost was balanced out in part by a decrease in Covid vaccinations. Omitting this, prescriptions filled increased 4.5%.

.